Tired of worrying about dividend cuts?

With Snowball-Analytics, you can quickly identify companies with strong financials and consistent dividend payments, helping you build a diversified portfolio that generates a stable income stream

Let's build secure portfolio today!For investors, time is a precious commodity. By using Dividend Rating, you can save time and effort on research, allowing you to focus on what really matters - making informed investment decisions. With its comprehensive analysis of key financial metrics, Dividend Rating empowers investors to invest in stable dividend-paying companies with confidence.

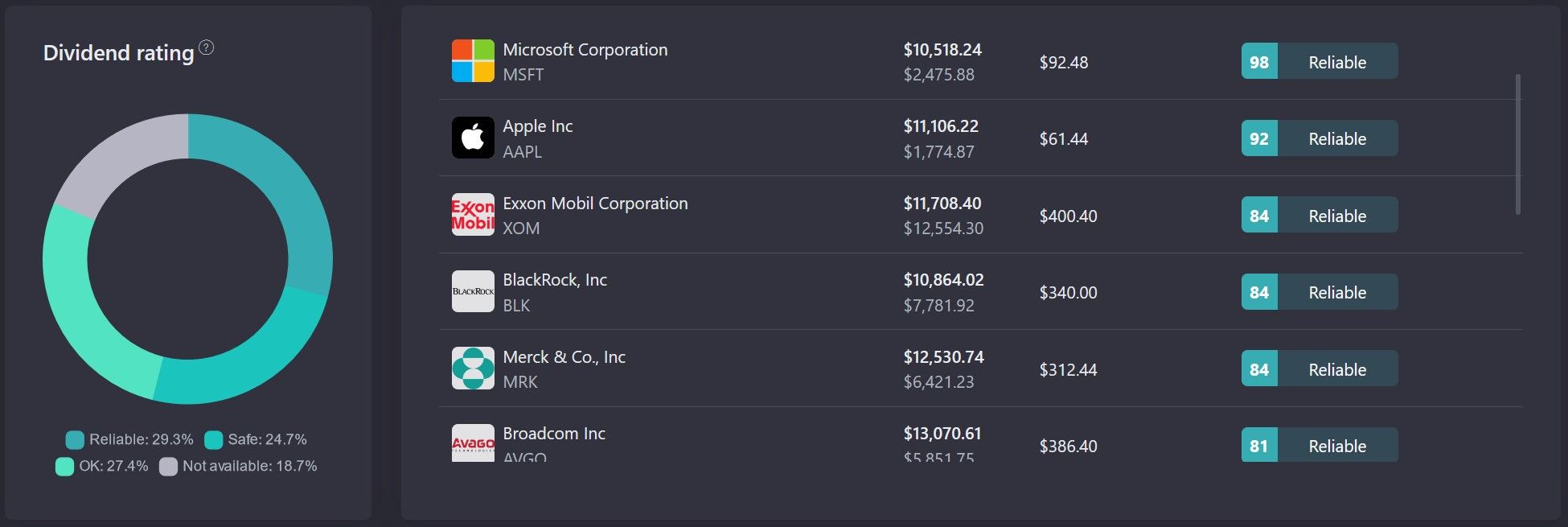

By using Snowball-Analytics.com portfolio tracking service, you can easily identify companies with strong financials and consistent dividend payments that align with your investment strategy. This can help you build a diversified portfolio that generates a stable income stream while minimizing your investment risk.

What is Dividend Rating?

Dividend Rating is a tool provided by Snowball-Analytics that assesses the financial stability of companies that pay dividends. The system takes into account 13 fundamental criteria of the company's financial condition, such as earnings, payout ratio, and dividend yield.

Try now!The company must at any time be able to repay urgently the following types of obligations: external obligations to be considered solvent, and short-term obligations to be considered liquid. Business activity indicators are also important. To determine these indicators, we use coefficients calculated on the basis of the company's financial statements. We make up the rating by adding these indicators with different weights.

- The main group of coefficients is directly related to dividend payments, which includes indicators of Payout (the amount of dividend payments relative to profit), dividend yield, etc., as well as the dynamics of these coefficients;

- The second group includes indicators related to the assets and debts of the company, including the debt coverage ratio due to revenue (liquidity), the amount of interest paid on loans, equity adequacy, etc;

- In the third group there are coefficients related to the company's current activities, such as free cash flow and free cash reserve;

- The fourth group of coefficients is related to the company's revenue, profit and market price, as well as their dynamics and growth forecasts.

By analyzing these factors, the Dividend Rating provides an assessment of the company's likelihood of sustaining or cutting their dividend payout in the future.

How can Dividend Rating benefit investors?

There are many benefits to using Snowball-Analytics Dividend Rating.

- It is easy to use and understand. Investors can quickly see which companies are financially stable and have a low risk of dividend cuts.

- It minimizes investment risk by identifying stable value dividend-paying companies with strong financials.

- It helps investors save time and effort by quickly assessing a company's financial stability and dividend sustainability.

- By using the dividend yield scanner in combination with the high Dividend stocks screener, investors can quickly and easily build a diversified portfolio that generates a reliable income stream over time.

Discover Stable Dividend-Paying Companies

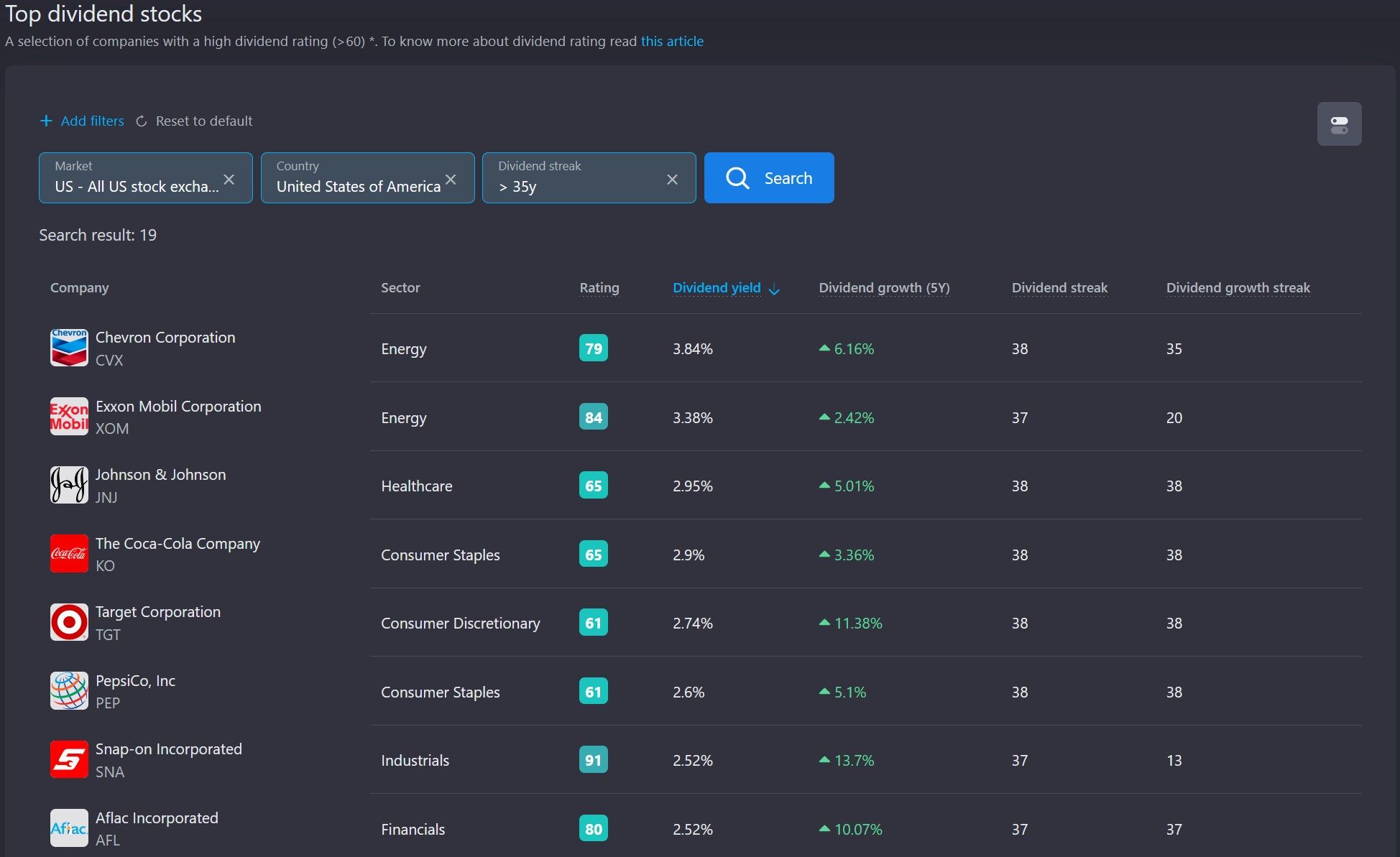

Dividend Rating, combined with Top Dividend stocks screener, are a best dividend stock screener - tools that helps investors identify companies of any cap that have a strong financial foundation and consistently pay dividends. By investing in these companies, you can build a diversified portfolio that generates a reliable income stream over time. No more guesswork, no more uncertainty.

Save Time on Research

Investing in the stock market requires a significant amount of research and analysis, especially when it comes to identifying stable dividend-paying companies. Fortunately, Dividend Rating is here to save you time and effort on research and analysis. By automating the analysis of key financial metrics, the system provides a comprehensive view of a company's financial health, allowing you to make informed investment decisions with confidence.

Gone are the days of poring over financial reports and dividend histories to find the best investment opportunities. With Dividend Rating, you no longer have to spend countless hours analyzing financial data. The system analyzes 13 fundamental indicators, taking the guesswork out of investing and helping you identify stable dividend-paying companies with ease.

So why waste time on research when you can let Dividend Rating do the work for you? Take advantage of this powerful tool and start identifying stable dividend-paying companies with ease.

Reduce Investment Risk

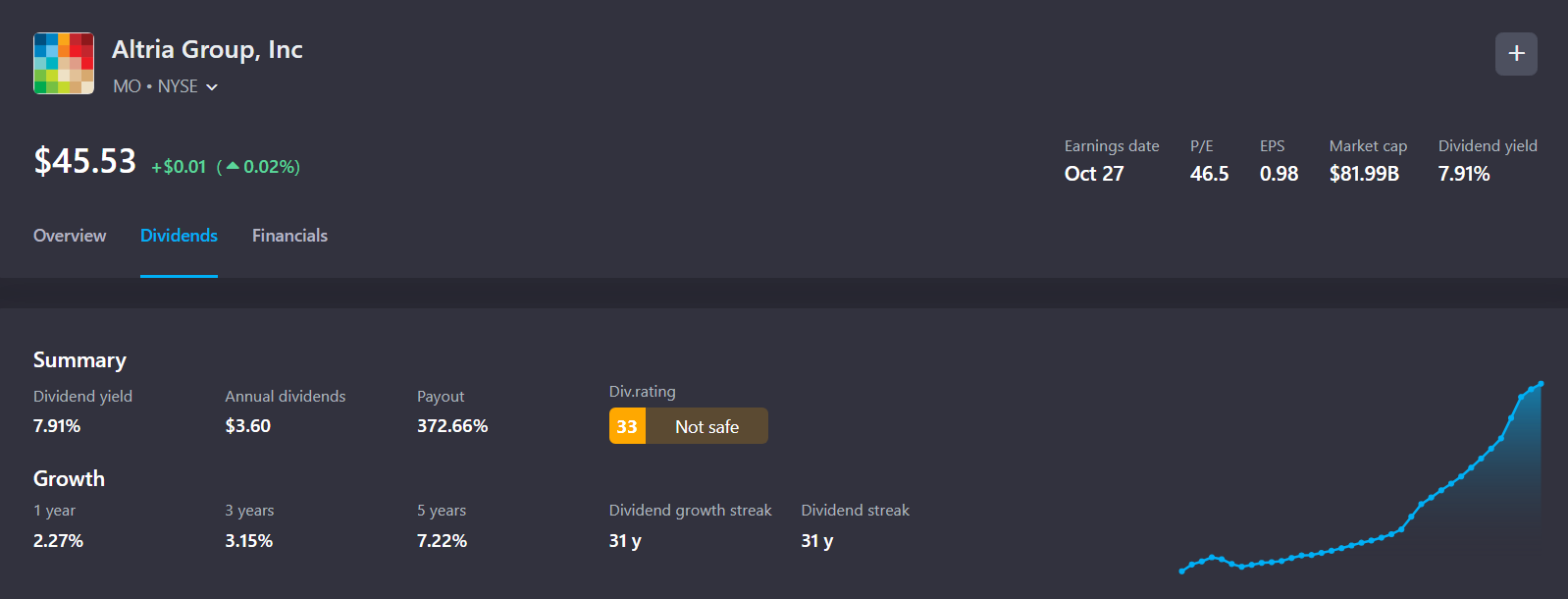

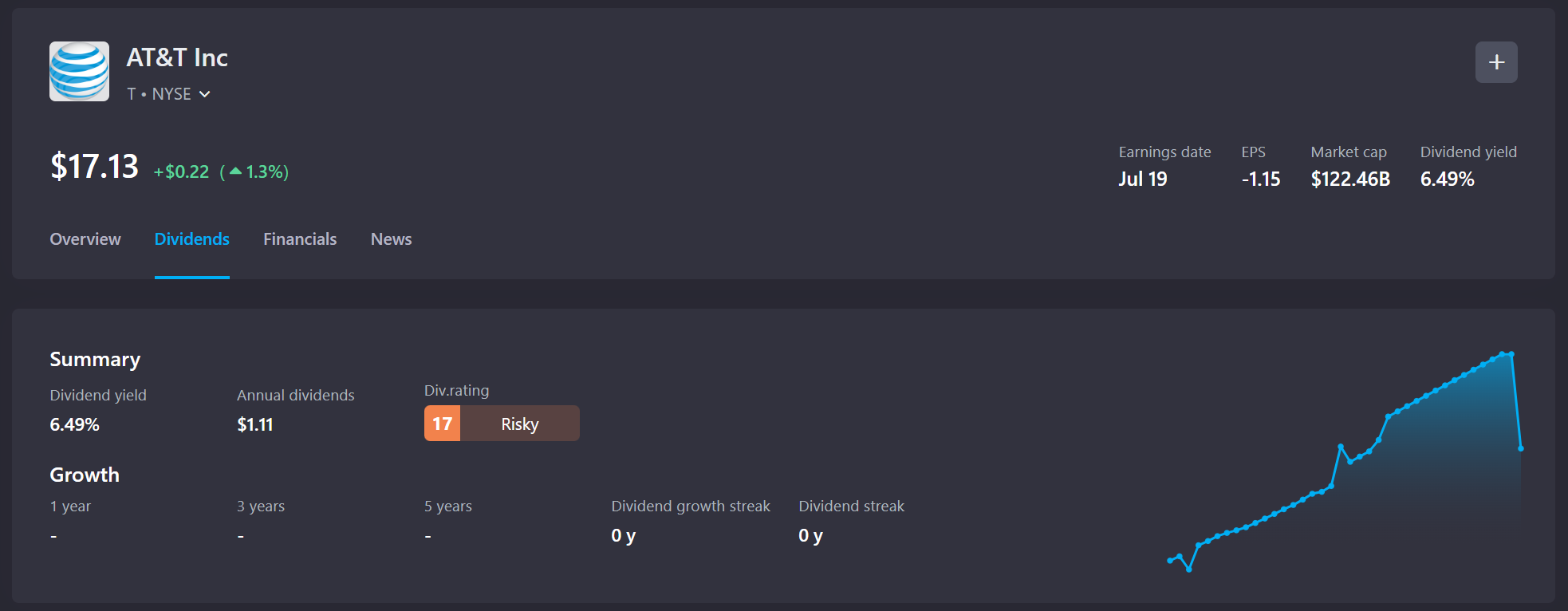

By investing in companies with a higher Dividend Rating, you can reduce your investment risk and increase your chances of generating a steady stream of income. Dividend Rating can also help you identify companies that may be at risk of cutting their dividend payout in the future, allowing you to adjust your investment strategy accordingly.

User-friendly but powerful tool for dividend stocks

Dividend Rating is a user-friendly tool designed to help investors evaluate and monitor dividend-paying stocks. With the system's 13 fundamental indicators, investors can quickly assess a company's financial stability and likelihood of sustaining its dividend payout. This allows investors to make informed decisions about potential investments or monitor existing ones with ease.

Overall, using Dividend Rating by Snowball-Analytics can help you identify stable and reliable dividend-paying companies, make informed investment decisions, save time on research, reduce investment risk, and stay ahead of the game.

Dividend Rating is a proprietary system developed by Snowball-Analytics. The system is based on a comprehensive analysis of key financial metrics of companies that pay dividends. The factors analyzed include the company's earnings per share, payout ratio, dividend yield, revenue growth, debt-to-equity ratio, and more. Each of these factors is given a weight based on its importance in assessing a company's financial stability.

Once the factors are weighted, Snowball-Analytics assigns a rating to the company, ranging from 0 to 100. Companies with an 100 rating are considered to have the strongest financial stability and are most likely to sustain their dividend payouts. Companies with a rating below 35, on the other hand, are considered to be at high risk of cutting their dividend payout.

Don't let the hassle of dividend cuts get in the way of achieving your financial goals.

Dividend Rating is a valuable tool for investors looking to build a passive income stream and maximize their returns while minimizing investment risks. By assessing the financial stability of companies that pay dividends, Snowball-Analytics provides investors with a comprehensive rating system that can help them make informed decisions about their investments. With Dividend Rating, investors can create a diversified portfolio of stocks that generate a stable income stream and maximize their returns.