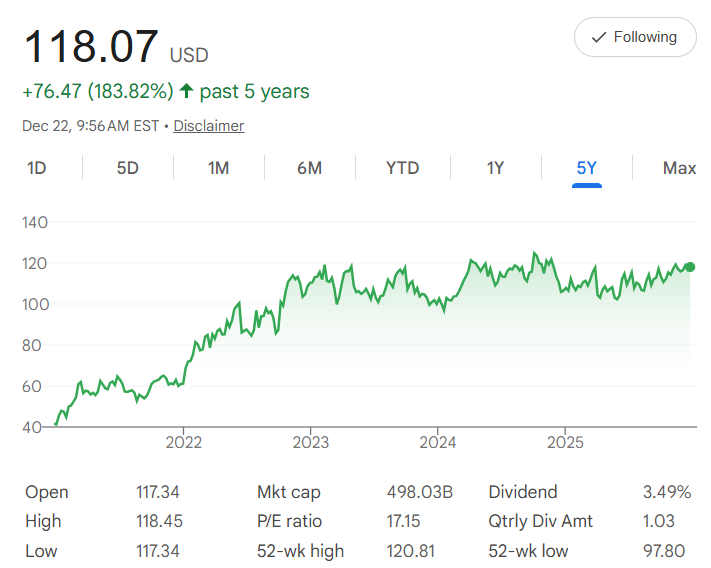

XOM's Energy Endurance: $500 Monthly Bets Turn Short-Term Dips into Five-Year Fuel

Five years ago, Exxon Mobil Corporation $XOM shares were around $66.65 each. As of today, it's at $116.69—a 75.09% gain from its core strength in oil exploration, refining, and chemicals, powering global energy needs. But let's zoom into the six-month chart for the real endurance test: Starting July near $115, it held steady through August highs around $118 on stable oil prices and production reports, then dipped in September-October to lows near $110 amid market volatility or energy sector shifts, before rebounding into December for a net 4.43% uptick. That mid-period pullback from $118 to $110 highlights typical short-term swings, but the overall climb shows resilience—with the 52-week high of $120.81 just touched and low at $97.80 far below, it's a reminder that brief drops are opportunities in a long-term uptrend.

The five-year compound annual growth rate (CAGR) is 11.87%, the average yearly lift (total growth raised to 1/5 power, minus 1) that rewards patience—about 12% growth per year.Dollar-cost averaging (DCA) powers through: Keep $500 flowing monthly for five years, totaling $30,000. Those September dips to $110? Your cue to buy extra shares cheap, lowering your average cost while peaks like August take smaller portions. From $116.69, at a 0.94% monthly growth rate, it all compounds. In 60 months, your stake could reach $40,331—a $10,331 profit and 34% return. Early investments get the deepest fuel from compounding, but dip buys like recent ones accelerate the recovery.

Build your portfolio, one day at a time.

Get our daily 5-year horizon picks sent to your inbox. Subscribe here.

The essential message: If you trust Exxon Mobil to perform—delivering on production efficiency, expanding low-carbon tech like carbon capture, and growing through mergers like Pioneer—keep investing regularly, no matter short-term drops. In fact, buy more when prices fall, turning those chart valleys into your advantage. Over five years, the odds favor product improvements and energy demand that drive the stock higher. With a $492.10B market cap, P/E of 16.95 signaling value, and 3.53% dividend yield (quarterly $1.03), plus risks like oil volatility or regulatory shifts, your DCA could build a robust energy reserve by 2030. Consider broader factors: XOM's financial health with low debt, global assets, and sustainability pushes add stability, but monitor geopolitical events and transition to renewables. Stay fueled?