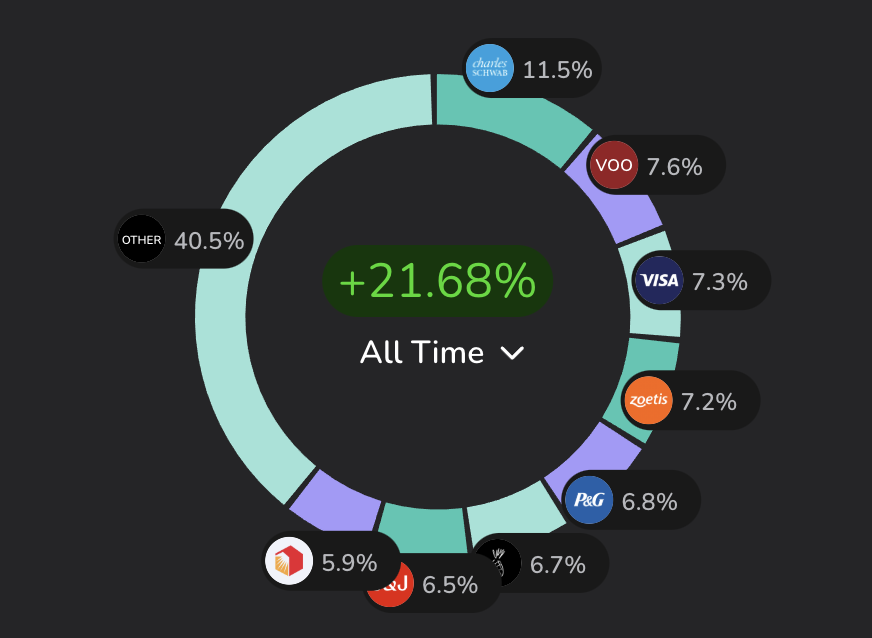

When it comes to diversification, one of my rules of thumb is to try and avoid letting any individual position make up more than 10% of my portfolio. This doesn’t include ETFs, of course.

For the most part, I’ve done a good job of sticking to that over the years, but I am cutting it close with a few of my holdings right now.

In fact, my top five positions make up about 40% of my portfolio’s total value. In this newsletter, I’m going to walk you through exactly what these holdings are, why I own them, and how much dividend income they’re bringing in for me every year.

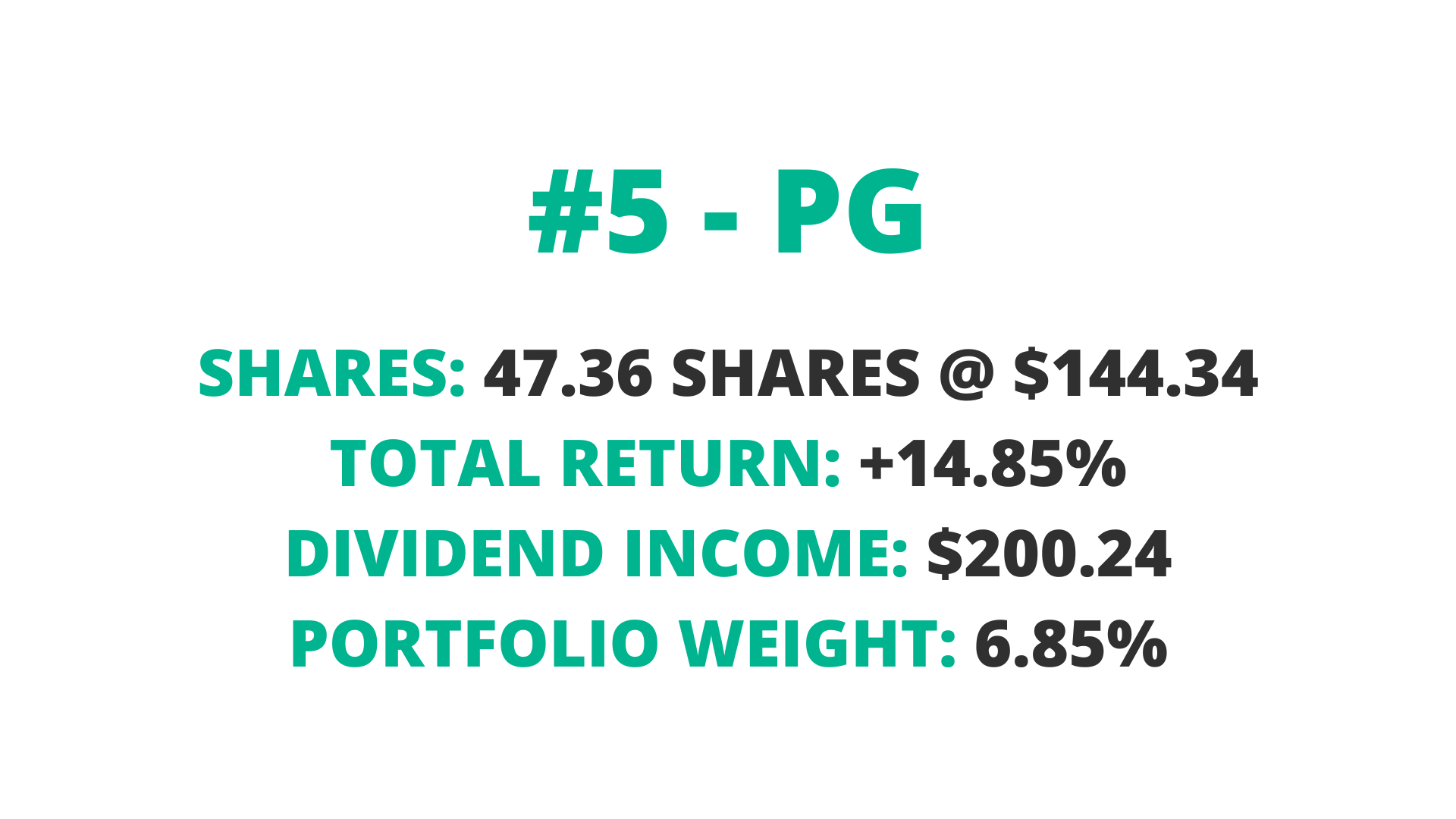

#5 — Procter & Gamble (PG)

Procter & Gamble (PG) is one of the most reliable consumer staples companies in the world. I bet you could look around your house right now and find at least a handful of PG products.

Their lineup is full of household essentials—everything from Tide laundry detergent to Pampers diapers to Crest toothpaste—which creates consistent demand no matter what’s happening in the economy. After all, people are always going to brush their teeth and wash their clothes, and babies are always going to need diapers.

PG is also a dividend king that has been growing its dividend for over 65 consecutive years, making it one of the safest sleep-well-at-night (SWAN) stocks you can own. I’m happy to have it as one of my largest positions.

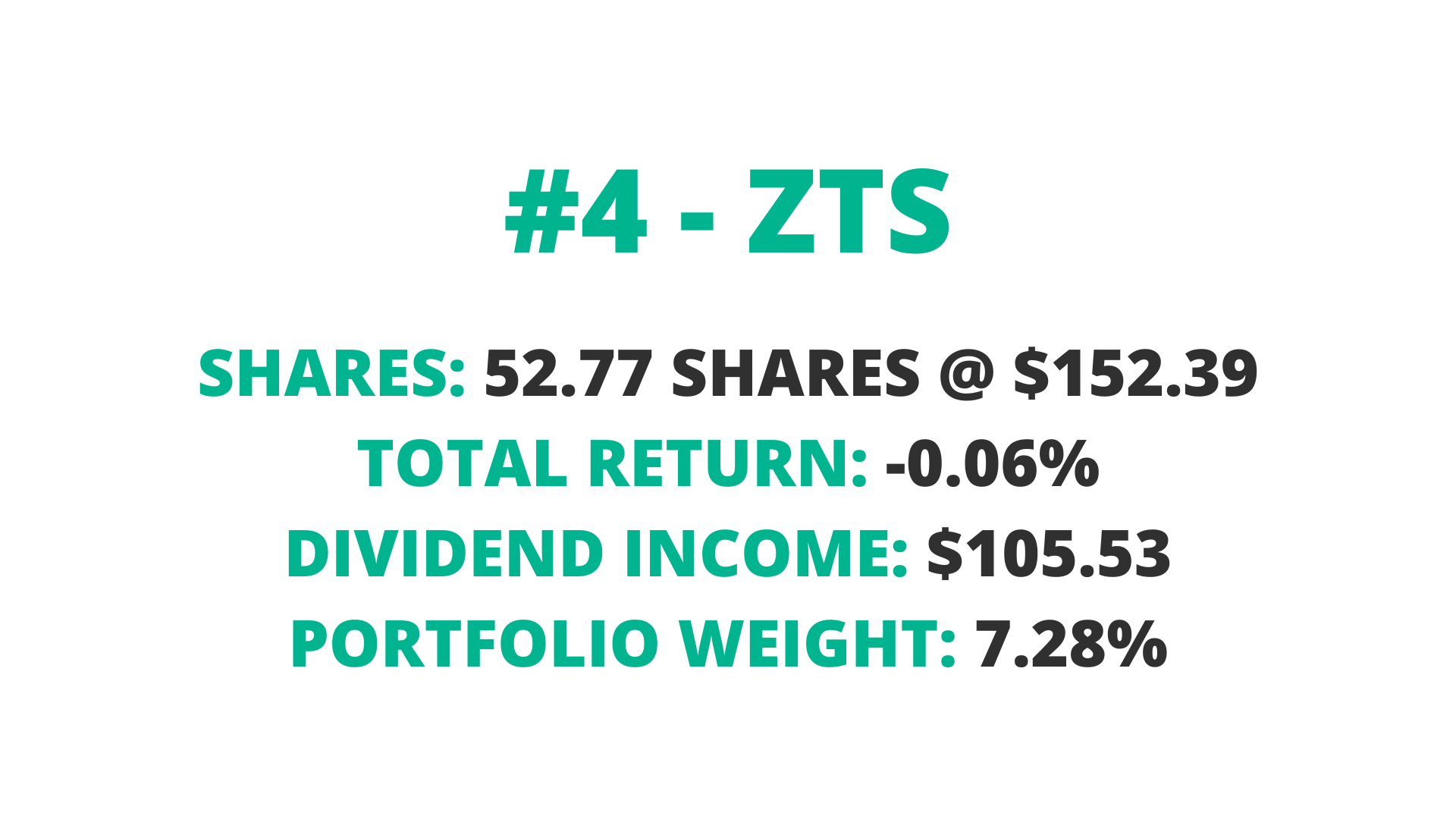

#4 — Zoetis (ZTS)

Zoetis (ZTS) is the world leader in animal health, and the newest addition to my portfolio.

They make health care and pharmaceutical products for the pets we own (cats and dogs) and the animals we eat (poultry, livestock, and fish). Zoetis spun off from Pfizer back in 2013, and is in an industry that’s continues to expand as pet ownership and the demand for protein continues to grow.

The share price has been pretty flat since I started buying it a few months ago, but the business itself has historically been a strong grower. And the dividend has followed suit, with a 5-year dividend growth CAGR of over 20%.

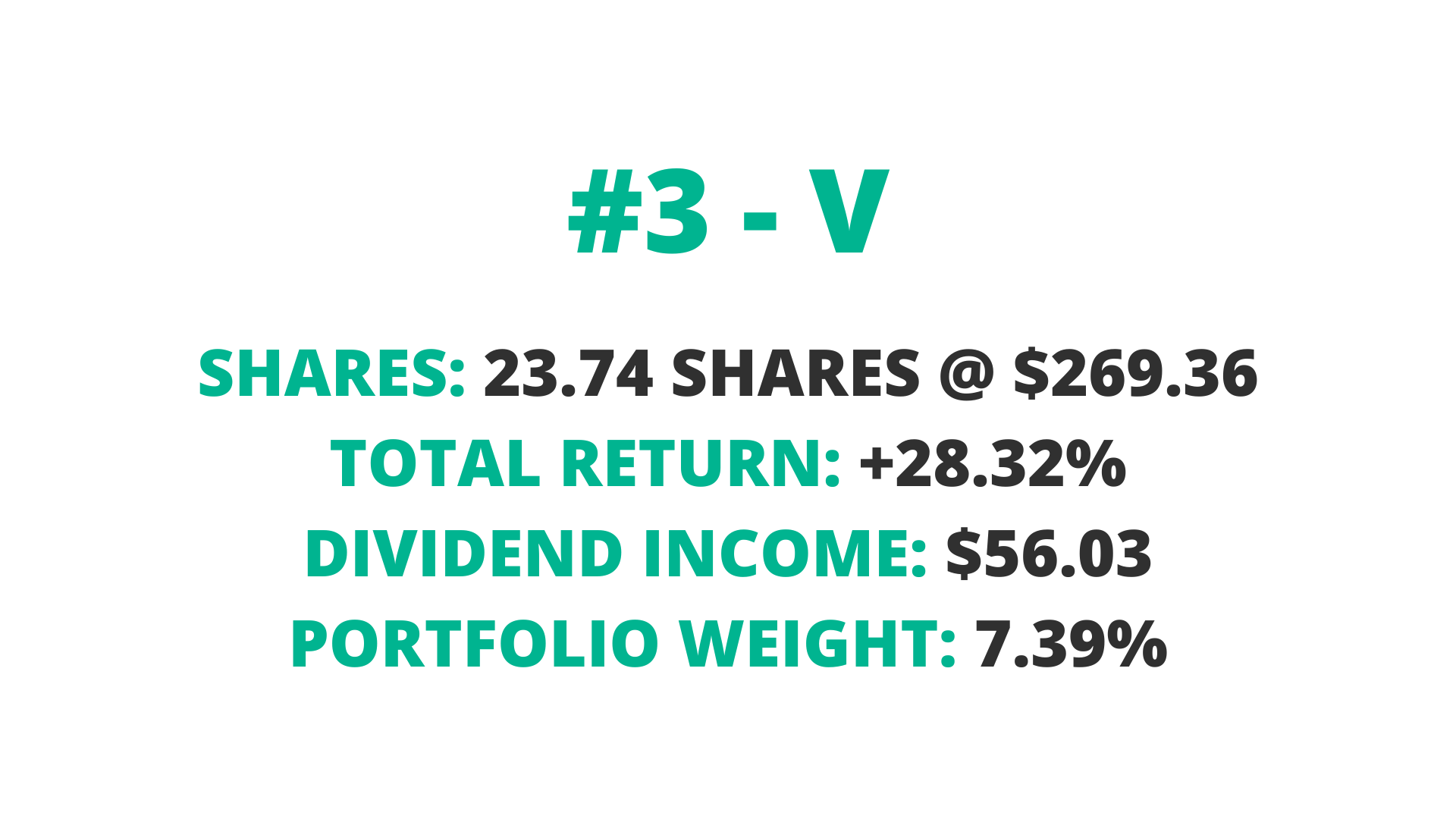

#3 — Visa (V)

I absolutely love Visa (V), which is a company that needs no introduction. I think Visa is the gold standard of stocks, and I can’t think of a more financially perfect company.

Visa is a free cash-flow printing machine, and even though it’s my largest individual stock position (but not by much), I wish I owned twice as many shares. This is one stock I’d definitely break my 10% rule of thumb for.

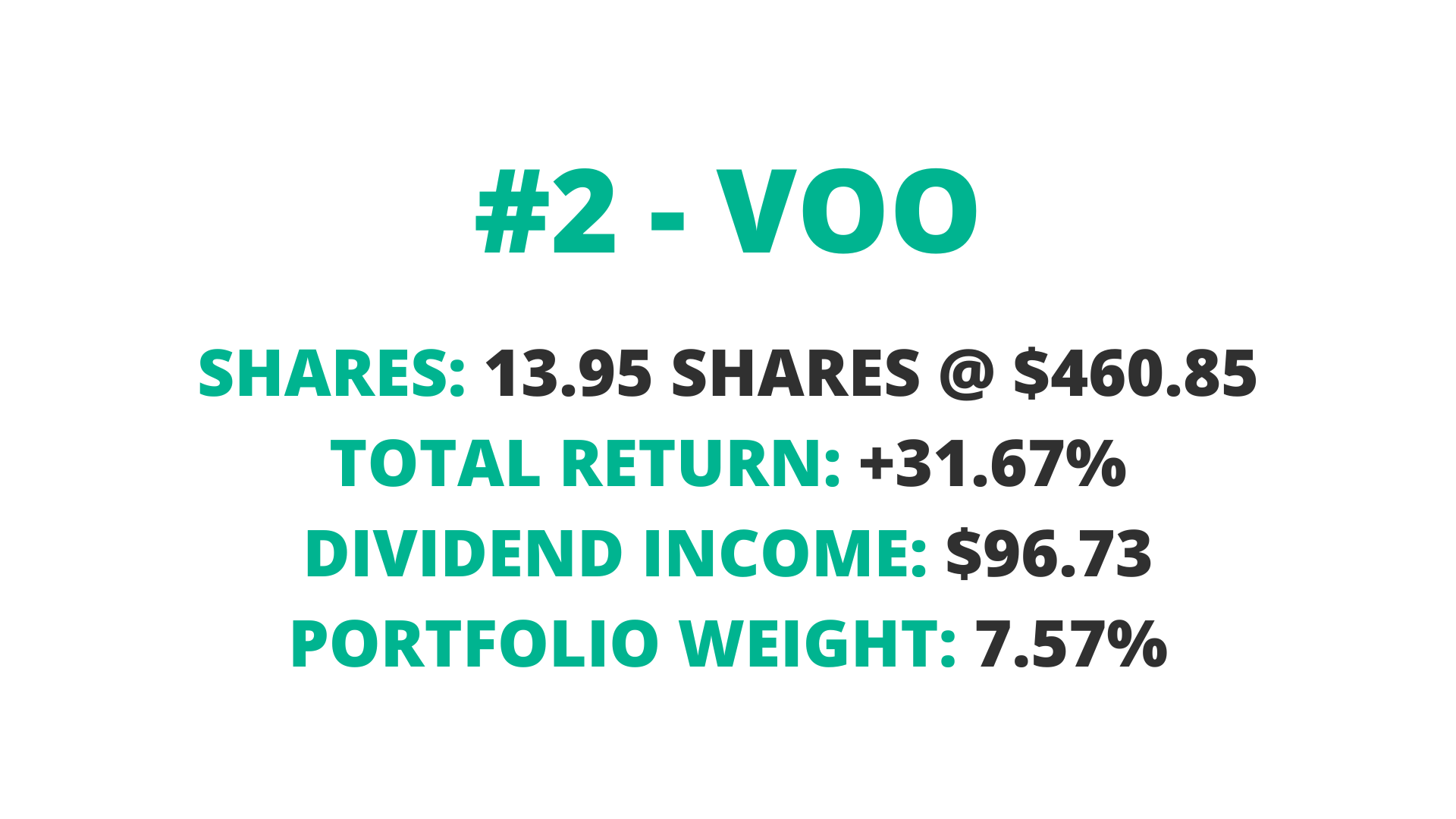

#2 — Vanguard S&P 500 ETF (VOO)

I don’t talk about VOO as much as my individual stock positions, but this ETF has been a cornerstone of my portfolio and offers something I don’t get from my individual stocks.

With just this one ETF, I get exposure to 500 of the largest U.S. companies—which gives me the opportunity to buy into (and benefit from) the entire American economy.

The yield isn’t huge at around 1.2%, but between share price appreciation and steady dividend growth, VOO makes for a great foundation in the portfolio.

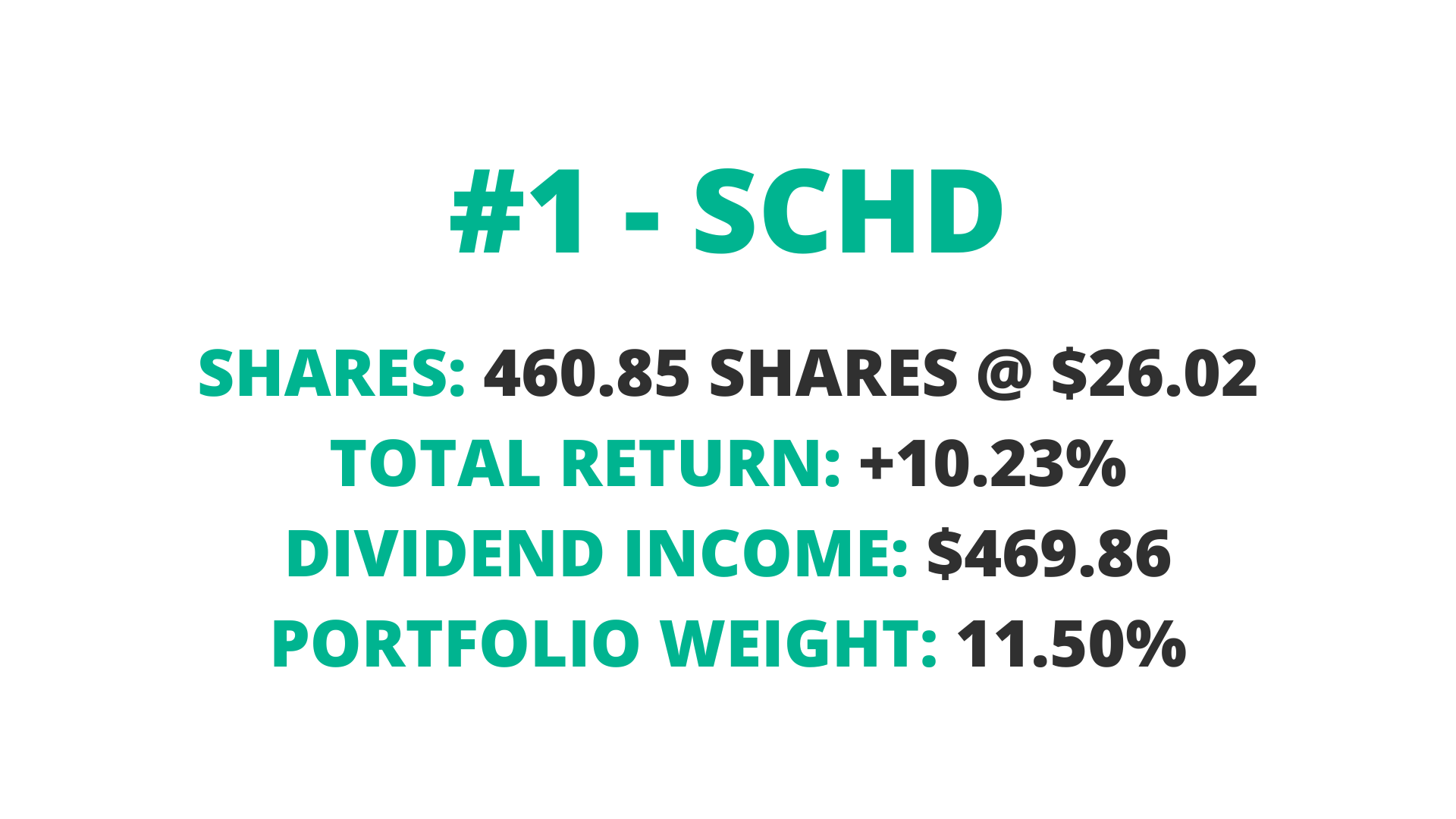

#1 — Schwab U.S. Dividend Equity ETF (SCHD)

SCHD has been the largest position in my portfolio for a while now, and despite the negative sentiment currently surrounding the fund, I still consider it to be the Holy Grail of Dividend ETFs.

With SCHD, you’re not getting sketchy stocks with no proven track record. You’re buying into high-quality, recognizable companies with strong financials and a history of consistently growing their dividends like HD, CVX, and PEP—along with 100 other dividend-paying companies.

With a double-digit dividend growth rate, a solid yield, and a focus on high-quality businesses, it’s been the perfect holding for my dividend portfolio, and it pairs really well with VOO.

Overall, I’m really happy with my top five, and now I’d love to hear from you: What are your top 5 largest positions? Let me know in the comments below!

And if you want to learn about a few stocks that I think are ALMOST PERFECT, check out this video here.