The income investing world is full of beautiful lies.

The most seductive one? "Higher yield equals better returns."

Here's reality: Most high-yield options ETFs are quietly liquidating your portfolio while disguising it as "income." You're getting taxed on your own capital being returned to you.

After analyzing the US options-based ETF landscape, I've found 12 funds that break this pattern: Zero NAV erosion while generating real income.

These aren't yield traps. These are wealth-building engines.

The Numbers That Expose The Trap

Two investors. Same $10,000 starting capital. Five years later, wildly different outcomes.

Investor A: Chasing The 45% Yield

45% annual yield

NAV dropping 12% per year

Result after 5 years: $5,300 in capital (down 47%)

Annual income now: $2,385 (also down 47%)

Investor B: The 22% "Boring" Yield

22% annual yield

NAV growing 4% per year

Result after 5 years: $12,167 in capital (up 22%)

Annual income now: $2,677 (up 22%)

The fund with half the yield delivered:

130% more capital

12% more annual income

Actual wealth creation instead of slow liquidation

This is NAV erosion in action.

And most income investors don't see it until it's too late.

The 5 Tests Every Fund Must Pass

I don't buy any options-based ETF until it clears all five hurdles:

1. Sector Conviction I need multi-year bullish conviction on the underlying assets. No amount of yield matters if the sector is dying.

2. NAV Integrity The fund must maintain or grow its net asset value. Structural decay is non-negotiable... it disqualifies the fund immediately.

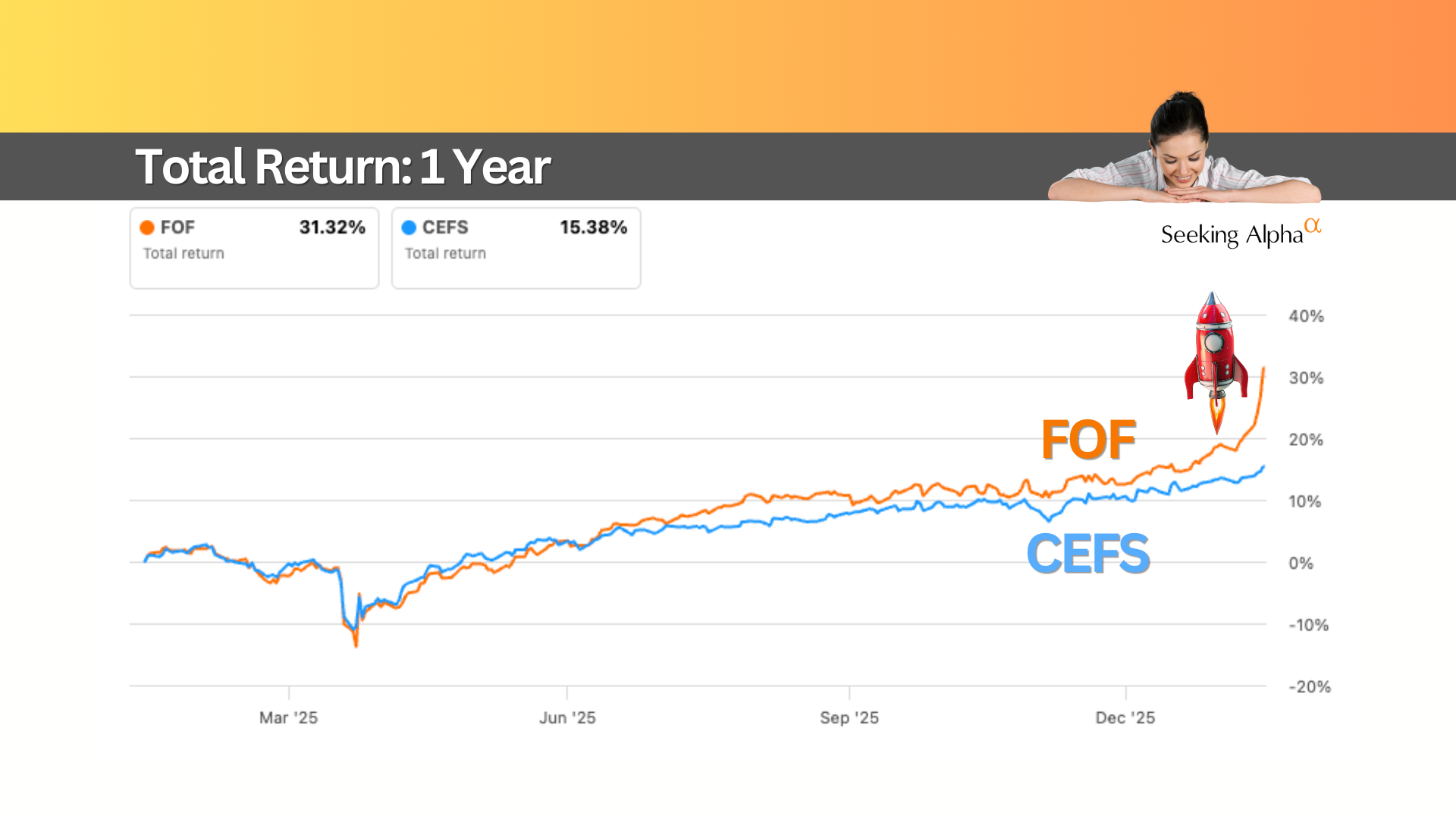

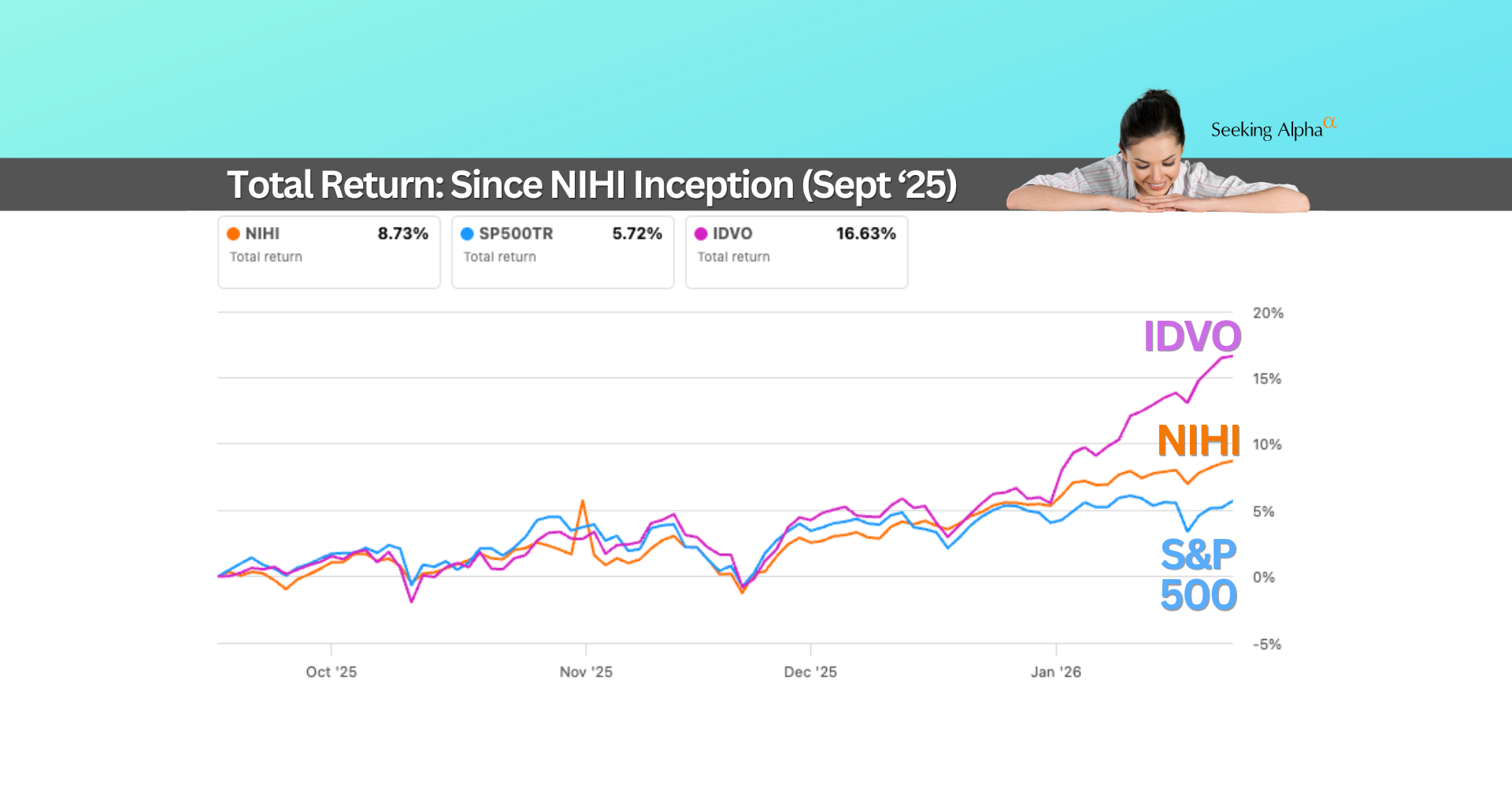

3. Proven Performance 10-20% total returns over time. Not just distributions, actual total returns that prove the strategy works in real markets.

4. Realistic Yields Below 40%. Anything higher is almost always unsustainable!! Either returning your capital, capping too much upside, or both.

5. Intelligent Options Strategy Out-of-the-money strikes, thoughtful expirations, dynamic management. Not weekly ATM covered calls that sacrifice all upside.

When a fund passes all five tests, you get something rare: income without destroying your future.

The 12 US Funds That Pass

Here's the complete list, organized by provider:

XFunds/Nicholas

YieldMax

TappAlpha

REX Shares

Roundhill

NEOS Investments

Kurv

Goldman Sachs

Every single one has demonstrated:

Sustainable distribution mechanics

Options strategies that don't cap 100% of upside

NAV stability or growth over extended periods

Exposure to sectors with genuine long-term potential

Why Most High-Yield Funds Fail

The mechanics matter more than the marketing.

The Destroyers Do This:

Write aggressive weekly covered calls or options-based strategies

Maximize short-term premium at the expense of all upside

Miss every significant rally

Liquidate positions slowly as shares get called away

Distribute more than the strategy actually earns

These 12 Do This:

Use strikes 10-15% out-of-the-money

Monthly or quarterly expirations (not weekly)

Adjust strikes dynamically based on volatility

Use put-write strategies that preserve upside

Actually earn what they distribute

The difference in outcomes?

Bad funds cap 100% of upside and still erode NAV.

These funds capture 60-80% of upside moves while generating income.

Understanding Real NAV Decay

There's a critical distinction most investors miss.

This Is NOT NAV Decay:

Your tech fund drops 15% because the Nasdaq corrects.

This is market volatility

Your NAV reflects underlying asset prices

It recovers when the market recovers

This IS NAV Decay:

Your fund's structure systematically destroys value regardless of market direction:

Distributions exceed what the options strategy earns

Aggressive covered calls cap all upside in rallies

Shares constantly called away below fair value

Poor management and high fees compound the damage

When NAV decay is structural, no bull market saves you.

The fund's mechanics are the problem.

These 12 funds avoid structural decay entirely.

The Wealth-Building Math

This has never been about maximizing yield.

It's about maximizing total wealth while generating income.

Five Years Out:

The High-Yield Trap (45% yield, -12% NAV):

Your $10K → $5,300 (-47%)

Annual income: $2,385 (down 47%)

The Wealth Builder (22% yield, +4% NAV):

Your $10K → $12,167 (+22%)

Annual income: $2,677 (up 22%)

Lower yield wins.

More capital. More income. Actual compounding that works for you.

What You Need To Look For

Four indicators separate winners from traps:

NAV stability – Consistent or growing net asset value

Sustainable yields – Below 40%, ideally 15-25%

Smart options mechanics – OTM strikes, longer expirations, dynamic management

Bullish sectors – Tech, semiconductors, crypto, broad indexes with tailwinds

These 12 tickers check every single box.

My Non-Negotiable Checklist

Before adding any options ETF to your portfolio, run it through this filter:

Sector conviction – Multi-year bullish thesis on the underlying assets

Sector conviction – Multi-year bullish thesis on the underlying assets

NAV integrity – Zero structural decay

NAV integrity – Zero structural decay

Performance proof – 10-20% total returns demonstrated over time

Performance proof – 10-20% total returns demonstrated over time

Yield reality – Below 40%, sustainably earned

Yield reality – Below 40%, sustainably earned

Strategy intelligence – Options mechanics that preserve meaningful upside

Strategy intelligence – Options mechanics that preserve meaningful upside

When all five criteria align, you get what these 12 US funds deliver:

Income that builds wealth instead of destroying it.

Final Word

The US options-based ETF market is overflowing with wealth traps disguised as income solutions.

50% yields that turn $10K into $5K. Weekly distributions that are just your capital being returned. Funds that cap 100% of your upside to maximize short-term premium.

Don't fall for it.

These 12 US tickers prove you can generate meaningful income while maintaining capital integrity.

They've passed every test.

Your portfolio and your future, deserve funds that actually work.