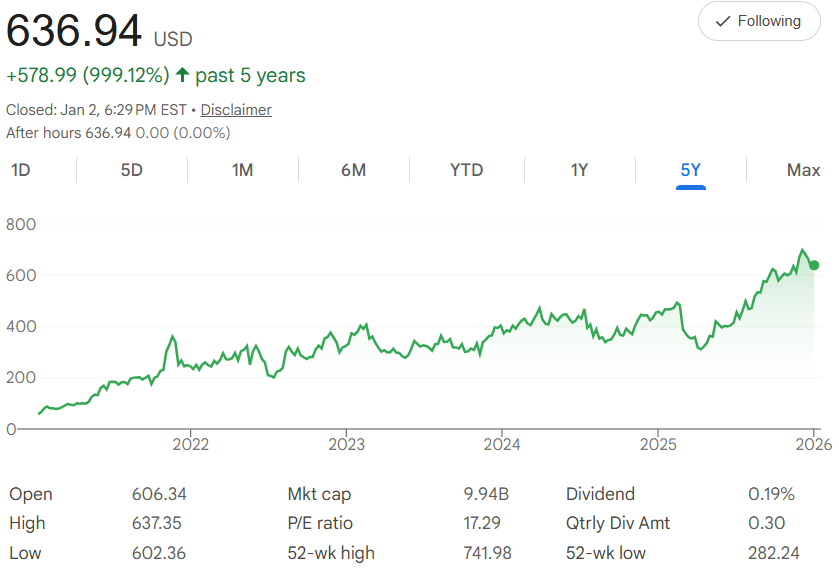

Five years ago, Dillard's Inc. $DDS shares were trading around $63 each. Today, it's closed at $636.94—a remarkable 999% rise that showcases its success in upscale department stores, with strong sales in fashion, cosmetics, and home goods, even in a tough retail landscape. The chart tells a story of steady growth from 2022 lows, with ups and downs but clear momentum in 2024-2025, and a 52-week high of $741.98 marking the recent top appeal.

In simple terms, the compound annual growth rate (CAGR) is 59.23%. That's the average yearly boost—calculated by raising the total growth factor to the 1/5 power and subtracting 1. It means growing your money by nearly 60% each year, on average.

Dollar-cost averaging (DCA) makes this easy to follow: Invest $500 every month for five years, totaling $30,000. This buys more shares on lower days and fewer on higher ones, helping balance the retail ups and downs. Projecting forward at the same historical pace, with a monthly growth rate of about 3.95% from $636.94, your shares add up steadily.

Build your portfolio, one day at a time.

Get our daily 5-year horizon picks sent to your inbox. Subscribe here.

After 60 months, your total could reach $116,998. That's a gain of $86,998—a 290% return on your investment. The early buys get the biggest compounding lift, while later ones still catch the trend.

This is based on the past, which isn't a sure thing ahead—retail can face consumer spending changes or online rivals, but a P/E ratio of 17.29 shows reasonable pricing, and a small 0.19% dividend yield adds quarterly payouts of $0.30.

With that 52-week high of $741.98 in view and a $9.94B market cap, DDS has enduring style. If DCA's your regular choice, it could turn your $500 habit into a sharp portfolio by 2031. Dress for success?