Let's be real – the world is jam-packed with digital tools for managing your money, so many that it's tough to keep track of every new one. This abundance means you're pretty likely to find something that fits your needs perfectly. However, it also means that a lot of investors either settle for something that's just okay, or they get overwhelmed and stop looking altogether.

So, whether you're on the hunt for a financial advisor, looking to get smarter about budgeting your current income, wanting a clearer picture of your overall financial health, or all of the above, we're diving into some popular personal finance tools in this piece. The goal? To help you pick the right tool, or maybe even a mix of tools, that works best for you.

Track your Financial Progress in Simple but Informative Way

Let's face it, setting goals is tricky when your money is all over the place – checks, stocks, gadgets, different accounts, countries, institutions. It's like trying to solve a puzzle with pieces scattered everywhere.

But imagine having a personal finance tool that puts all your financial info right at your fingertips. It's like having a financial dashboard where you can see everything clearly, which makes it way easier to set and follow through on important money goals.

Snowball Analytics: Simple and powerful portfolio tracker.

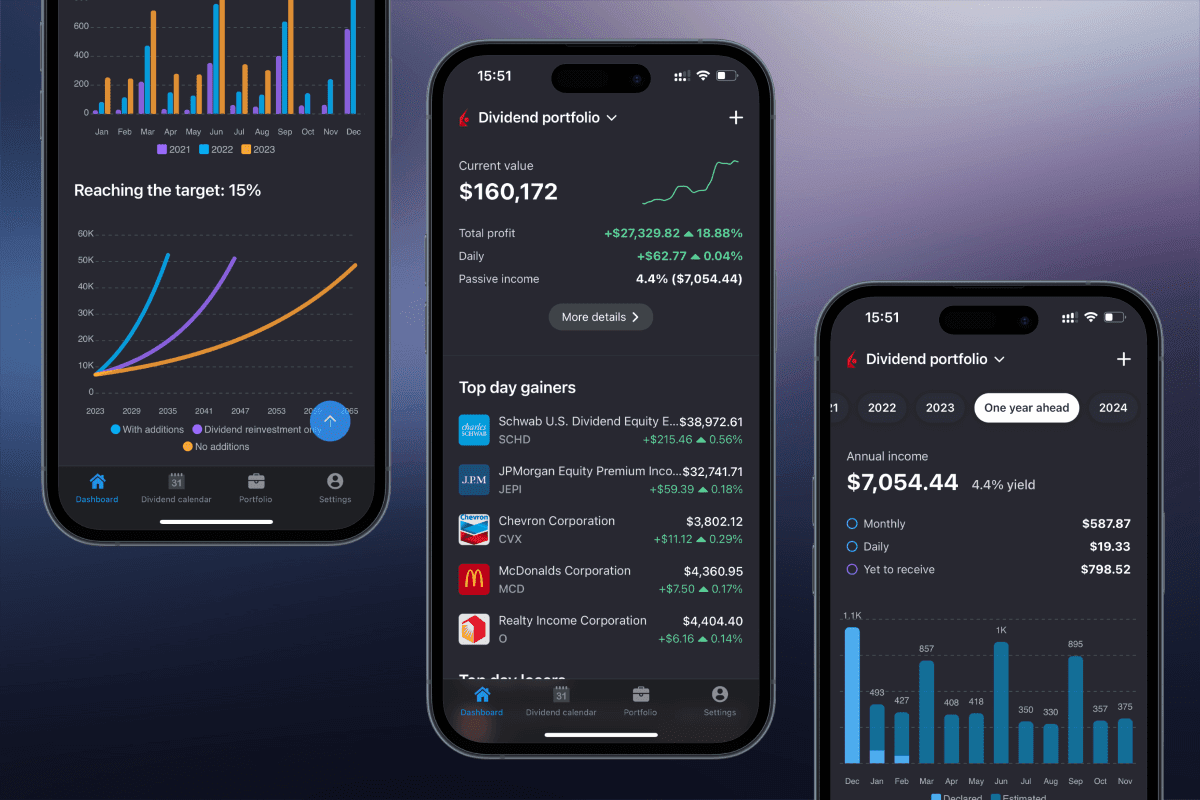

Snowball Analytics, created by private equity investors, who wanted to make a simple but informative tool to track investments automatically and in one place. Now it grew from just personal investment sheet software to a investors community with financial tools that helps users collaborate and keep track of all of their assets, track portfolios and net worth from a single, simple platform.

Snowball Analytics is like your investment spreadsheet, but it's easier to start, automatic and allows you to add and track your 401k, Roth IRA, bank accounts, savings accounts, brokerage accounts, and pretty much any other financial accounts (check out the thousands+ of financial institutions!).

The main page provides general information about the status of the portfolio:

- Value - the current value of the portfolio in the selected currency

- Invested - the amount of purchases of all current (unsold) assets + currency

- Total profit, which includes dividends received, realized PL, fees paid and taxes on dividends for the entire lifetime of the portfolio

- Internal Rate of Return - net annual return earned by the investor over a period of time and calculated on the basis of the incoming and outgoing cash flows

- Passive income from dividends and regular payments. Only regular payments are considered (special dividends and one-time payments are not included). The yield (%) is displayed in relation to the current value of assets (excluding cash balance).

On the Analytics - Dividends tab you can find a detailed asset analysis from the point of view of the dividend investment strategy. The filter option is available and functions like the other tabs on the page. You can use this filter to have the analytics displayed only for selected holdings /categories.

App for mobile

This service has a great web mobile application that you can use similar to mobile application. Just place a website icon on your device's home screen, which can then be used like any other app. Or use native apps for iOS and Android.

Security

Snowball Analytics uses best-in-class security practices to keep user information safe. The personal data it stores is encrypted both in transit and at rest to keep it as safe as possible. It never collects your brokerage passwords or log in credentials as it uses a third-party integrator to protect your data.

Also, Snowball Analytics is based in the EU, so it follows GDPR privacy laws. This means that they won't sell your personal information without your consent, and you have the right to opt out of any marketing campaign

Sharesight

Sharesight, founded in 2006 by a father-and-son duo from New Zealand, has established itself as one of the pioneering portfolio tracking tools globally. As an older platform, its visual representation methods might now seem outdated - the platform's static and table-based presentation suits more mature investors, but as time progresses, newer approaches are becoming essential.

Another crucial difference from Sharesight is that Snowball Analytics excels in dividend tracking and is great tool for managing dividend portfolios. It has special tools just for keeping track of dividends and making them work better for you. You can see how much you're getting in dividends, how it's changing over time, and even get a special "Dividend rating" to help you decide which ones are best for your investments.

Another beneficial feature is a tax reporting tool that allows you to customize your tax residency and set the end of your tax year. Additionally, you can navigate between 8 major cryptocurrencies as part of its asset portfolio.

However, the presentation of dividend payments resembles a spreadsheet with data on stocks, payment dates, and the amount of money to be received. Poor visualization make the portfolio tracking process quite boring.

Sharesight charge USD 24 per month for Premium Subscription. However even the most expensive plan is limited to 10 portfolios and 7 days to test a free trial version.

This is why Snowball Analytics deserves special attention as it provides more tools and features for less payment with multiple dashboards and graphs that transform the dividend tracking process into an engaging and informative experience.

Dividend.watch

DividendWatch is another European-based portfolio tracking tool in the same price category as Snowball Analytics. Its premium subscription starts at USD 8 per month; however, some features are missing.

Unlike Snowball Analytics, DividendWatch supports only 23 exchanges and 83,100 stocks and has fewer forecasting options.

DividendWatch will be appreciated by Twitter lovers. It is a well-done dividend analysis tool with a user-friendly dashboard. It has a customizable list of stocks and the possibility to check all the news related to a certain stock. As for other instruments, this tool supports ETFs, REITs, and 11 currencies.

It is also possible to see a diagram that represents the evolution of your portfolio on a monthly and yearly basis. However, it seems that it was developed only as a top-level option. You may also face some light difficulties with portfolio planning or setting up benchmark comparison.

Calendars and earnings reports with diversification by industry are available to download. However, if you need to have more detailed portfolio performance analytics, we still recommend using Snowball Analytics.

You will get twice as many options for the same price - USD 8 per month for a premium subscription.

After evaluating the advantages and disadvantages of popular portfolio trackers, Snowball Analytics emerged as the preferred choice for private investors focused on affordability and user-friendly interface.