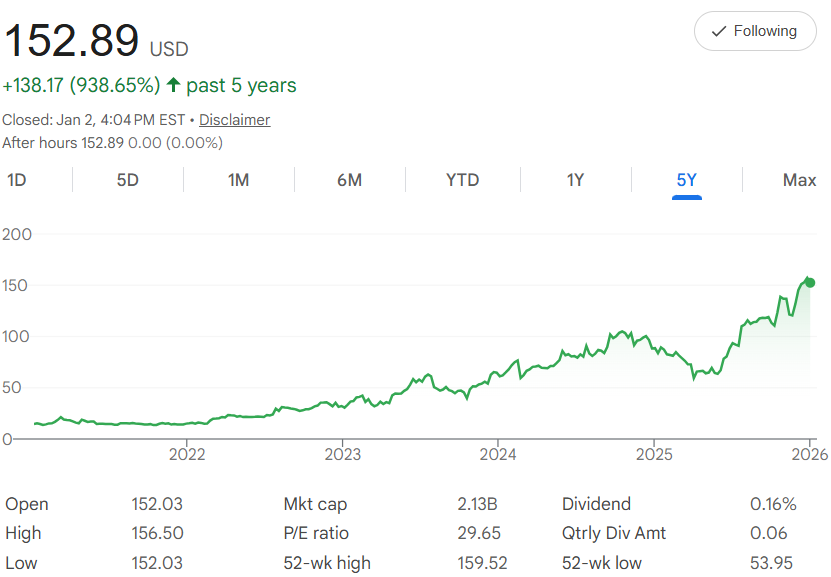

Five years ago, Bel Fuse Inc. $BELFA shares were trading around $14.72 each. Today, it's closed at $152.89—a strong 938.65% rise that comes from its role in electronic components like fuses, connectors, and magnetic products for industries such as auto, aerospace, and telecom. The chart shows a slow start through 2023, then steady gains in 2024 and a sharp push in 2025, with a 52-week high of $159.52 highlighting recent peak performance.

In simple terms, the compound annual growth rate (CAGR) is 59.95%. That's the average yearly lift—calculated by raising the total growth factor to the 1/5 power and subtracting 1. It means growing your money by nearly 60% each year, on average.

Dollar-cost averaging (DCA) keeps it connected: Invest $500 every month for five years, totaling $30,000. This buys more shares on dips and fewer on peaks, helping balance the electronic market swings.

Build your portfolio, one day at a time.

Get our daily 5-year horizon picks sent to your inbox. Subscribe here.

Projecting forward at the same historical pace, with a monthly growth rate of about 3.99% from $152.89, your shares build over time. After 60 months, your total could reach $122,998. That's a gain of $92,998—a 310% return on your investment. The early buys get the biggest compounding charge, while later ones still add to the current.

This is based on the past, which isn't guaranteed ahead—component stocks can fluctuate with supply chains or tech demand, but a P/E ratio of 29.65 shows reasonable pricing.

With that 52-week high of $159.52 in view and a $2.13B market cap, BELFA has wiring. If DCA's your steady link, it could turn your $500 habit into a powered payoff by 2031.

Plug in?