I wish to briefly introduce the Dividend Aristocrats for those who are not yet familiar with this group of companies. These are businesses that do not simply pay dividends for decade, they have increased them annually for a minimum of 25 consecutive years.

In 2025, interest in the Aristocrats has markedly increased: many of them have already demonstrated a rally due to stable results and expectations of a more accommodative monetary policy.

For investors, this represents a reliable anchor point: the Aristocrats have survived multiple economic cycles, maintaining stable cash flows and discipline regarding shareholder distributions. Some of these companies will also be included in my own portfolio. However, strong price appreciation is not a reason to suspend sound judgment. A long history of dividend increases helps in identifying more resilient businesses, but valuation and quality remain crucial.

In this analysis, I’ll explain how to use this list effectively.

After reading the article, please share which of the Aristocrats are currently in your portfolio?

Examples of "Top" Aristocrats 2025

When I reviewed the list at the beginning of December 2025 several companies with notable performance particularly stood out. Here are the examples:

Div.rating | Ticker | Company | Dividend yield | Div.growth, 5 years | Payout ratio |

31 | Franklin Resources, Inc. | 5.75% | 3.27% | 130.25% | |

32 | Amcor plc | 6.11% | 2.09% | 165.36% | |

55 | Realty Income Corporation | 5.7% | 3.42% | 75.55% | |

39 | Target Corporation | 5.27% | 11.02% | 50.41% | |

19 | Stanley Black & Decker, Inc | 4.69% | 3.49% | 123.07% | |

52 | Hormel Foods Corporation | 5.08% | 4.52% | 83.32% | |

52 | T. Rowe Price Group, Inc. | 5.02% | 7.13% | 68.73% | |

28 | Kenvue Inc. | 4.89% | - | 109.98% | |

47 | Kimberly‑Clark Corporation | 4.75% | 3.16% | 67.61% | |

50 | The Clorox Company | 4.64% | 2.54% | 74.32% | |

51 | Federal Realty Investment Trust | 4.59% | 0.98% | 64.31% | |

25 | Eversource Energy | 4.56% | 5.81% | 123.42% | |

51 | Chevron Corporation | 4.61% | 5.8% | 68.53% | |

40 | Archer-Daniels-Midland Company | 3.42% | 7.21% | 88.9% | |

72 | Air Products & Chemicals, Inc. | 2.77% | 5.9% | 101.85% | |

84 | Cintas Corporation | 0.98% | 19.14% | 34.09% | |

51 | Genuine Parts Company | 3.2% | 5.29% | 69.26% | |

47 | Lowe's Companies, Inc. | 2.02% | 15.87% | 38.55% | |

64 | Dover Corporation | 1.12% | 0.99% | 12.36% | |

67 | PPG Industries, Inc. | 2.85% | 5.77% | 61.82% | |

73 | Sherwin-Williams Company | 0.92% | 12.08% | 29.89% | |

88 | Ecolab Inc. | 0.95% | 6.59% | 32.94% | |

94 | S&P Global Inc. | 0.78% | 7.46% | 28.68% |

Some of these companies stand out as solid long-term holdings, even without perfect entry points, offering a reliable combination of dividend income and business stability.

Why I Personally Consider the Aristocrats a Prudent Choice

When I compiled my "candidate watchlist," the following factors attracted me:

Businesses that consistently raise dividends for decades are a clear sign of a healthy business model, stable cash flow, and commitment to shareholders. Even if the stock price doesn't grow quickly, the dividends provide a "safety cushion."

With a good dividend yield (5% +), you receive real income, which—with reasonable diversification—can almost be viewed as "rental income," but in the form of dividends.

By holding a portfolio of 5–10 Aristocrats across various sectors (Finance, Retail, Industrials, Real Estate, and others) rather than just one company, you mitigate the risk that a single failure will severely impact your overall return.

Why Do Aristocrats Withstand Crises Better Than the Market?

When I compared the performance of the Dividend Aristocrats Index against the standard S&P 500 during various crises, I noticed a recurring pattern: the Aristocrats fall less and recover faster. Here is why this occurs:

1) Their Businesses Won't Fail in a Single Cycle

Companies that raise dividends for decades are typically highly conservative: they have low debt burdens, they avoid aggressive expansion, and they aren't reliant on a single product or client. This provides them with a safety margin (or "reserve of strength").

2) They Continue Paying Even During a Crisis

While the market is in turmoil and stock prices are collapsing, the investor still receives dividends—and this emotionally helps them withstand the volatility.

3) These Companies Proactively Form a Financial "Cushion"

To raise dividends for years, a company must ensure it has sufficient cash for both payouts and operational activities. Therefore, before crises, they often have high cash flow, stable margins, and low liabilities. This helps them navigate downturns more easily.

4) Their Customers are Those Who Always Spend Money

Many Aristocrats operate recurring businesses related to goods where demand does not fall: food products, housing services, insurance, packaging, and industrial consumables.

Why "Boring" Companies Deliver Superior Results

I'll be honest: when I first looked at the Aristocrats, I thought, "How boring: just packaging, tools, food products, and services." But later, I grasped an important truth:

"Boring" equals Cash Flow Stability. Companies like Hormel Foods, Cintas, Amcor, and others aren't chasing trends or innovative technologies—they sell what people need every single day.

Fewer Headlines Means Less Panic, Less Volatility. Investors aren't running in fear because there are no loud failures, tech scandals, or unachievable promises. These companies don't chase hype; they quietly build up their profits. And it is precisely this "boring" profit that forms the foundation for annual dividend growth.

Growing Dividends + Compound Interest

This is what many underestimate.

If a stock grows slowly but the dividend increases steadily, the total return can be immense.

Example of a "typical" Aristocrat company:

The stock price over 20 years might have doubled, let's say.

But the dividend over the same period could have grown 4 to 8 times.

If the dividends were reinvested, the capital appreciation becomes exponential.

Why this works:

You receive dividends, then you use them to buy more shares.

Those newly purchased shares generate more dividends (the compounding effect).

The company raises the dividend every year, and after 10–20 years, the yield on your original investment can be much higher than your initial yield.

Example:If a company provided a 2% dividend in the first year, and 15 years later is paying 6–7% on the current price, the yield on your initial purchase price could be 15–20% annually just from dividends. This is the very essence of the “hidden wealth machine.”

Young Aristocrats: The potential for rapid growth?

There is one more pattern I noticed while studying the lists over the years:Companies that have just achieved Aristocrat status (25 years of growth) often continue to accelerate their payouts. Having just entered the elite, it is important for them to demonstrate stable cash flow to the market.

These are mid-aged companies. They have already passed the phases of initial overvaluation but have not yet become market "veterans" like Coca-Cola. This means they are often still expanding.

Dividend growth is often double-digit. While the "old guard" grows dividends by 4–6% annually, the newcomers may show 10–15%. This makes them interesting for those who are building long-term dividend income.

Younger companies are often smaller in capitalization and adapt faster. It is easier for them to change their structure, launch new products, and optimize their business.

Ticker | Company | Dividend yield |

Erie Indemnity | 1.86% | |

Eversource Energy | 4.51% | |

FactSet Research Systems | 1.59% | |

C.H. Robinson Worldwide | 1.58% | |

Nordson Corporation | 1.38% | |

J.M. Smucker | 4.26% | |

Fastenal | 4.26% |

Examples of “Young” Dividend Aristocrats 2025

When going through the Dividend Aristocrats list, I focused on companies that only relatively recently reached the 25-year dividend growth mark. These “younger” Aristocrats have already proven their discipline, but they’re often still in a phase where the business can grow and adapt.

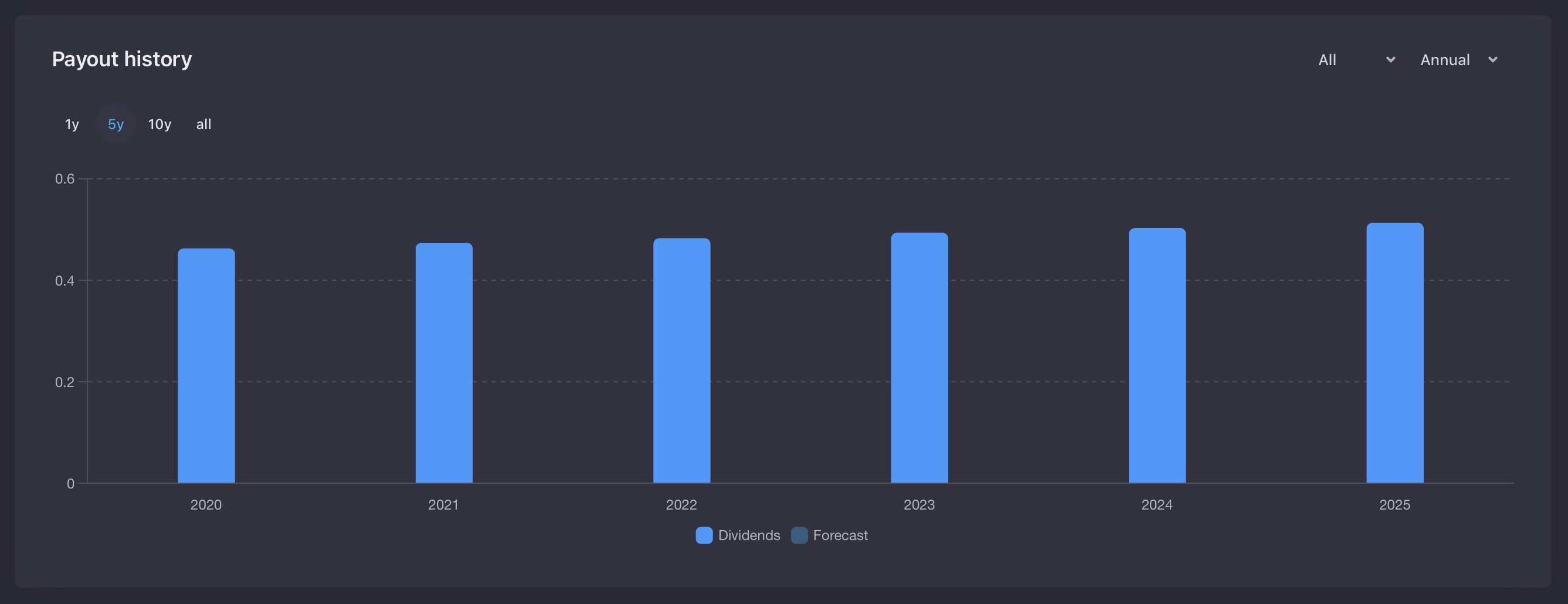

Amcor plc (AMCR) — Packaging

5-Year Price Performance:

Looking at the five-year chart, Amcor clearly lagged the S&P 500 over this period. While the broader market delivered strong returns, AMCR moved in a much narrower range and spent long stretches under pressure.

At the same time, the chart shows that price declines were relatively controlled and followed by gradual recoveries rather than sharp collapses. This behavior reflects the defensive nature of the business: demand for packaging remains stable, but growth expectations are limited.

How to read this:

Amcor hasn’t been a price-performance story over the last five years. Instead, it behaved like a classic income-oriented stock — lower volatility, muted upside, and limited participation in market rallies.Dividends, however, remained a key part of the total return, supported by steady cash flows from essential end markets such as food and consumer packaging.

Why it still fits the list:

AMCR is a good example of why Dividend Aristocrats should not be judged on price charts alone. For investors focused on income and capital preservation rather than beating the index, this kind of performance profile can still make sense as part of a diversified dividend portfolio.

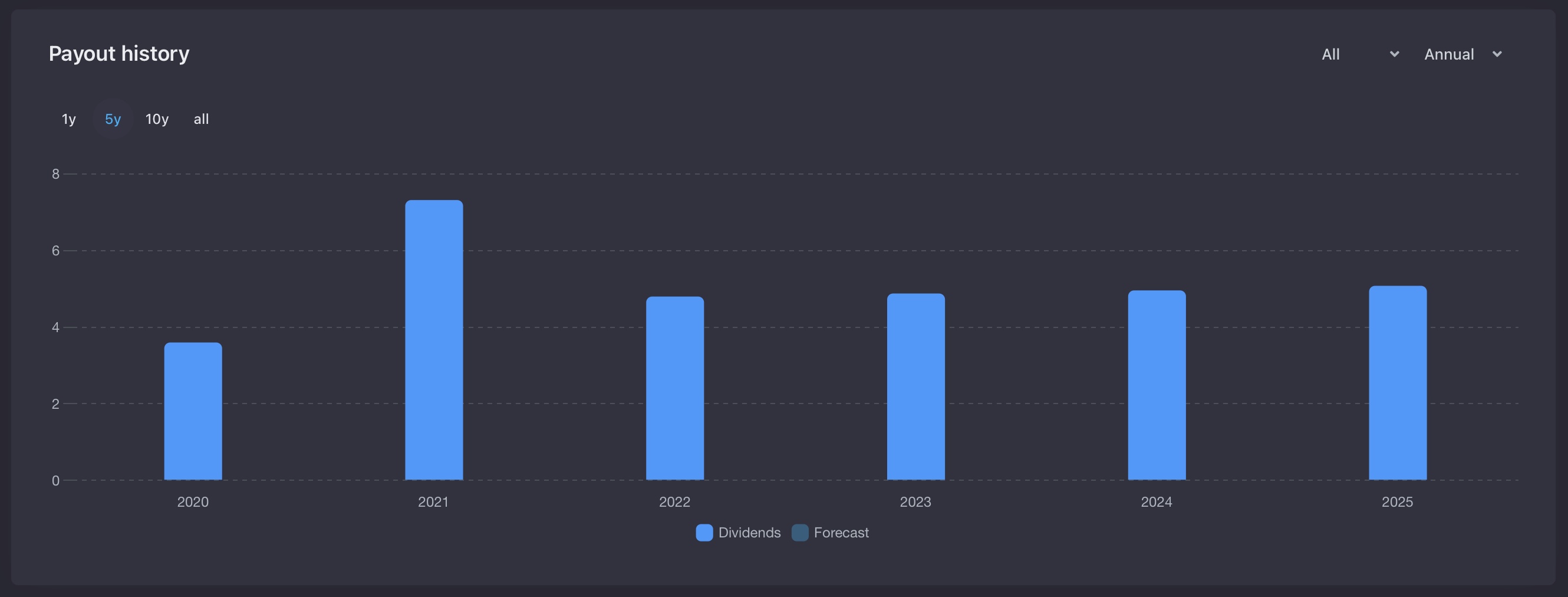

T. Rowe Price Group (TROW) — Financial Services

5-Year Price Performance:

Looking at the five-year chart, T. Rowe Price clearly lagged the S&P 500 over this period. While the broader market delivered strong gains, TROW struggled through a prolonged downturn tied to weaker asset flows and pressure across the asset management sector.

The chart highlights significant volatility, especially during 2022–2023, followed by a partial recovery in 2024–2025. Unlike the index, TROW has not been able to fully recapture prior highs, reflecting ongoing sensitivity to market cycles and investor sentiment.

How to read this:

TROW has not been a price-performance story over the past five years. Instead, it behaved like a cyclical income stock — sharp drawdowns during market stress, followed by gradual stabilization rather than strong upside participation during rallies.

Total returns, however, were supported by dividends. Despite earnings pressure, the company maintained and increased its dividend, backed by a strong balance sheet and consistent cash generation.

Why it still fits the list:

T. Rowe Price is a good example of a high-quality financial business going through an unfavorable part of the cycle. For investors focused on income, valuation discipline, and long-term recovery rather than short-term price momentum, TROW can still have a place in a diversified dividend-focused portfolio.

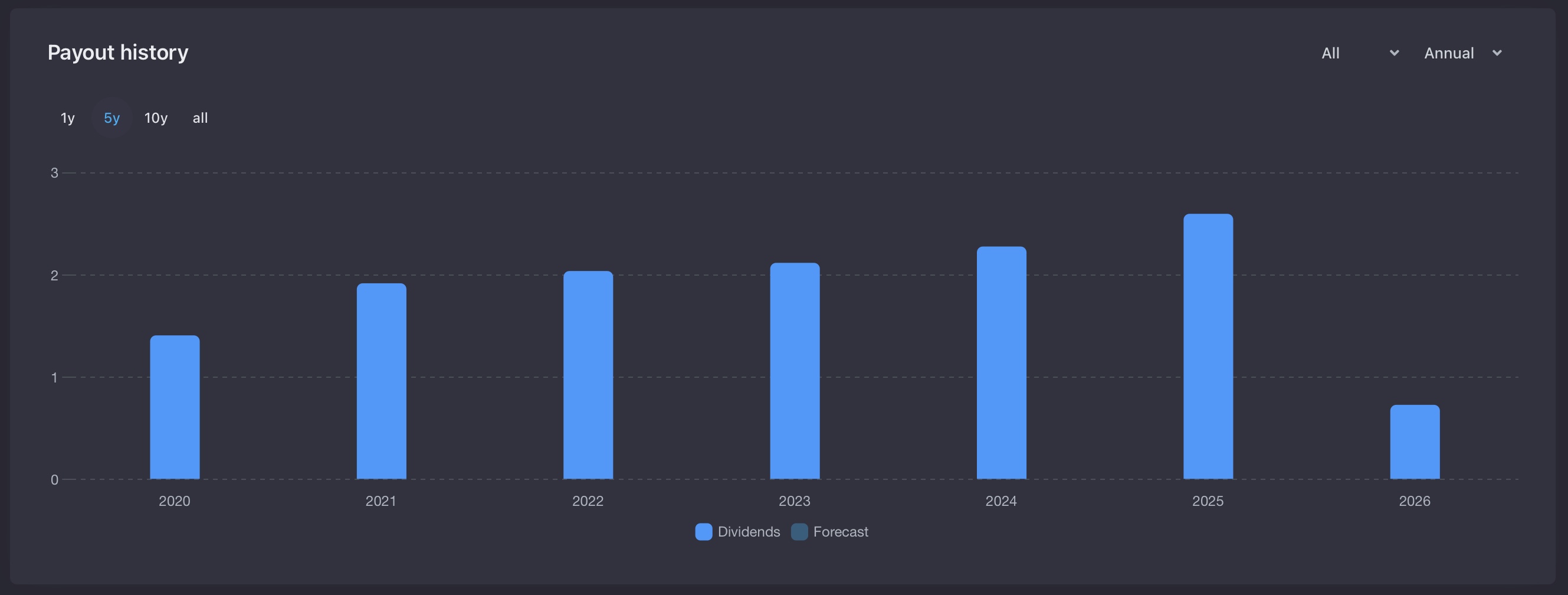

Ecolab Inc. (ECL) — Industrial & Environmental Services

5-Year Price Performance:

Over the past five years, Ecolab (ECL) delivered a solid, though less aggressive, price performance compared with the S&P 500. While the broader market benefited from strong multiple expansion, ECL followed a steadier and more cyclical path, reflecting its exposure to industrial activity, input costs, and global economic conditions.

After a period of pressure in 2022–2023, the stock gradually recovered in 2024–2025, demonstrating the resilience of its business model and the durability of demand for its essential services.

How to read this:

ECL’s five-year chart highlights stability rather than momentum-driven growth. The company operates in mission-critical areas such as water management, hygiene, and industrial efficiency — markets that prioritize reliability and long-term relationships over rapid expansion.

Price volatility during economic slowdowns was followed by normalization, not permanent impairment. Importantly, total shareholder returns were supported by a consistently growing dividend, backed by recurring revenue, strong free cash flow growth, and a globally diversified customer base.

Why it fits the list:

Ecolab is a textbook example of a “young” Dividend Aristocrat — a business with a long runway for growth, but already demonstrating dividend discipline and shareholder-friendly capital allocation.

Its services are largely non-discretionary, giving the company pricing power and earnings resilience across cycles. Combined with a long dividend growth streak and exposure to powerful structural trends such as water scarcity and sustainability, ECL remains a high-quality compounder suitable for long-term dividend-focused portfolios.

How I Approach Forming an Aristocrats Portfolio

If I were forming a portfolio now (for a long-term dividend strategy, for example), I would proceed as follows:

Select 7–12 Aristocrat companies across different sectors: for instance, one Financial, one Industrial, one Consumer Staples, one REIT, and one Retail—to avoid "putting all your eggs in one basket."

Evaluate the current dividend yield + the "premium" age (the streak of increases)—the longer a company has raised dividends, the higher the trust.

Avoid concentrating solely on the highest yields: I would allocate part of the portfolio to companies with a slightly lower income but a more stable business to balance risk and return.

Periodically review the portfolio: If a business starts experiencing difficulties, or if dividend increases cease, I would consider replacing it with another Aristocrat.

Disclaimer: The information in this material is provided for educational purposes only and does not constitute investment or financial advice. Any decisions regarding the purchase or sale of securities are made solely based on your own analysis.

Disclaimer: The information in this material is provided for educational purposes only and does not constitute investment or financial advice. Any decisions regarding the purchase or sale of securities are made solely based on your own analysis.