I reviewed large U.S. stocks and built a top-10 based on 12-month total return (with dividends reinvested). I only included companies with clear financials and active trading.

How the ranking works

I evaluate only large, publicly listed U.S. companies. The core metric is 12-month total return with dividends reinvested.

To keep the list usable, we screen out weak or thinly traded names up front. A company must show positive free cash flow over the last twelve months, at least 5% revenue growth year over year, and an average daily trading value of $50 million or more. This reduces one-off spikes and improves list reliability.

Ranking is straightforward: total return comes first. If two names are close, I place higher the one with lower price swings over the same period and stronger fundamentals such as return on invested capital, operating margin, and net debt to EBITDA. The approach is intentionally transparent so it’s easy to replicate.

Top 10 companies (12-month view)

Robinhood (HOOD). Online platform for trading stocks, options, ETFs, and crypto; revenue comes from interest income, paid subscriptions, and order flow. In Q2 2025, revenue rose 45% y/y to $989M; earnings per share (fully diluted) increased to $0.42 from $0.21 a year earlier; Robinhood Gold subscribers reached 3.5M. Over the past 12 months, the stock gained ~404%, with a recent high near $152. Investors.robinhood.com

Palantir (PLTR). Data and AI software for enterprise and government; monetized via licenses and services. In Q2 2025, total revenue grew 48% y/y; U.S. commercial revenue was up 93% y/y. Management raised the full-year revenue growth target to ~45%. Over the past 12 months, the stock is up ~324%, with a high near $187. Investors.palantir.com

AppLovin (APP). Growth platform for mobile apps—ads, analytics, and monetization; revenue from subscriptions and fees. In Q2 2025, revenue was $1.259B (+77% y/y); net income $820M (+164% y/y); from continuing operations $772M (+156% y/y). Over the past 12 months, the stock rose ~310%, with a high near $719. Investors.applovin.com

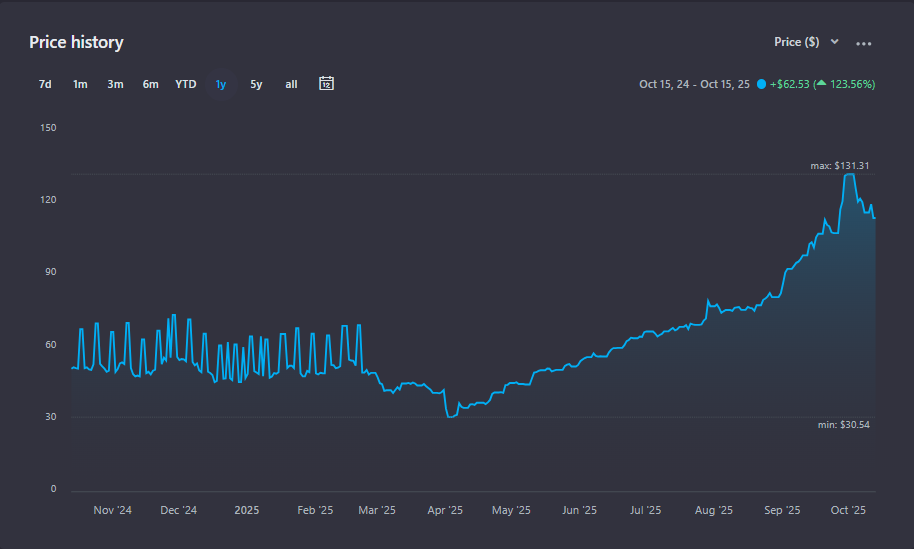

Western Digital (WDC). HDDs, SSDs, and storage solutions for data centers and PCs; core markets include cloud, consumer, and enterprise. Fiscal 2025 revenue was $9.52B (+51% y/y); Q4 revenue $2.61B (+30% y/y); quarterly free cash flow $675M. Over the past 12 months, the stock is up ~124%, with a high near $131. Investor.wdc.com

General Electric (GE, GE Aerospace). Jet engines and services for commercial and defense aviation; model combines engine sales with high-margin services. In Q2 2025, adjusted revenue $10.2B (+23% y/y); GAAP revenue $11.0B (+21% y/y), driven by commercial engines and services. Over the past 12 months, the stock gained ~48%, with local highs in October 2025. Geaerospace.com

Oracle (ORCL). Database software and cloud services (IaaS/PaaS/SaaS); revenue from subscriptions and cloud infrastructure. In Q1 fiscal 2026 revenue was $14.9B (+12% y/y); cloud revenue $7.2B (+28% y/y); remaining performance obligations $455B (+359% y/y). Over the past 12 months, the stock is up ~72%, with a high near $328.

Note: Oracle’s fiscal year starts on June 1 and ends on May 31. Investor.oracle.com

Broadcom (AVGO). Networking chips, custom ASICs, and infrastructure software; strong footprint in data centers. In Q3 2025, AI-related revenue rose 63% y/y to $5.2B; total quarterly revenue was about $15.95B. Over the past 12 months, the stock is up ~96%, with a high near $370. Investors.broadcom.com

Nvidia (NVDA). Accelerators and software for AI and high-performance computing; data centers are the key driver. In Q2 fiscal 2026, total revenue $46.7B (+56% y/y); data-center revenue $41.1B (+56% y/y). Over the past 12 months, the stock is up ~37%, with a high near $193. Nvidianews.nvidia.com

Uber (UBER). Platform for mobility and delivery; revenue from trip/order commissions plus ads and subscriptions. In Q2 2025, revenue $12.7B (+18% y/y); operating income $1.5B (+82% y/y); net income $1.4B. Over the past 12 months, the stock is up ~13%, with a high near $100. Investor.uber.com

Tapestry (TPR). Parent of Coach, Kate Spade, and Stuart Weitzman; sells accessories and apparel via retail and online. In Q4 fiscal 2025, record revenue $1.7B (+8% y/y); full-year revenue $7.0B (+5% y/y), with Coach as the main contributor. Over the past 12 months, the stock is up ~157%, with a high near $117. Tapestry.gcs-web.com

How to use this list

Treat this as a starting point. It highlights large U.S. companies that actually delivered over the past year and passed simple business and trading checks. Before buying, glance at the latest report: revenue trend, margins, and debt. If two names look similar on return, consider the one with lower price swings and a business you understand better.

Finding stocks that fit your portfolio

Decide on your time horizon and goal—steady contributions over several years or a one-off purchase. Review basic metrics for each holding: revenue, margins, debt, and cash flow. Check the stock’s typical yearly volatility and whether it matches your comfort with risk. A common way to start is to take small positions in one or two names, then add more gradually; this helps you gauge how the approach feels in practice.

An alternative to picking individual stocks

Selecting single names takes time and ongoing follow-up. If that’s not your style, consider broad U.S. market index funds. One fund gives you small stakes in hundreds of companies, which reduces dependence on any single stock. It doesn’t remove risk entirely, but it smooths the ride and makes upkeep simpler.

Bottom line

Use this as a starting point, not a shortcut. It won’t replace your own checks or your goals. Before acting, match any pick to your time horizon and risk tolerance. This is for information only and is not financial advice. And let’s discuss what you’re investing in and why.