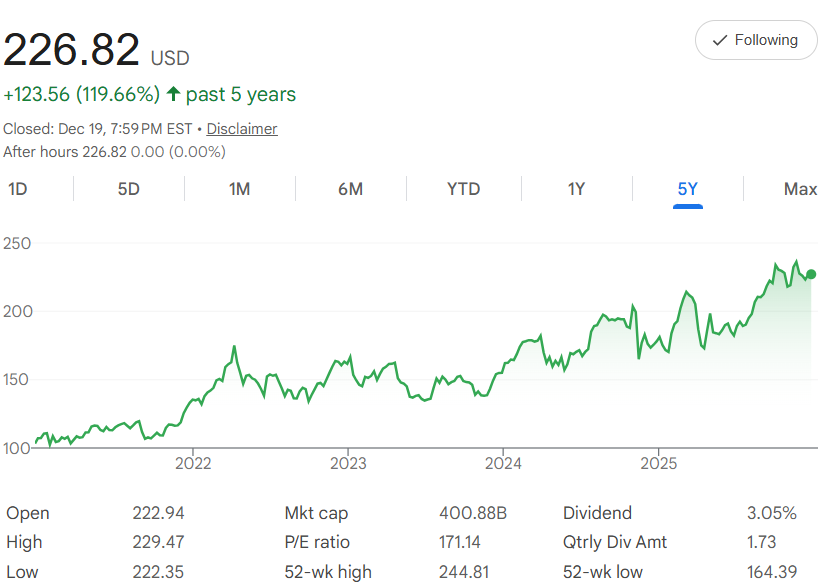

ABBV's Steady Medicine: $500 Monthly Bets Could Build Lasting Value in Five Years

Five years ago, AbbVie Inc. $ABBV shares were trading around $103.26 each. Today, December 19, 2025, it's closed at $226.82—a solid 119.66% price gain that comes from its strong lineup of drugs like Humira for arthritis, Skyrizi for psoriasis, and Rinvoq for immune conditions, plus growing oncology and neuroscience portfolios. The chart shows a reliable upward path from 2022 lows, with consistent progress through 2025, and a 52-week high of $244.81 indicating more room for treatment-driven growth.In basic terms, the compound annual growth rate (CAGR) is 17.04%. That's the average yearly lift that explains the rise—calculated by raising the total growth factor to the 1/5 power and subtracting 1. Simply put, it's like adding about 17% to your money each year, on average.

Build your portfolio, one day at a time.

Get our daily 5-year horizon picks sent to your inbox. Subscribe here.

Dollar-cost averaging (DCA) makes this approachable: Invest $500 every month for five years, totaling $30,000. You buy more shares on lower days and fewer on higher ones, which helps even out the market moves. Projecting forward at the same historical pace, with a monthly growth rate of about 1.31% from $226.82, your shares add value over time.

After 60 months, your total could reach $45,919. That's a gain of $15,919—a 53% return on your investment. The early buys get the most from compounding, while later ones still benefit from the upward trend.

This is based on the past, which doesn't guarantee the future—pharma can face patent expirations or competition, but a P/E ratio of 171.14 reflects specialty focus, and a 3.05% dividend yield provides regular payouts. With that 52-week high of $244.81 in sight and a $400.88B market cap, ABBV has endurance. If DCA fits your patient plan, it could turn your $500 habit into a healthy balance by 2030. Ready to dose up?