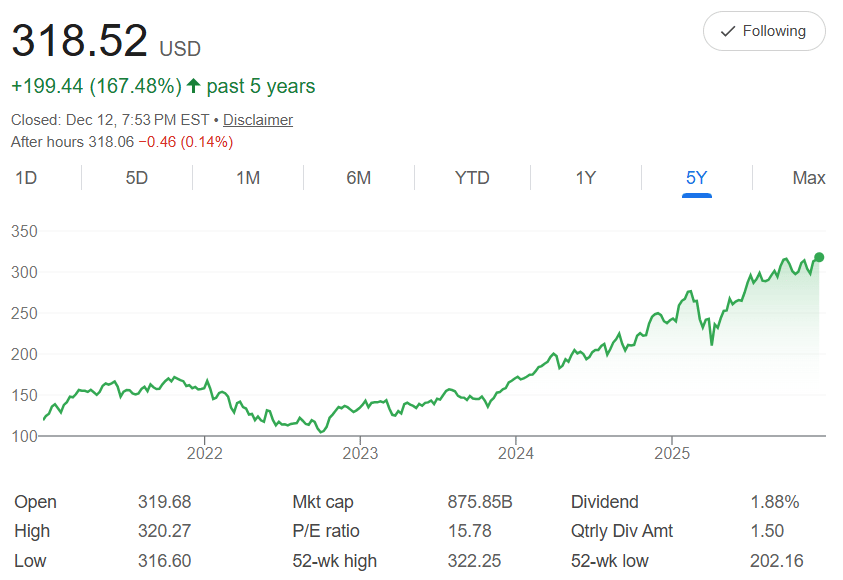

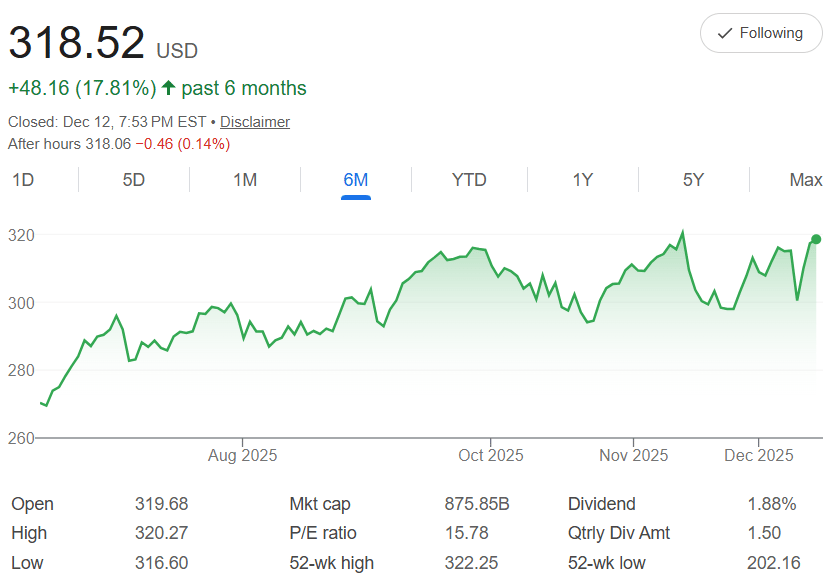

Five years ago, JPMorgan Chase $JPM shares were around $119.08 each. As of today, it's at $318.52—a 167% climb from its role as a top bank handling loans, investments, and everyday finance for millions. Now, check the six-month chart for the real test: From August near $280, it rose to peaks around $320 in October on strong earnings and rate outlooks, then eased to November lows near $300 amid market worries or sector shifts, rebounding to today's close for a net 17.81% gain. After-hours at $318.06 shows the wiggle, but the uptrend holds—with the 52-week high of $322.25 just hit and low at $202.16 far behind, it's a reminder that short-term wobbles are part of the ride.

The five-year compound annual growth rate (CAGR) is a steady 21.78%, the average yearly step-up (total growth raised to 1/5 power, minus 1) that builds trust—about 22% growth per year.

Dollar-cost averaging (DCA) banks on this: Keep $500 coming in monthly for five years, totaling $30,000. Those November dips to $300? Your chance to buy extra shares cheap, dropping your average cost while peaks like October take less. From $318.52, at a 1.66% monthly growth rate, it all compounds.

In 60 months, your stake could grow to $48,942—a $18,942 profit and 63% return. Early investments compound deepest, but dip buys like recent ones accelerate the rebound.

Build your portfolio, one day at a time.

Get our daily 5-year horizon picks sent to your inbox. Subscribe here.

The main point: If you trust JPMorgan to deliver—upgrading digital banking, expanding services, and growing through tech innovations—keep investing regularly, no matter short-term drops. In fact, buy more when prices fall, turning those chart valleys into your advantage. Over five years, the odds favor product improvements and market wins that lift the stock higher. With an $875.85B market cap and P/E of 15.78 signaling value, plus 1.88% dividend yield, your DCA could secure a strong position by 2030.