In the world of retail investing, there is a loud, persistent pressure to pick a side. It often feels like you have to join a "tribe." On one side, you have the Dividend Seekers: the cautious, income-focused investors who obsess over yield and "getting paid to wait." On the other side, you have the Growth Chasers: the high-octane thrill-seekers looking for the next 10x tech disruptor or biotech moonshot.

The tribes rarely speak the same language. One side calls the other "boring," while the response is often "reckless." But here is the secret the pros won't tell you: the most resilient wealth isn't built at the extremes. It is built in the middle.

The Lesson of the "Growth-Only" Trap

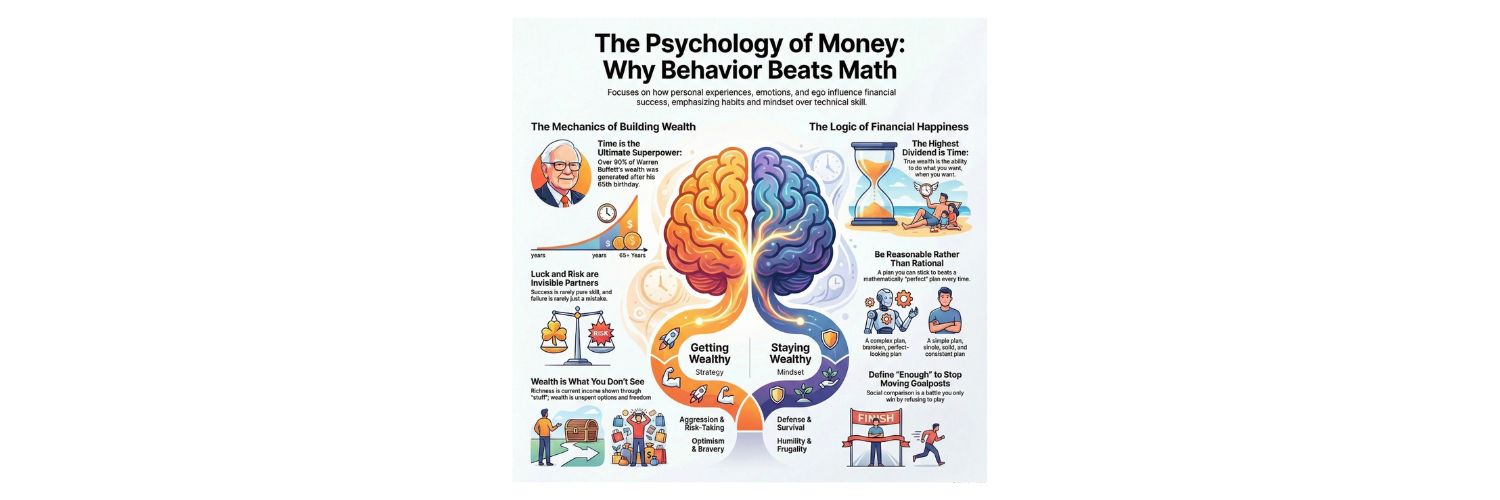

I know this because I lived it. A few years ago, I was a card-carrying member of the Growth Tribe. My portfolio was a collection of high-flying software companies and "disruptive" innovators. When the market was up, I felt like a genius. Watching a position climb 15% in a week is a powerful dopamine hit.

But then, the tide turned.

As interest rates rose and the market’s appetite for "unprofitable growth" evaporated, my portfolio didn't just dip—it cratered. I watched names I loved drop 40%, 60%, and even 80%. There was no "floor." Because these companies paid no dividends, there was nothing to tether the stock price to reality, and no cash hitting my account to soothe the pain. I realized, quite painfully, that while I liked the idea of high risk, the actual decline was far above my true risk tolerance. I wasn't just losing money; I was losing sleep.

The Middle Ground: The Best of Both Worlds

Instead of choosing between a stagnant utility company paying 5% or a volatile tech firm paying 0%, you look for companies that do both. These are firms that are profitable enough to pay a dividend but are still growing fast enough to increase that payout every single year.

When you invest in dividend growers, you get a "double compounding" effect. You get the capital appreciation of the stock price, plus a rising stream of income that you can reinvest to buy more shares. This creates a psychological "win-win": if the stock price goes up, your net worth grows. If the stock price goes down, your dividend yield (on cost) goes up, and your reinvested dividends buy more shares at a discount.

Scaling Growth to Your Risk Tolerance

Once you have established a "core" of these steady dividend growers, you can then sprinkle in "pure" growth plays based on your specific risk tolerance. Think of your portfolio like a high-performance vehicle. This is my approximate breakdown:

The Core (60-80%): Dividend growth stocks provide the chassis and the safety features.

The Turbo (20-40%): High-growth and some non-dividend stocks provide the extra speed.

The Bottom Line

You don't need to join a tribe. You need a strategy that survives the winter. By anchoring your portfolio in dividend-paying growers and adding pure growth only up to the level where you can still sleep at night, you create a machine that builds wealth in the sunshine and protects it in the rain.

My Choice is to Stop choosing and Start blending.

Tell me about your strategy and tell me if im an idiot and need to pick one of these sides?!?