Normally, high-yield income funds are expected to underperform their benchmark index. The trade-off is simple: you give up some growth potential for a steady stream of income. But what if you could have both? I recently gave the Amplify CWP Growth & Income ETF, or QDVO, an honorable mention, and since then, its performance has only become more impressive. This fund, which yields approximately 8%, has delivered a higher total return than the NASDAQ 100 itself over the past year. Now that it’s celebrated its first birthday, it’s time for a deeper look inside.

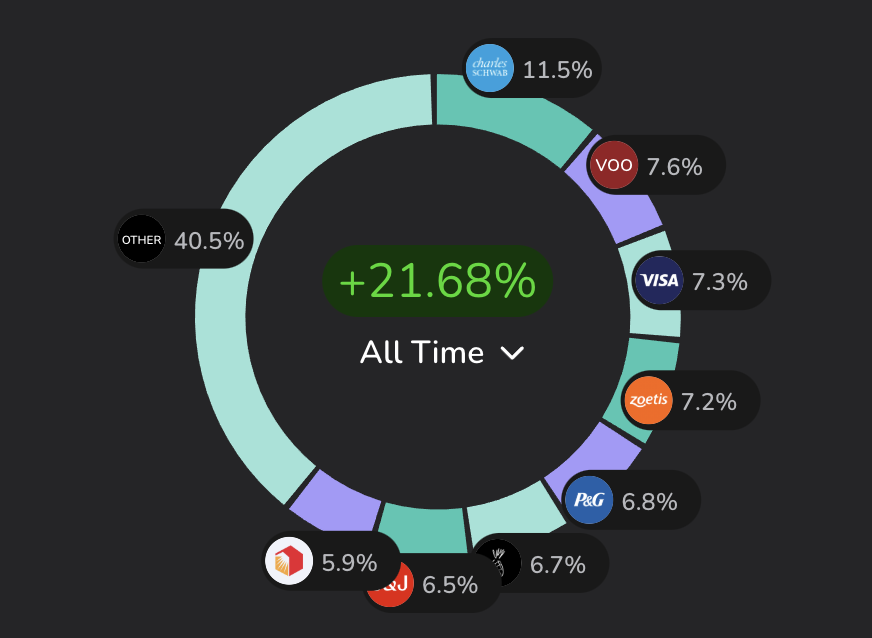

So, what is QDVO and how does it manage this? The fund is actively managed by Capital Wealth Planning. Its strategy is two-fold: first, it actively selects a concentrated portfolio of growth stocks, typically between 20 and 40 holdings. While its top names look a lot like the largest NASDAQ 100 stocks, it's not a pure index fund. For example, it includes companies like Visa and Home Depot, which aren't in the NASDAQ 100, and it weights its holdings differently. The second part of its strategy is to generate income by selling covered calls, a core component of its distributions.

The key to its success seems to be its option strategy. Unlike funds that sell calls on their entire portfolio, QDVO’s approach appears to give up less of the upside. We saw this during the "tariff chaos" market correction in April, where QDVO’s total return dropped significantly less than half that of the NASDAQ 100. Its call options have a shorter duration—less than four weeks—and it sells calls on individual stocks, not just the overall index. This dynamic strategy seems to have allowed it to capture more of the market’s upside, which is why it has outperformed the NASDAQ 100 over the past year.

As for taxes and fees, there's a notable difference compared to some other popular funds. While some competitors are known for distributing a high percentage of tax-advantaged return of capital, the evidence for QDVO suggests its distributions are largely ordinary income. This is a key consideration for investors. However, its expense ratio is slightly lower than some competitors, which is a small plus.

My take is that QDVO offers an intriguing blend of growth and income. Its ability to outperform the NASDAQ while providing an 8% yield is a rare find. My portfolio is mostly optimized for income, but I'm excited by the prospect of this fund's income stream growing as it continues to perform. While I remain cautious due to its short history, I plan to start a small position and add to it slowly as long as its strong performance continues. After all, the evidence so far suggests that for an income investor, this one is a serious contender.