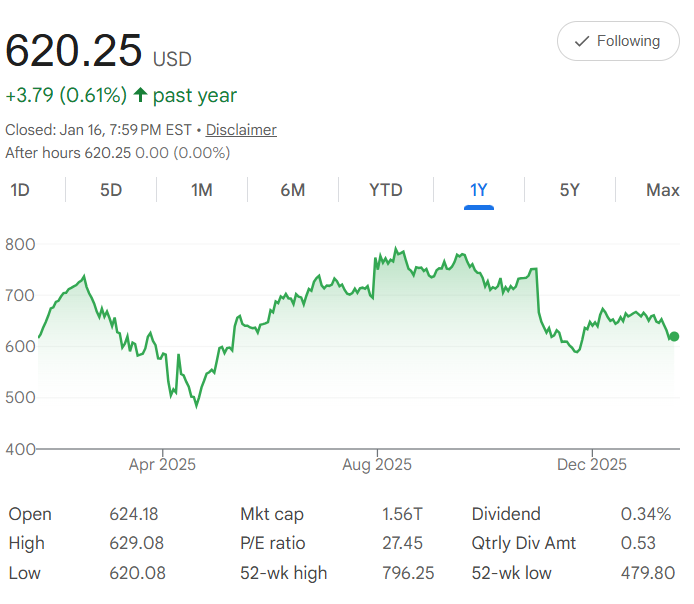

Five years ago, Meta Platforms Inc. $META shares were around $340 each. As of today, it's at $620.25—a 82.43% gain from its core in social media, ads, and ventures into VR, AI, and metaverse tech via Facebook, Instagram, and WhatsApp. The chart shows a firm base from 2022 lows, with steady expansion through 2025, and after-hours at $620.25. That 52-week high of $796.25 points to more connections ahead. In basic terms, the compound annual growth rate (CAGR) is 12.78%. That's the average yearly lift—calculated by raising the total growth factor to the 1/5 power and subtracting 1. It means growing your money by about 13% each year, on average. Dollar-cost averaging (DCA) keeps it linked: Invest $500 every month for five years, totaling $30,000.

Build your portfolio, one day at a time.

Get our daily 5-year horizon picks sent to your inbox. Subscribe here.

You buy more shares on quiet days and fewer on active ones, helping balance the tech waves. Projecting forward at the same historical pace, with a monthly growth rate of about 1.01% from $620.25, your shares grow steadily. After 60 months, your total could reach $41,998. That's a gain of $11,998—a 40% return on your investment. The early buys get the most from compounding, while later ones still add to the web.

This follows the past, which isn't a lock for tomorrow—social media can face privacy rules or ad shifts, but a P/E ratio of 27.45 signals fair pricing, and a 0.34% dividend yield offers small regular payouts.

With that 52-week high of $796.25 in view and a $1.56T market cap, META has depth. If DCA's your steady link, it could turn your $500 habit into a connected reward by 2031. Plug in?