WFRD's Tech Takeoff: $500 Monthly Bets Could Launch Steady Growth in Five Years

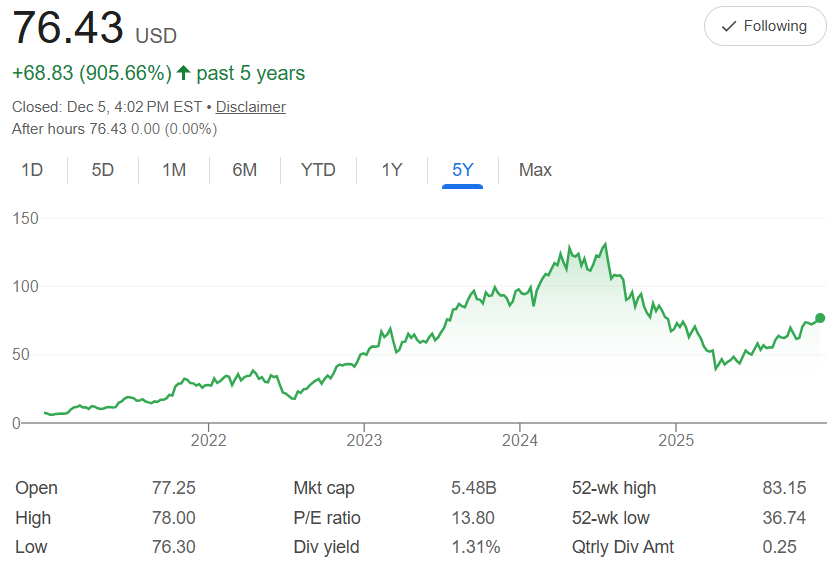

Five years ago, Weatherford International $WFRD shares were trading around $7.75 each. Today, it's closed at $76.43—a remarkable 905% surge that highlights its role in oilfield services, from drilling tools to digital monitoring amid energy demand recovery. The chart traces a strong rebound from 2022 lows, with consistent climbs through 2025, and a 52-week high of $83.15 signaling more potential in the sector.

To break it down simply, the compound annual growth rate (CAGR) is 58.05%. That's the average yearly lift that drove this—calculated by taking the ending price over the starting one, raising it to the 1/5 power, and subtracting 1. In plain terms, it's like growing your money by nearly 60% each year, on average.

Build your portfolio, one day at a time.

Get our daily 5-year horizon picks sent to your inbox. Subscribe here.

Dollar-cost averaging (DCA) keeps the flight smooth: Put $500 in every month for five years, totaling $30,000. You buy more shares on dips and fewer on peaks, which helps through any turbulence. Projecting at the historical pace, with a monthly growth rate of about 3.89% from $76.43, your shares build altitude over time. After 60 months, your portfolio could reach $114,069. That's a gain of $84,069—a 280% return on your investment. The early buys get the strongest compounding push, while later ones still catch the updraft.

This rides the past wave, but energy stocks can fluctuate with oil prices—though a P/E ratio of 13.80 and 1.31% dividend yield add some grounding.

With that 52-week high of $83.15 nearby and a $5.48B market cap, WFRD has momentum.

If DCA's your reliable runway, it could elevate your $500 habit into a solid landing by 2030. All aboard?