The biggest lie in income investing?

"High yield means high returns."

The truth? Most high-yield options ETFs slowly liquidate your capital while paying you back your own money and creating a taxable event.

I've been writing about this problem in the US market using my [5-part framework] for identifying sustainable options-based ETFs.

But here's what European investors need to know:

The same principles apply globally.

And I've identified 16 European options-based ETFs that pass the most critical test: Zero NAV erosion.

These funds deliver income while maintaining or growing their net asset value. That's the difference between building wealth and slowly going broke.

Why NAV Stability Is Everything

Let me show you the math that changes everything.

High Yield, Decaying NAV:

35% yield

-10% NAV annually

5-year result: €10K → €5,905 capital (-41%)

Annual income drops to €2,067

Moderate Yield, Stable NAV:

20% yield

+5% NAV annually

5-year result: €10K → €12,763 capital (+28%)

Annual income grows to €2,553

The "lower-yielding" fund delivers:

116% more capital preservation

24% more annual income by year 5

Compounding that actually works FOR you, not against you

This is why NAV erosion is the silent killer of income portfolios.

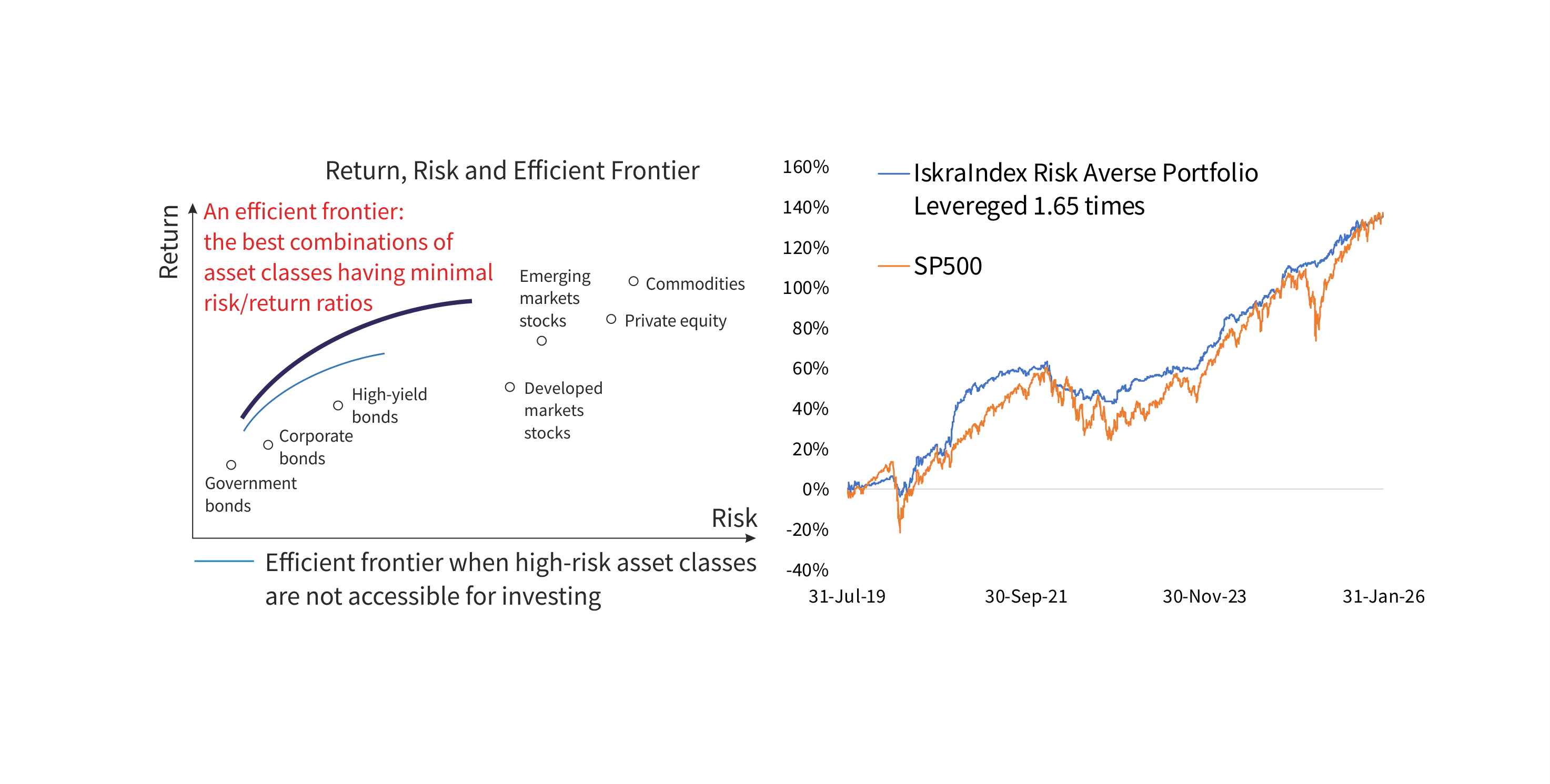

The Framework (US-Based, But Universal)

In my previous article on US options ETFs, I laid out my 5-part framework for avoiding yield traps:

Bullish sector – Only invest in industries with multi-year tailwinds

NAV stability or growth – No structural decay

10-20% total returns – Proven track record

Yields below 40% – Sustainable distribution mechanics

Smart options strategy – Not sacrificing all upside for premium

These principles don't stop at the Atlantic Ocean.

They apply to UCITS funds, European ETFs, and any options-based product globally.

The 16 European Tickers With Zero NAV Erosion

These European-listed funds have demonstrated they can generate income without structural decay:

Income Shares -

$MAGD $GLDE $SLVI $GOOO $MSFI $TLTI $BABI $AMDI $AVGI

Rex Shares -

Yieldmax -

JPM -

IShares -

Income Shares seem to be leading the way since the strategy in the option-based ETPs space for Europe as you can tell above.

Each of these has proven:

Sustainable distribution mechanics

Options strategies that preserve upside capture

NAV stability or growth over time

Exposure to sectors with long-term conviction (tech, semiconductors, broad indexes)

What Separates These From The Wealth Destroyers

The difference between zero-NAV-erosion funds and the traps comes down to options strategy mechanics.

What the bad funds do:

Sell aggressive at-the-money, out-the-money covered calls weekly

Cap 100% of upside to maximize premium

Miss every rally

Slowly liquidate holdings as shares get called away below market value

What these 16 funds do:

Use out-of-the-money strikes (10-15% above current price)

Longer expirations (monthly/quarterly vs weekly)

Dynamic strike selection based on volatility

Put-write strategies that generate income without capping upside

Tactical adjustments that preserve capital appreciation

The result?

They capture 60-80% of upside moves while still generating meaningful income.

True NAV Decay vs. Market Volatility

This is critical to understand.

NOT True NAV Decay:Your semiconductor ETF drops 20% because ASML corrects in a market pullback.

This is temporary market volatility

Your NAV reflects the underlying asset value

It recovers when the market recovers

TRUE NAV Decay: Your fund's structure erodes value over time independent of market moves:

Paying out more than the options strategy earns (return of capital)

Mechanically capping upside with aggressive covered calls

Shares constantly getting called away below market value

Expense ratios and poor management eating returns

True NAV decay means the fund's mechanics are fundamentally broken.

No market recovery will save you.

These 16 European funds avoid that structural decay.

The Long-Term Wealth Formula

This isn't about chasing the highest yield.

It's about maximizing total wealth while generating income.

A 22% yield with +4% NAV growth will make you wealthier than a 45% yield with -12% NAV decay.

Every single time.

The math is simple:

After 5 years:

High yield, decaying NAV (45% yield, -12% NAV):

Your €10K → €5,300 in capital (-47%)

Annual income: €2,385 (down 47%)

Moderate yield, stable NAV (22% yield, +4% NAV):

Your €10K → €12,167 in capital (+22%)

Annual income: €2,677 (up 22%)

Lower yield. More wealth. More income long-term.

The same principles that make US options ETFs work (or fail) apply to European products.

You just need to know what to look for:

NAV stability

Sustainable yields (not 50%+ traps)

Smart options strategies

Bullish underlying sectors

These 16 tickers check every box.

My Checklist (Apply This To ANY Options ETF)

Before buying any options-based ETF - US, European, or otherwise, it must pass these tests:

Bullish sector – Multi-year conviction in the underlying industry

Bullish sector – Multi-year conviction in the underlying industry  NAV stability or growth – No structural decay eating your principal

NAV stability or growth – No structural decay eating your principal  10-20% total returns – Proven track record

10-20% total returns – Proven track record  Yields below 40% – Sustainable distribution mechanics

Yields below 40% – Sustainable distribution mechanics  Smart options strategy – Not sacrificing all upside for premium

Smart options strategy – Not sacrificing all upside for premium

When all 5 align, you get what these 16 European funds deliver:

Income that doesn't cost you your future.

Final Thought

The options-based ETF space... Whether in New York or London, is filled with traps disguised as income opportunities.

Don't fall for the 50% yield with -15% annual NAV decay.

Stick to funds that prove they can generate income while maintaining capital integrity.

These 16 European tickers do exactly that.

Your portfolio and your future self - will thank you.