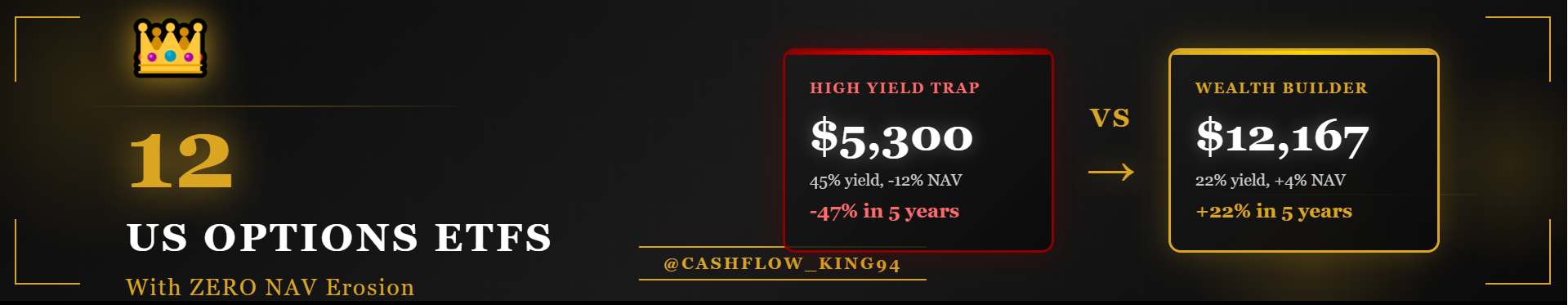

The income investing world is full of beautiful lies.

The most seductive one? "Higher yield equals better returns."

Here's reality: Most high-yield options ETFs are quietly liquidating your portfolio while disguising it as "income