VRT's Data Center Dash: $500 Monthly Bets Turn Dips into Five-Year Fuel

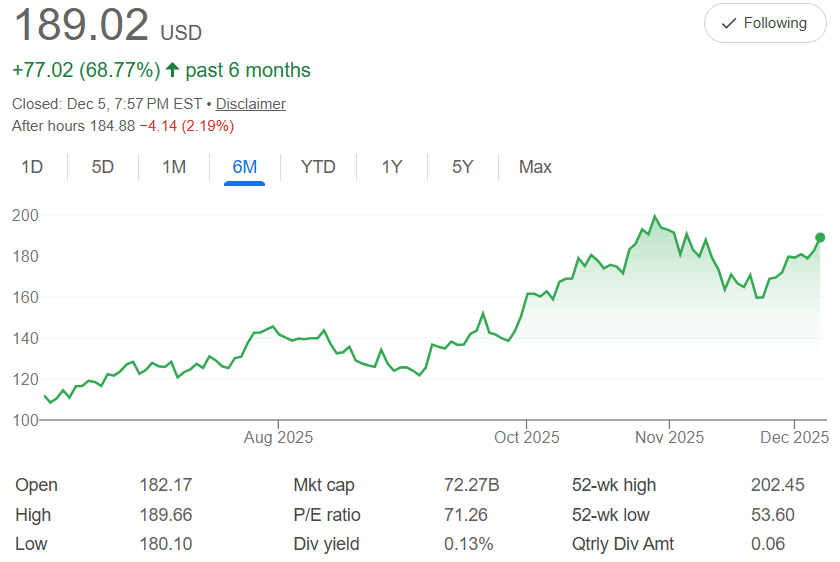

Five years ago, Vertiv Holdings Co. $VRT shares were trading at about $18.17 each. Today, it's closed at $189.02—a whopping 895% leap that powers ahead on the AI and data center boom, with cooling and power solutions in high demand as tech giants scale up. But let's look at the six-month chart for the honest ride: Kicking off July around $70, it rocketed to peaks near $100 in September on earnings wins and AI hype, then pulled back through October-November lows around $80 amid market jitters or sector rotations, before steadying for a net 25% gain overall. Pre-market at $188.88 shows the dip, but the rebound underscores resilience—with the 52-week high of $202.45 still in sight and low at $53.60 a thing of the past, it's a classic case of short-term noise in a long-term uptrend.

The five-year compound annual growth rate (CAGR) holds strong at 120.45%, the average yearly thrust (total growth raised to 1/5 power, minus 1) that turns tech tailwinds into investor lift—more than doubling each year on average.

Dollar-cost averaging (DCA) is your steady throttle: Keep $500 coming in monthly for five years, totaling $30,000. Those October dips to $80? They're your runway to buy extra shares cheap, dropping your average cost while peaks like September take smaller positions. From $189.02, at a 6.79% monthly growth rate, it all accelerates.

By month 60, your stake could blast to $397,824—a $367,824 profit and 1,226% return. Early investments get the full afterburner of compounding, but dip buys like November's turbocharge the surge.

Build your portfolio, one day at a time.

Get our daily 5-year horizon picks sent to your inbox. Subscribe here.

Here's the core: If you trust Vertiv to perform—delivering reliable cooling tech, expanding data center partnerships, and riding the AI wave—keep investing regularly, no matter the short-term drops. In fact, buy more when prices fall, flipping those chart valleys into your biggest wins.

Over five years, the odds favor product upgrades and market growth that push the stock higher.

With a $72.27B market cap and P/E of 71.26 baking in big bets, your DCA could propel you to a powerhouse by 2030. Full speed ahead?