CVX's Steady Oil Flow: $500 Monthly Bets Turn Short-Term Dips into Five-Year Strength

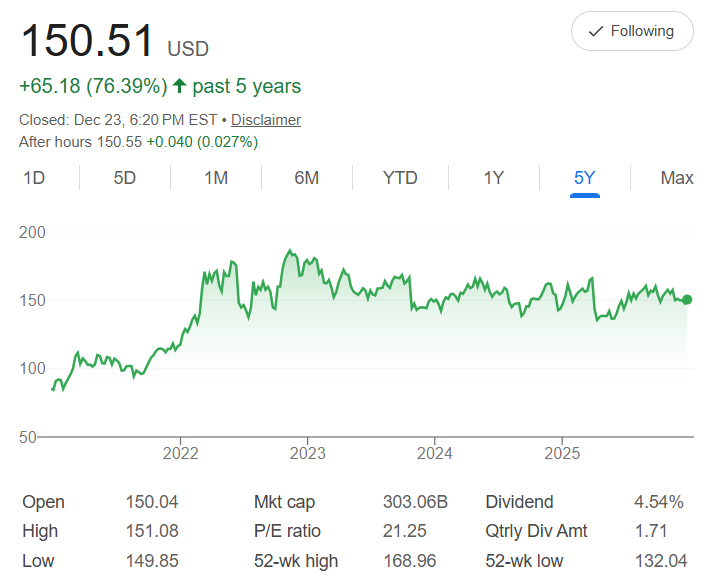

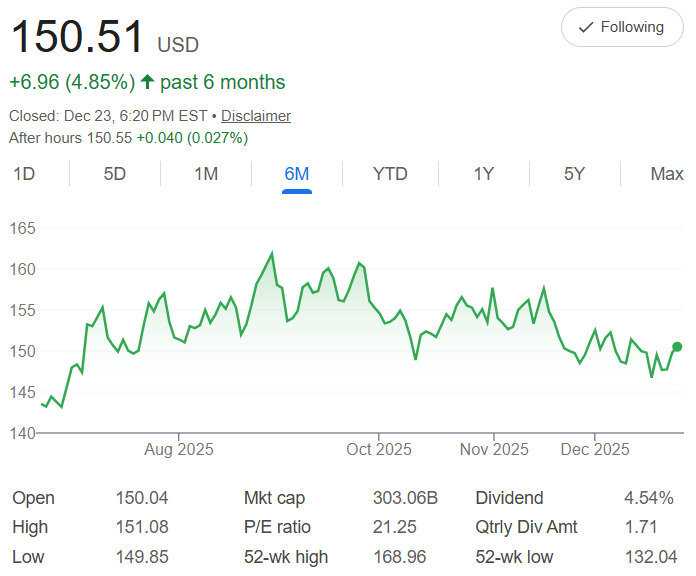

Five years ago, Chevron Corporation (CVX) shares were around $110 each. As of December 19, 2025, it's at $147.75—a reliable 34.15% gain from its integrated operations in exploration, production, refining, and chemicals, providing energy worldwide with a focus on efficiency and lower-carbon initiatives. Now, examine the six-month chart for the practical view: Starting August near $150, it pushed to October highs around $160 on solid earnings and oil stability, then eased through November-December to today's levels amid broader energy sector pressure or commodity fluctuations, netting a small 0.61% gain. That mid-period dip from $160 to $145 is typical short-term noise—perhaps from oil price swings or market sentiment—but the overall hold shows endurance, with the 52-week high of $168.96 already achieved and low at $132.04 not too distant.

The five-year compound annual growth rate (CAGR) is 6.05%, the average yearly step-up (total growth raised to 1/5 power, minus 1) that rewards consistency—about 6% growth per year.

Dollar-cost averaging (DCA) navigates this: Keep $500 coming monthly for five years, totaling $30,000. Those November dips to $145? Your opportunity to buy extra shares at a discount, lowering your average cost while peaks like October take smaller amounts. From $147.75, at a 0.49% monthly growth rate, it all builds quietly.

In 60 months, your stake could reach $34,212—a $4,212 profit and 14% return. Early investments compound steadily, but dip buys like recent ones position you better for rebounds.

The core takeaway: If you trust Chevron to deliver—optimizing production, advancing carbon capture tech, and growing through acquisitions like Hess—keep investing regularly, regardless of short-term drops.

Build your portfolio, one day at a time.

Get our daily 5-year horizon picks sent to your inbox. Subscribe here.

In fact, buy more when prices fall, turning those chart valleys into your advantage. Over five years, the odds favor operational improvements and sustained energy demand that lift the stock higher.

With a $297.50B market cap, P/E of 20.86 signaling fair value, and generous 4.63% dividend yield (quarterly $1.71), plus risks like volatile oil prices or regulatory changes on emissions, your DCA could create a dependable income and growth stream by 2030.

Flow steady?