I need to share something important with you today.

Over the past 18 months, I've been running an experiment. Not with paper trading. Not with hypotheticals. With real money, real positions, and real consequences.

I've been testing high-yield ETFs... the ones promising 40%, 50%, even 60%+ yields. The products that flood your social media feeds with eye-popping distribution rates and "passive income" promises.

And after 18 months of living and breathing this space, I've learned some hard truths that nobody wants to talk about.

The Experiment

I didn't go into this blindly. I documented everything:

Every distribution received

Every NAV movement

Every total return calculation

Every hidden cost

I wanted to answer one simple question: Do high-yield ETFs actually build wealth, or are they just recycling your own capital back to you?

The answer? It's complicated. And that's exactly why I made this video.

https://www.youtube.com/watch?v=UmclOQFEm_I

What I Discovered

After 18 months, the data told a story that the marketing materials never will:

The Income Reality

The Income Reality

Yes, the distributions hit your account like clockwork. Yes, seeing those payments feels good. But when you zoom out and look at total return, a very different picture emerges.

The NAV Erosion Problem

The NAV Erosion Problem

This is the silent killer. While you're celebrating your distributions, your Net Asset Value is quietly declining. In many cases, the "income" you're receiving is just your own capital being returned to you and you're getting taxed on it.

Income Now vs Growth Later

Income Now vs Growth Later

Here's the trade-off nobody explains clearly: Most high-yield strategies cap your upside. When the underlying stocks rip higher, you get left behind because you've sold away your gains for premium income.

The Winners and Losers

The Winners and Losers

Not all high-yield products are created equal. Some genuinely work for specific strategies. Others are wealth destroyers dressed up as income vehicles. I break down which is which in the video.

My Updated Strategy

My Updated Strategy

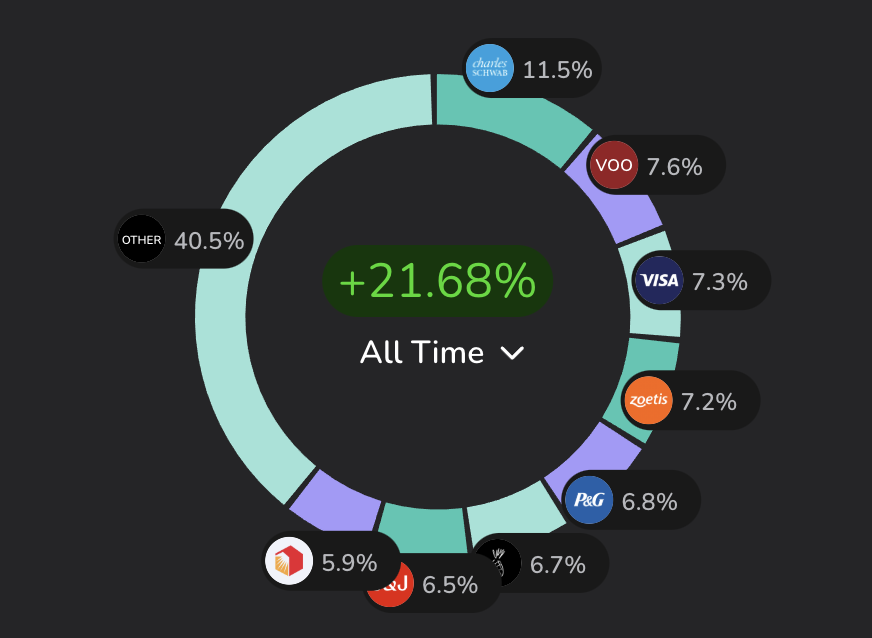

This experience fundamentally changed how I think about income investing. It's why I shifted to my new 75/25 strategy... prioritizing sustainable growth with strategic income, rather than chasing unsustainable yields.

Why I'm Sharing This With You

You're here because you want the truth. You want someone who's actually testing these products, not just regurgitating marketing material from ETF issuers.

I've spent 18 months and a significant amount of capital learning these lessons. I'm sharing them so you don't have to make the same mistakes.

This video has become my best-performing content because it resonates with something people are experiencing but nobody is talking about honestly: Most high-yield ETFs are not what they appear to be.

Whether you're in the UK, the US, or anywhere else, the principles are the same. Yield alone won't make you rich. In fact, chasing yield often keeps you poor.

The Bottom Line

After 18 months of real-world testing, here's what I know for certain:

Income investing can work — but only with the right products and the right strategy

Income investing can work — but only with the right products and the right strategy

Most 40%+ yield products are giving you your own money back

Most 40%+ yield products are giving you your own money back

Sustainable yields combined with growth potential beat pure yield plays every time

Sustainable yields combined with growth potential beat pure yield plays every time

NAV erosion is real, and it's destroying long-term wealth for millions of investors

NAV erosion is real, and it's destroying long-term wealth for millions of investors

There ARE quality income products out there — you just need to know how to identify them

There ARE quality income products out there — you just need to know how to identify them

That's exactly what I cover in this video. Real experience. Real data. Real results.

https://www.youtube.com/watch?v=UmclOQFEm_I

After you watch it, I'd love to hear your thoughts:

Have you experienced similar issues with high-yield products?

What's your current income strategy?

Are you rethinking any of your positions after seeing the data?

Drop your comments below. Let's have an honest conversation about what actually works in this space.

Remember: Think long-term. Your portfolio will thank you for it.

Stay smart, Cashflow King

P.S. This is exactly the kind of research and real-world testing that I share exclusively with my community in Patreon.

While everyone else is chasing the next shiny 50% yield product, we're focused on strategies that actually build lasting wealth. That's the difference.

You can sign up for free to get my Newsletter and articles direct to your inbox.

Patreon - https://www.patreon.com/c/CashflowKing