If personal finance were actually about math, we’d all be millionaires with six-pack abs. We know the formulas. We know how to subtract expenses from income. But the most dangerous financial decisions aren’t made in Excel; they’re made in the dark of night when we’re feeling insecure, or at a party when we’re feeling envious. It’s time to stop treating your bank account like a math problem and start treating it like a behavior problem.

Most financial advice reads like a geometry textbook: if you follow the formula, you get the result. But in the real world, people don’t make financial decisions on a spreadsheet. They make them at the dinner table, fueled by ego, fear, envy, and a unique personal history.

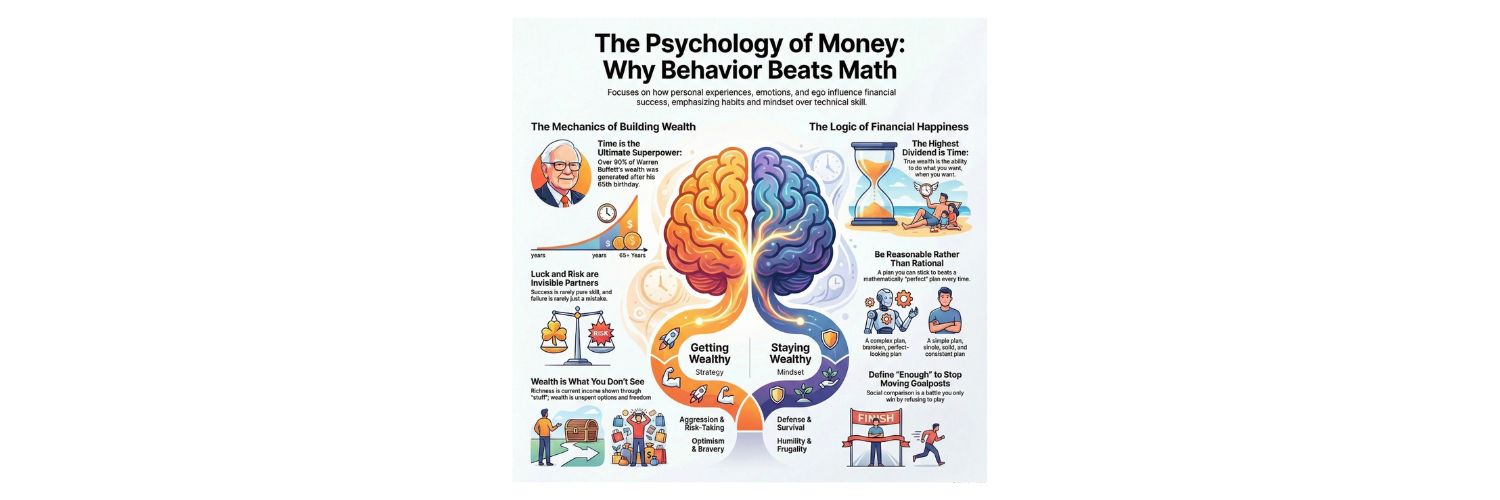

As Morgan Housel famously argued in The Psychology of Money, https://amzn.to/4q4lviT doing well with money has little to do with how smart you are and a lot to do with how you behave. Here is how to master the "invisible math" of wealth.

1. The Survival Strategy: Getting Rich vs. Staying Rich

Getting rich is an act of offense. It requires a blend of optimism, risk-taking, and putting yourself out there. It’s the excitement of the "hustle."

Staying rich, however, is a game of defense. It requires the opposite traits: humility, a touch of paranoia, and the realization that what you made can be taken away just as fast.

The Trap: Many people try to stay rich using the same aggressive risk-taking that made them rich.

The Fix: Accept that "getting" and "keeping" are two different skill sets. Success requires being an optimist about the long term, but a "survivalist" about the short term.

2. The Distinction Between Rich and Wealthy

We are trained to judge financial success by what we see: the cars, the homes, the Instagram-worthy vacations. This is richness; it is a function of current income spent.

Wealth, however, is what you don't see. It is the car not purchased. The diamond not bought. The equity left in the portfolio.

Richness is a display of status.

Wealth is a collection of options.

Wealth provides the greatest "unseen" benefit: the ability to wait, to pivot careers, or to retire early. Every dollar you save is a piece of your future that you own.

3. The Power of "Reasonable" Over "Rational"

If you were a robot, you would maximize every penny for the highest mathematical return. But you are a human with a nervous system.

Rational: Investing 100% of your net worth in equities because historically they return more.

Reasonable: Keeping 20% in cash because it stops you from panicking and selling everything when the market drops 30%.

A "perfect" plan that you abandon during a crisis is a failure. A "flawed" plan that you can stick to for thirty years is a stroke of genius. Build for endurance, not just efficiency.

4. The Goalpost Problem: The Cost of "Enough"

The hardest part of finance is not the math of compounding; it's the psychology of satisfaction. Modern capitalism is designed to make you feel like you’re falling behind.

The Danger: If your expectations grow at the same rate as your income, you will never feel the freedom your money was supposed to buy.

The Solution: Define your "enough." Without a finish line, the race for more eventually leads to regret or "social suicide" (taking risks with money you need for money you only want).

5. The Ultimate Superpower: Time

We tend to credit genius for the success of people like Warren Buffett. While he is a brilliant investor, his true secret is longevity. He started investing seriously at age 10; if he had started at 30 and retired at 60, you likely would never have heard of him.

The most powerful force in finance is time, but time only works if you give it decades to breathe. This brings us back to behavior: you have to be temperamentally stable enough to stay out of your own way.

Conclusion: The Highest Dividend

Money's greatest intrinsic value is its ability to give you control over your time. To wake up and say, "I can do whatever I want today." That isn't a math problem; it’s the ultimate behavioral reward.