In a market often defined by "fear of the unknown," income investors frequently find themselves looking backward to find the path forward. These two legendary credit funds have seen it all: the PIMCO Corporate & Income Opportunity Fund (PTY) and the PIMCO Corporate & Income Strategy Fund (PCN).

Both funds offer histories that pre-date the 2008 Global Financial Crisis. More importantly, both continued to pay distributions through that crisis, the 2020 pandemic shock, and everything in between. If you’re looking for "seasoned" assets that yield over 10%, these two deserve a spot on your watchlist.

The Distribution "Gold Standard"

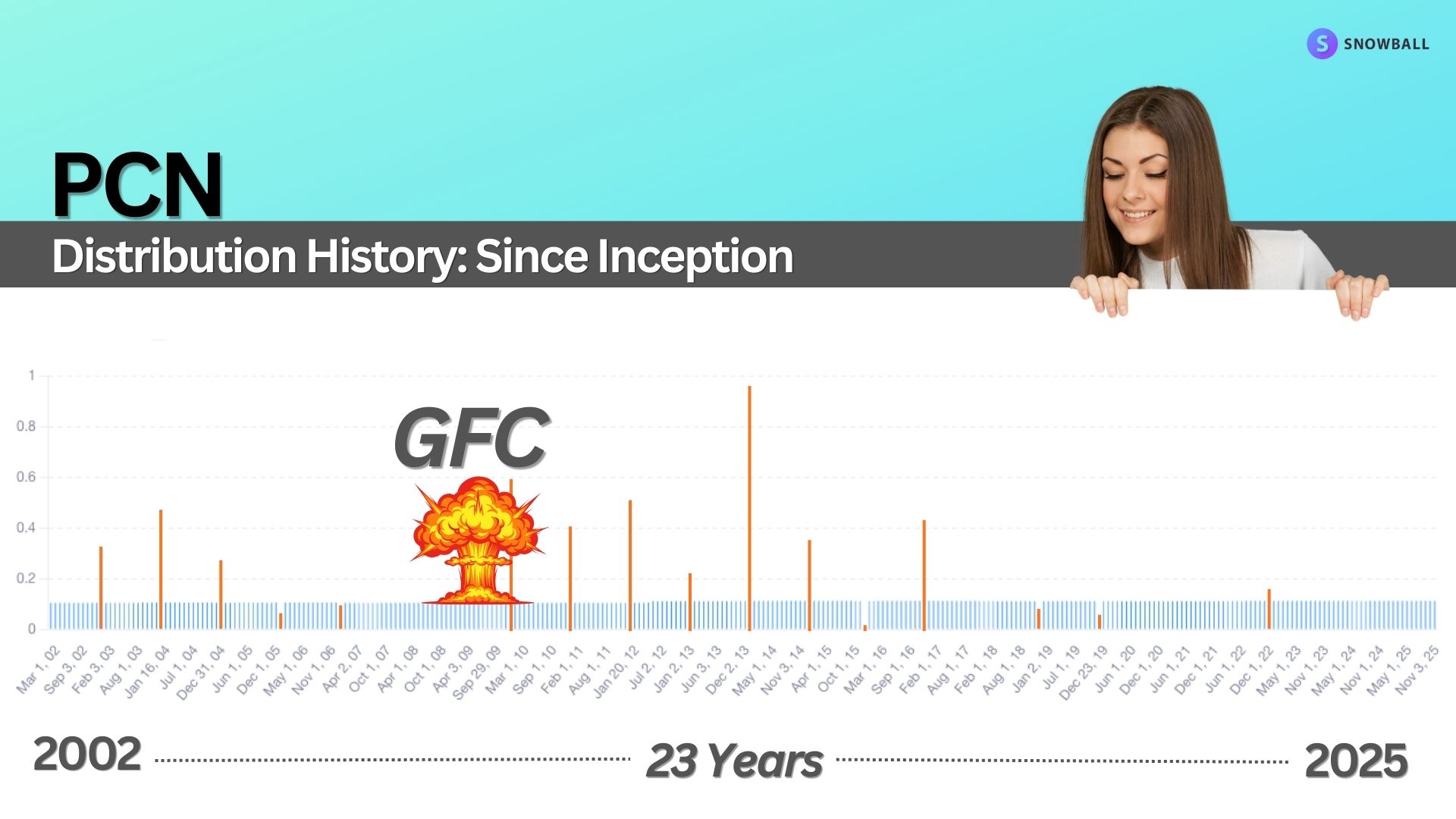

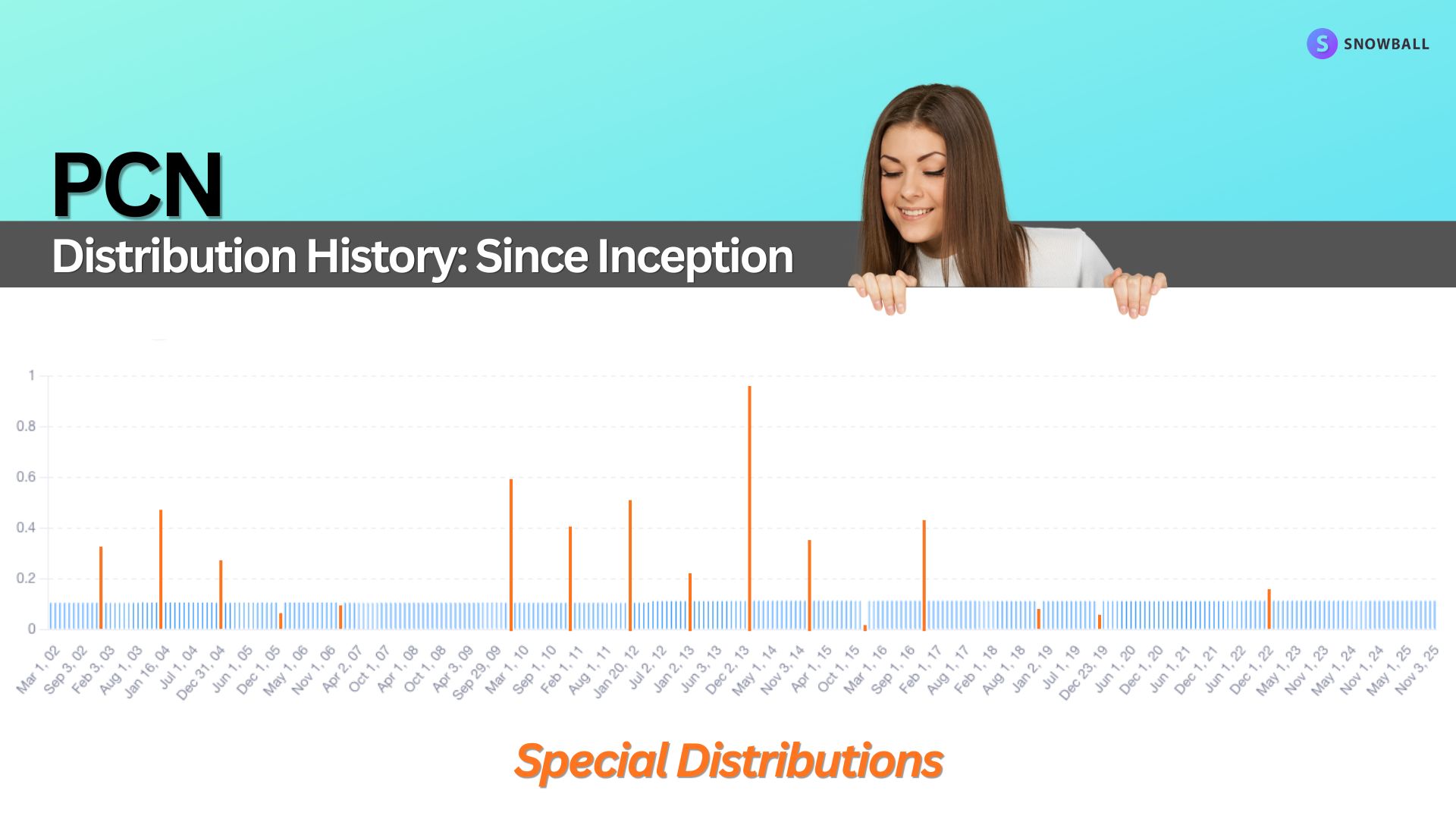

When it comes to consistency, PCN is a rare breed. Its distribution history spans 23 years with a simple story: $0.1125 per month with no cuts to the regular payout. While it doesn't offer the "dividend growth" of a stock like Main Street Capital, its double-digit yield allows investors to manufacture their own growth. By spending 8% and reinvesting the rest, you can effectively compound your income over time.

PTY, PIMCO's flagship CEF, has been slightly more dynamic. Its monthly payout has shifted between $0.12 and $0.14 over the decades. While not as "flat" as PCN, it has never halted payments—even during the darkest days of 2008.

What’s Under the Hood?

Both PTY and PCN are actively managed closed-end credit funds. Unlike a passive index fund, PIMCO’s managers use their judgment to navigate interest rate shifts and credit spreads. They primarily invest in the "credit" markets—meaning they receive income from interest payments on corporate bonds, government debt, and mortgage pools.

Why is the yield so high? It comes down to two factors:

High-Yield Focus: The majority of the holdings are "non-investment grade." You are essentially being paid a premium to take on credit risk that larger, "safer" funds (like LQD) avoid.

Active Trading: These funds don't just sit on bonds until maturity. They trade the portfolio to capture capital gains, which are then passed on to you in your monthly distribution.

Understanding the "PIMCO Premium"

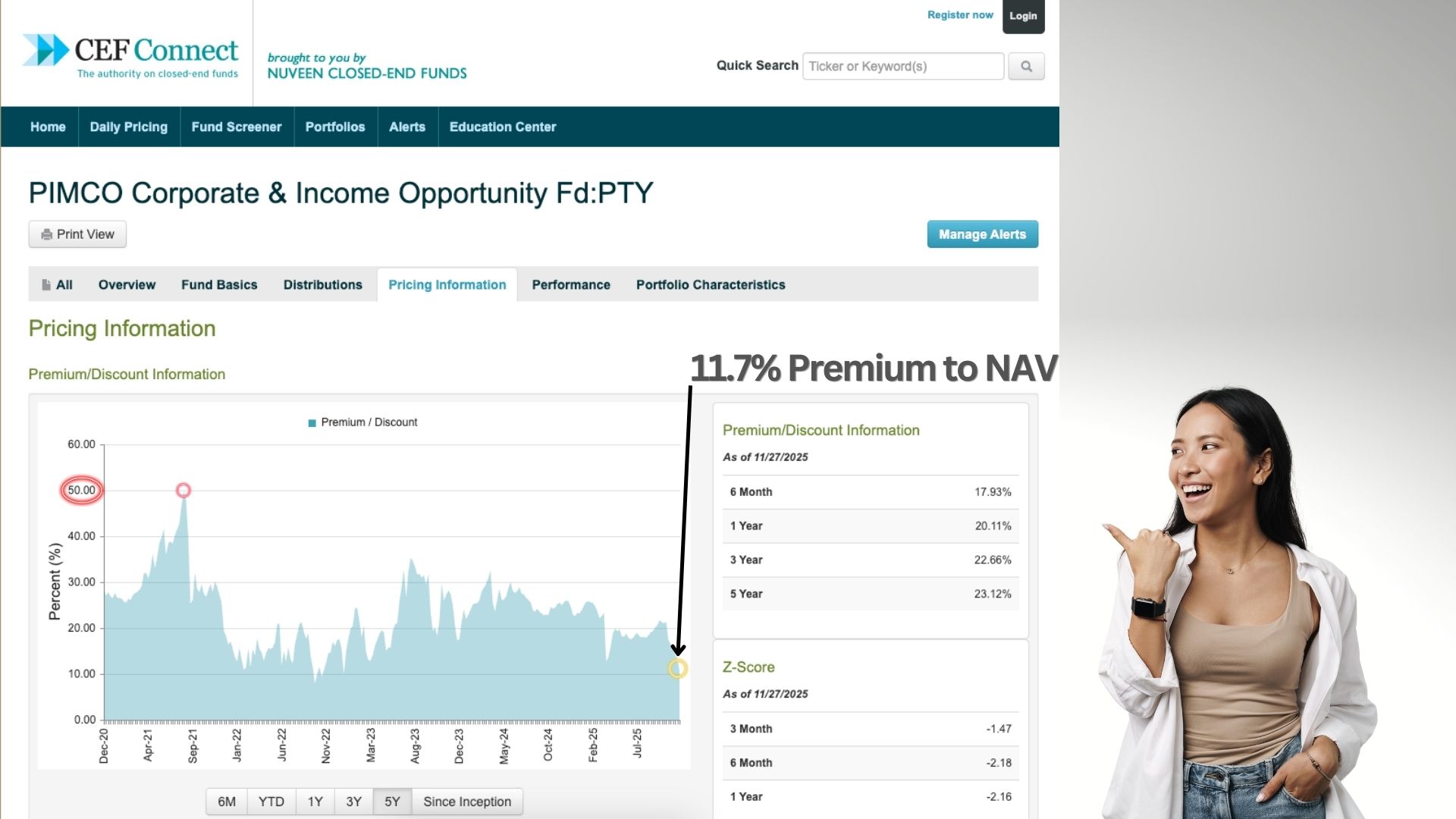

Because these funds have historically outperformed the S&P 500 on a total return basis since inception, they are rarely "cheap." Closed-end funds can trade for more than the value of their underlying assets (a premium), or less (a discount).

For years, PTY has traded at "nose-bleed" premiums, sometimes as high as 50%. However, as of late 2025, we are seeing a rare cooling period. PTY’s premium has dipped toward 11%, and PCN is sitting near 6%. While still not "discounts," these are significantly lower than their historical averages.

Is This Right For You?

These funds aren't for the "doomsday" investor. If you believe a total economic collapse or hyper-inflation is imminent, you’re likely better off in gold or treasuries.

However, if you are a long-term investor looking to diversify away from the S&P 500, and want exposure to a professionally managed credit portfolio, PTY and PCN are worth a look. At their current valuations, they offer a compelling entry point for those who have waited years to own a piece of the PIMCO powerhouse. Click here for the full review of PTY and PCN.

Want to see how these funds fit into a real-world retirement strategy? I share my full portfolio and monthly updates for free, here: Armchair Insider. If you want to learn from other Income Investors, check out the Armchair Insider Lounge.