In recent years, Chinese companies BYD, NIO and Huawei/Aito have been actively expanding their presence in the electric vehicle (EV) market, demonstrating the potential for global competition with Tesla. Improving relations between China and other countries, government support and technological innovations create conditions under which Chinese EV manufacturers become a real alternative to Tesla for both investors and consumers.

Macroeconomic and geopolitical context

Since the end of 2024, there has been a gradual improvement in trade and political relations between China and the United States, as well as between China and the EU countries. This creates a favorable background for the expansion of Chinese electric vehicle manufacturers into international markets.For investors, this means reducing political and trade risks in exports, and the possibility of expanding BYD and NIO's market share outside of China. However, possible restrictions or tariff barriers cannot be ruled out, especially in the key markets of the USA and Europe, they may limit growth and marginality.

Latest news on companies

BYD has launched electric vehicle sales in Argentina, taking advantage of a new policy allowing duty-free import of up to 50,000 electric vehicles in 2026. The company offers models priced up to $16,000, which makes them accessible to a wide audience.

In the UK, BYD has become the largest Chinese automaker, overtaking brands such as Citroën, Fiat and Honda. The brand sold over 11,271 cars in September, representing a substantial rise of 880% compared to the same month last year.

The updated ES8 model from NIO received more than 40,000 orders in 24 hours after launch. NIO shares rose 4.4% on the back of improved trade relations between the United States and China.

Huawei unveiled new Aito models at the international IAA Mobility exhibition in Munich, demonstrating its ambitions to expand its presence in Europe. The Aito models are equipped with Huawei's advanced technologies, including AR-HUD, driver assistance systems, and intelligent control systems.

What is the technological advantage of these companies?

BYD, NIO, and Huawei/Aito are actively investing in research and development, which allows them not only to catch up with Tesla, but also to create unique products:

BYD is strong in battery technology and hybrid systems, which reduces costs and maintains a competitive price.

NIO: relies on the premium segment and service solutions (battery exchange, autonomous functions).

Huawei/Aito: focus on the integration of software and intelligent control systems (AR-HUD, ADAS) that enhance the user experience.

Companies can compete directly with Tesla in terms of functionality and affordability, but Tesla retains an advantage in the global "ecosystem" (FSD, superchargers, brand reputation).

What are the current financial indicators and dividend policy?

1. Tesla (NASDAQ: TSLA)

Strengths:

Tesla remains the technology leader in terms of data volume for autonomous driving system (FSD) training, as well as software, electronics, and infrastructure integration within the vertical chain.

Scale and vertical integration:Our own gigafactories in the USA, China, Germany and Mexico provide cost and quality control.

Tesla is developing the areas of FSD, Robotaxi, Optimus, and energy systems (Tesla Energy), turning from an automaker into a "supplier of physical AI."

Global brand awareness. The company remains a symbol of innovation

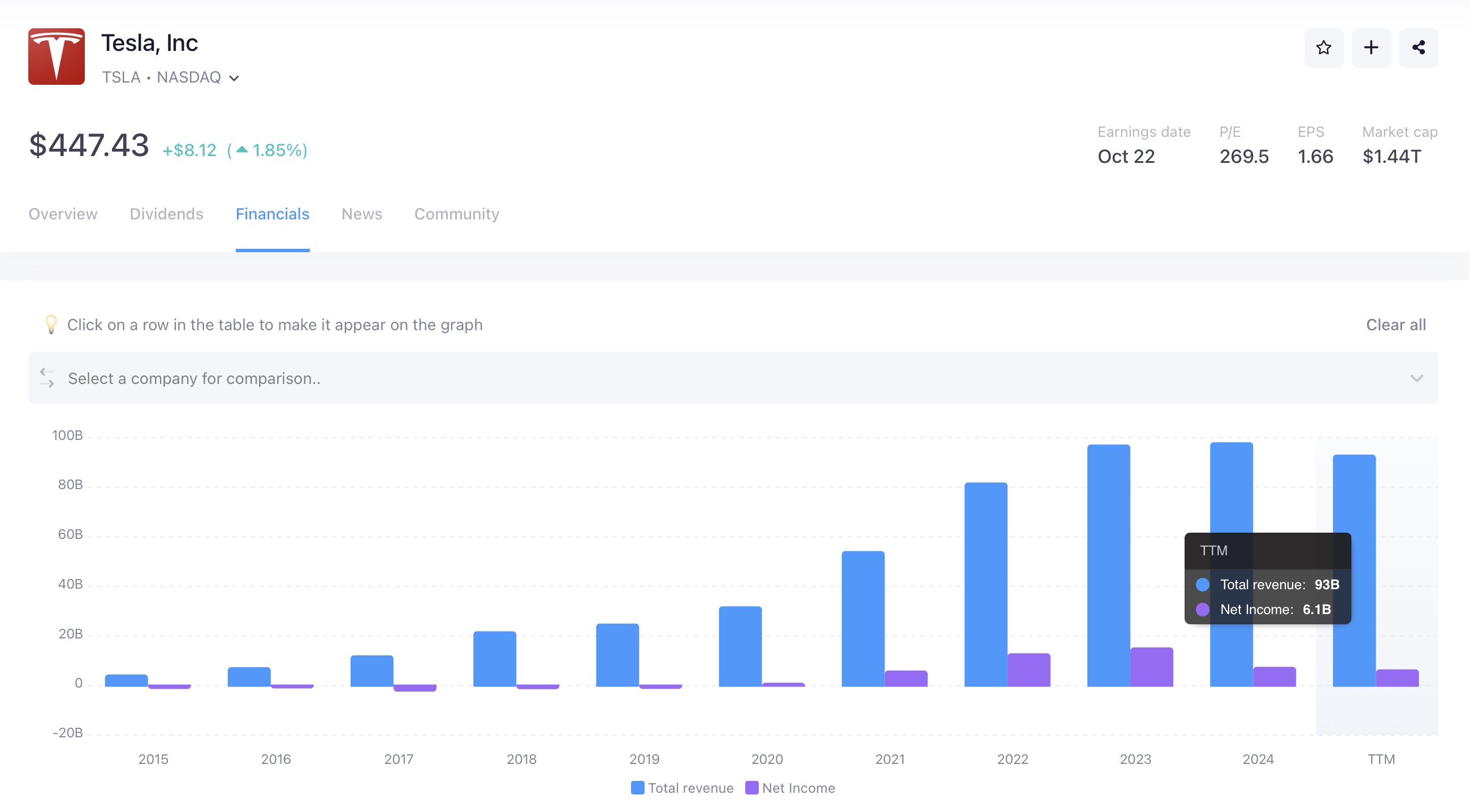

The company's total revenue for the current period of 2025 amounted to 93 billion, which is almost 6% less than in 2024. Net profit decreased by 15%. Now it stands at 6.1 billion.

The company stressed that it has recently focused on long-term investments and capital expenditures amid deteriorating financial performance. The money is invested in the development of initiatives in the field of autonomous technologies.

Dividend policy:

Tesla does not pay dividends, directing all available funds to development and innovation (R&D, new gigafactories, Dojo, Robotaxi and Optimus).

For investors, this is a purely growth asset (growth stock), where the main potential is in capitalization growth, not in dividend payments.

Risks:

High assessment and sensitivity to expectations: Current capitalization already includes a significant share of future growth from FSD and Robotaxi; with delays in implementation, these expectations may be adjusted by the market.

Regulatory barriers: The implementation of robotaxi and FSD in different countries depends on certifications and legal regulations. Any incidents or delays are a direct blow to capitalization.

Price competition: Chinese players are increasing pressure on the middle and premium segments by lowering the average selling price (ASP).

Investment attractiveness:

Tesla remains one of the strongest assets for investors focused on long-term growth and innovation, but it requires strategic patience and a willingness to deal with volatility.

2. BYD (BYD Company Limited)

Strengths:

BYD is one of the world leaders in sales of electric vehicles and hybrids, with good vertical integration (battery production, etc.), which reduces production costs.

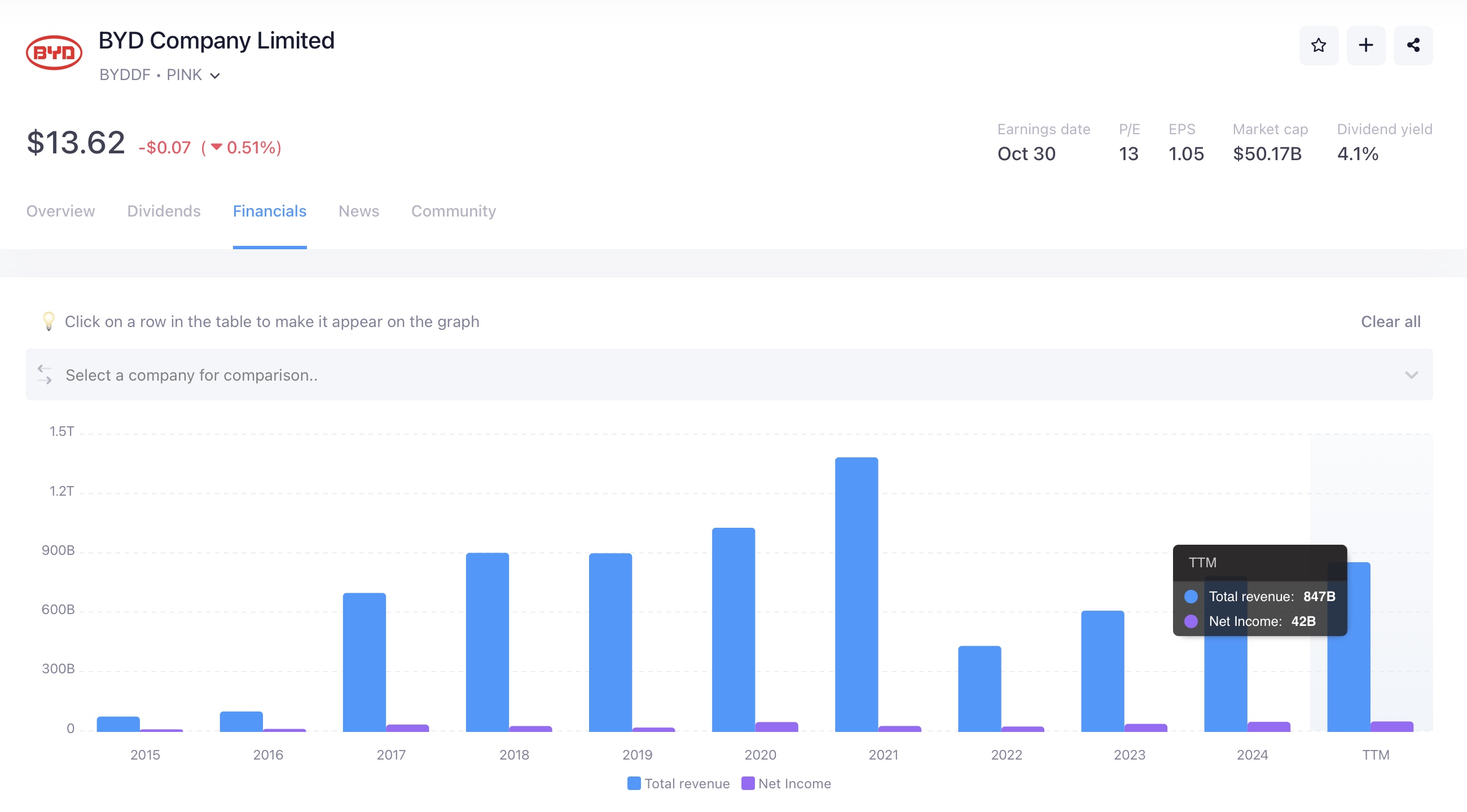

Revenue and net profit growth: reports for 2024 showed +29-53% in revenue in different segments, net profit also increased significantly. The company's total revenue for 2025 is 847 billion, while for 2024 it was 777 billion. Revenue growth was 70 billion. And net profit increased by 2 billion.

Dividend yield and policy:

The current dividend yield (TTM) is approximately 1.22-1.39% for BYD shares on the Chinese Stock Exchange/Hong Kong.

BYD pays dividends annually; there has been a growth in dividends in recent years, but not very aggressive.

Investment attractiveness:

BYD may be interesting as a relatively stable growth asset with a moderate dividend yield, especially if you believe the forecasts for EV sales growth

3. NIO (NIO Inc.)

Strengths:

Strong focus on the premium EV segment, autonomous driving, battery innovation, battery replacement, and infrastructure, which can provide a competitive advantage in China.

Growth potential due to demand in China and expansion abroad.

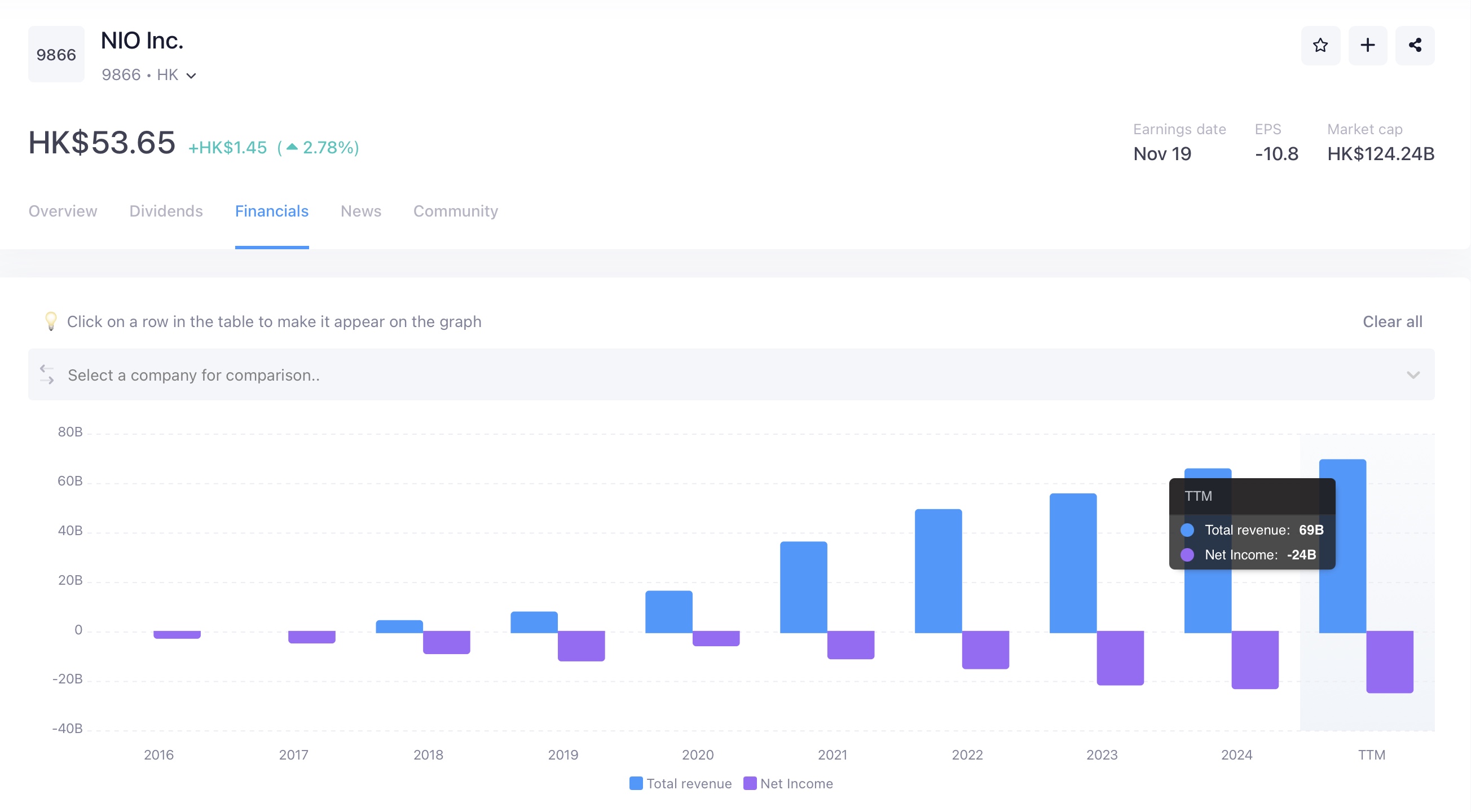

The company's total revenue for 2024-2025 increased by 2 billion, and now stands at 68 billion.

The chart shows a negative increase in profitability. This indicates the stage of the "investment cycle" that the company is currently in. NIO is actively investing in infrastructure, software, and international expansion. Investments are strategically justified, although in the short term they worsen profitability indicators and reduce profitability.

Dividend yield and policy:

Dividend yield: 0%. NIO doesn’t pay dividends

The company stated that its strategy is to retain most of the capital for growth, business expansion, and investments, rather than distributing profits in the form of dividends.

Risks:

Losses / weak profitability — there is no stable net profit to pay dividends yet.

Dependence on regulation in China, on the exchange rate, on subsidies and EV policies.

High competition, R&D costs, and the stock price can be very volatile.

Investment attractiveness:

NIO is interesting as a growing company. Despite lower margins and negative profitability growth, it remains a high-tech player with a strong brand in the premium segment. The main risk is related to dependence on external financing. However, the stabilization of China's macroeconomics creates the potential to restore profits in the next 2-3 years, provided that the plans for robotaxis and autonomous driving are successfully implemented.

4. Huawei / Aito

Note: Huawei (especially the part related to the Aito brand, which cooperates with Huawei) is a partially private entity with a specific ownership structure and internal allocation schemes (for example, schemes for employees). This affects transparency and accessibility as a public asset.

Strengths:

Huawei is a major technology player with a strong brand, sufficient resources, well—developed infrastructure, IP, technologies (5G, smartphones, IoT).

Projects like Aito are Huawei's partner EV projects that can take advantage of the brand's fame and sales channels.

Huawei announced revenue for H1 2025: 427.039 billion yuan (an increase of 3.95% compared to the same period in 2024

Dividend policy:

It is not publicly traded in the traditional way as an independent public company, so there is no standard dividend yield like public stocks.

Huawei distributes dividends under the Employee Stock Ownership Plan (ESOP) between employees and former employees.

Risks:

Non-public: Huawei shares are not freely traded on open exchanges, which limits the ability for many investors to buy them.

Regulation and sanctions (especially from the United States and its allies) can hinder access to technology and markets.

The yield through ESOP is limited for "external" investors (unless you are an employee) — this is not a traditional dividend/payout of a public company.

Investment attractiveness:

For investors focused on EV growth and technology, Huawei/Aito may be of interest indirectly (through partnerships, supplies, and the technology chain), but not as a source of dividends.

Is it worth paying attention to these companies and will they be able to compete with Tesla in the near future?

BYD — yes, it is already a serious competitor in terms of volume and in the mass segment; in the coming years it may bite off a significant share of the global market in terms of sales. But in terms of margins and soft monetization (FSD), Tesla is still in a winning position

NIO can compete locally (premium China) and is an interesting "growth" player, but on a global scale it lacks the scale and stable profits to generally replace Tesla as a leader. Despite the current losses, the company continues to invest in the premium segment and autonomous driving technologies, making it a potential beneficiary of the growing demand for smart cars in 2026-2028.

Huawei/Aito is a competitor in terms of "smart experience" and software; it can seriously take away from Tesla some of the advantages in the UX/connected car, but it is not a direct mass automaker with public shares.

Chinese electric car manufacturers are entering a new stage.Against the background of the stabilization of relations between China and the United States and the shift of the center of EV innovation to Asia, Chinese players are turning from local manufacturers into systemic participants in the global market.Collectively, these companies are no longer just catching up with Tesla — they are creating a multipolar structure of the global EV market, where innovation and profits are beginning to be redistributed in favor of China.