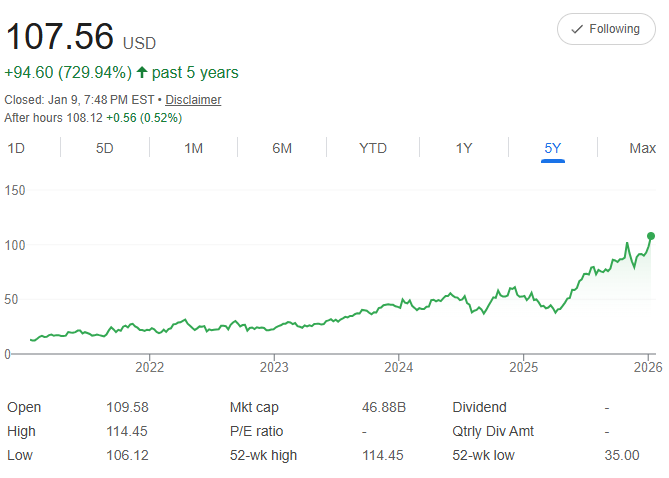

Five years ago, Cameco Corporation $CCJ shares were trading at much lower levels, but as today, the stock closed at $107.56—representing a massive 651.64% rise over the last five years, fueled by the global shift toward nuclear energy and a $46.8B market cap.

This explosive growth reflects a Compound Annual Growth Rate (CAGR) of 49.7%, meaning your money would have grown by nearly 50% each year on average. By following a dollar-cost averaging (DCA) strategy and committing $500 every month for five years (totaling $30,000), you would have navigated the uranium market's volatility by acquiring more shares during minor pullbacks and fewer during vertical climbs.

Build your portfolio, one day at a time.

Get our daily 5-year horizon picks sent to your inbox. Subscribe here.

Projecting forward at this historical pace with a monthly growth rate of approximately 3.4%, your total investment could reach $112,544 by 2031, resulting in a gain of $82,544—a 275.1% return.

While the nuclear sector faces regulatory changes and a 52-week high of $114.45 highlights its recent peak strength, CCJ’s critical role in the clean energy transition provides a powerful tailwind; if you keep this steady drill running, your $500 monthly habit could strike a radioactive windfall by 2031—but as global energy policies change, will you be leading the charge or left in the fallout when the next supply crunch hits?