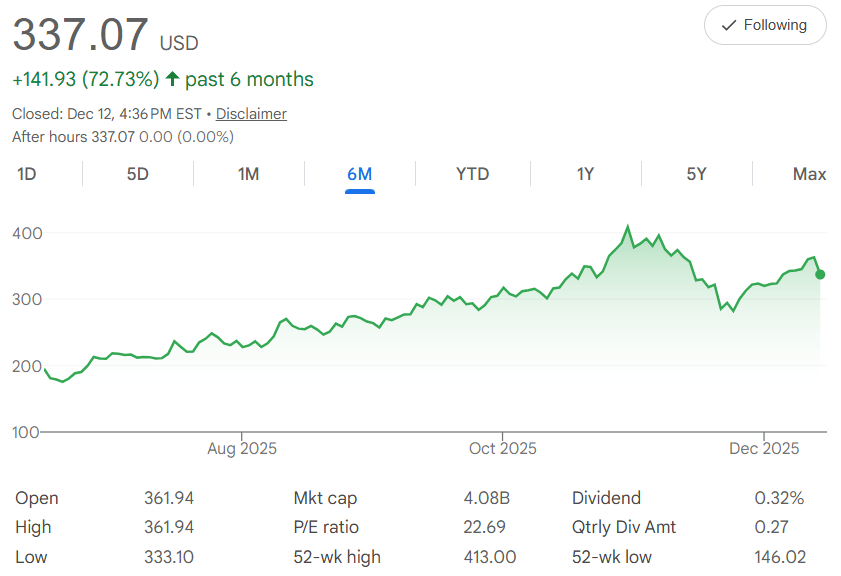

Five years ago, Powell Industries $POWL shares were around $30.70 each. Today, it's closed at $337.07—a massive 1,055% jump powered by booming demand for electrical switchgear, power control rooms, and infrastructure tied to data centers and energy projects. But zoom into the six-month chart for the real story: Starting August near $200, it climbed steadily to October peaks around $400 on strong orders and earnings beats, then pulled back through November-December to today's levels amid broader market rotations or profit-taking—for a net 72.73% gain despite the late dip. That pullback from $400 highs to $337 shows classic short-term volatility, but the overall uptrend holds firm, with the 52-week high of $413.00 already touched and low at $146.02 far in the rearview.

Build your portfolio, one day at a time.

Get our daily 5-year horizon picks sent to your inbox. Subscribe here.

The five-year compound annual growth rate (CAGR) stays at 61.66%, the reliable average yearly surge (total growth raised to 1/5 power, minus 1) that rewards backing solid industrial growth—over 60% compounded annually.

Dollar-cost averaging (DCA) is your steady current: Keep dropping $500 monthly for five years, totaling $30,000. Those November dips from $400? Prime time to load up on extra shares cheap, lowering your average cost while peaks like October take smaller bites. From $337.07, at a 4.09% monthly growth rate, it all builds up a charge.

In 60 months, your stake could reach $125,998—a $95,998 profit and 320% return. Early investments get the full jolt, but dip buys like December's supercharge the rebound.

The key point: If you trust Powell Industries to deliver—rolling out better electrical solutions, winning big contracts, and growing with data center and grid needs—keep investing regularly, no matter short-term drops. In fact, buy more when prices fall, turning those chart valleys into your strongest advantage. Over five years, the odds favor tech upgrades and market wins that drive the stock higher. With a $4.08B market cap, P/E of 22.69, and 0.32% dividend yield grounding it, your DCA discipline could light up a real payoff by 2030.

Stay connected?