There’s a lot going on in the stock market right now.

Not only are we knee-deep in the middle of earnings season (which always brings volatility), but on top of that, there continues to be noise around interest rates, tariff headlines, and shaky consumer sentiment.

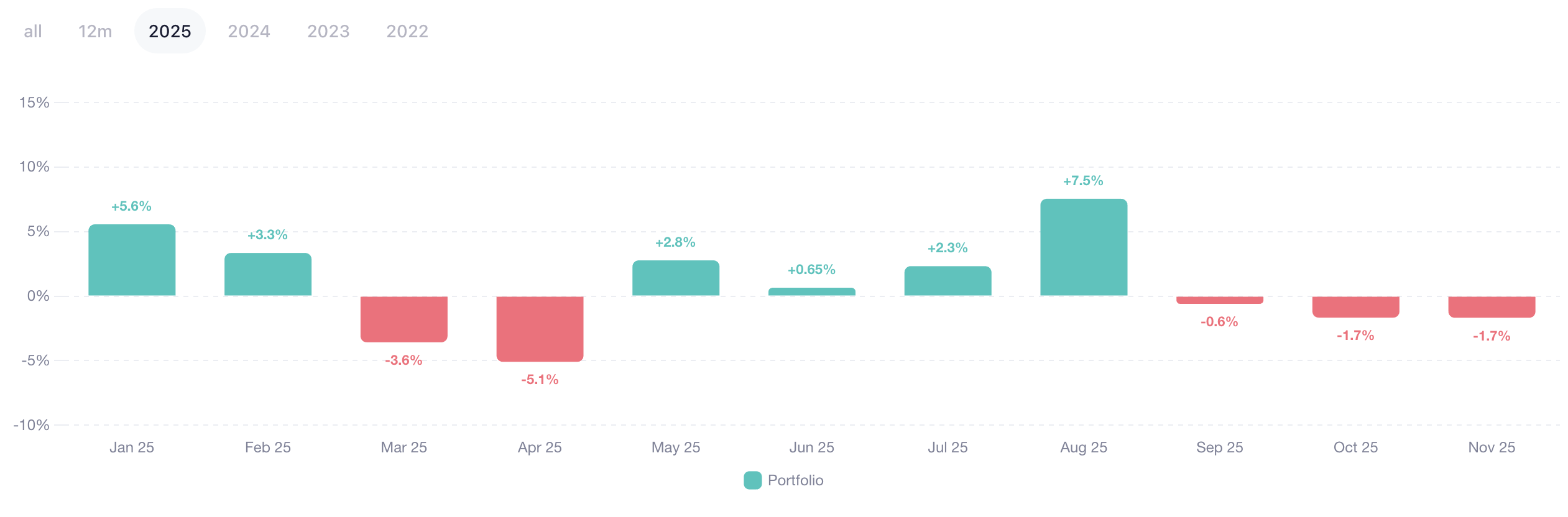

In other words, there are a lot of moving pieces right now, and my portfolio has definitely felt some of that impact lately.

The silver lining is that falling share prices make the great businesses I own cheaper to buy. And as someone who buys stocks every single week — and has been putting even more money to work lately — I welcome the opportunity to pick up more shares at more attractive prices.

This is especially true considering the fact that I don’t plan on selling any of these stocks. Not if I can help it, at least.

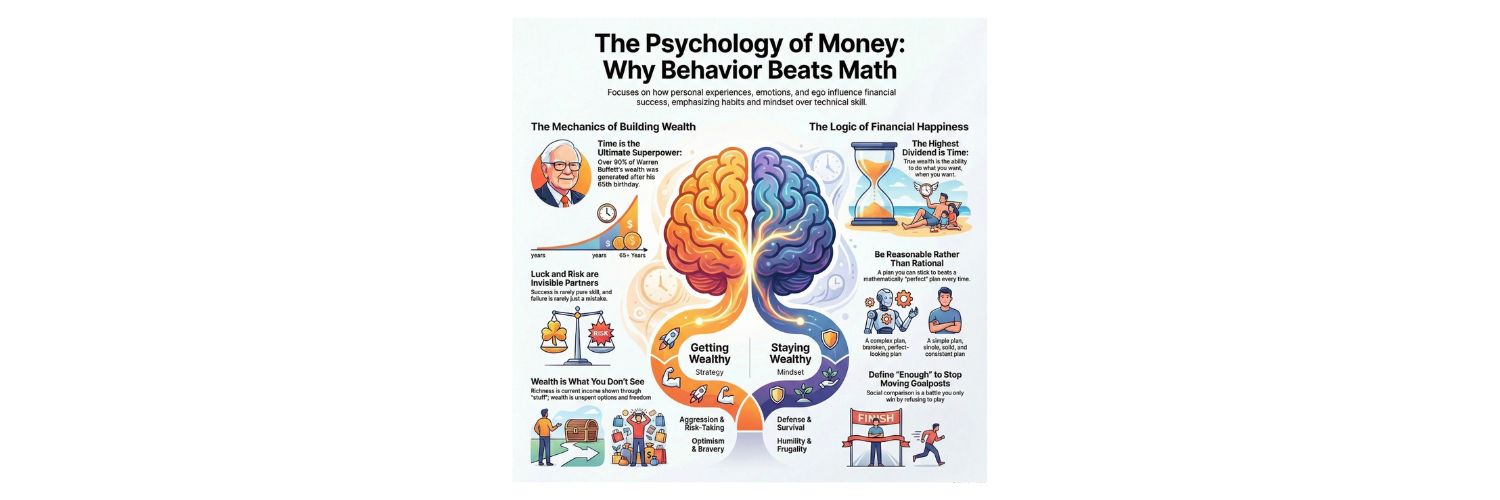

With every position I own, my goal is to hold onto it for life. Although it doesn’t always work out that way, the real benefit of ownership comes from the growing cash flow these companies pay me as a shareholder — not from selling shares for a profit.

That’s another silver lining: when share prices go lower, I get to grow my passive income stream at a discount, and I don’t have to obsess (and stress) about the fact that the price is lower.

Over a long period of time, sure, you want to see prices go up — that’s a sign of a healthy, growing business. But in the short term, if you’re still building out your position, you actually want to see them fall.

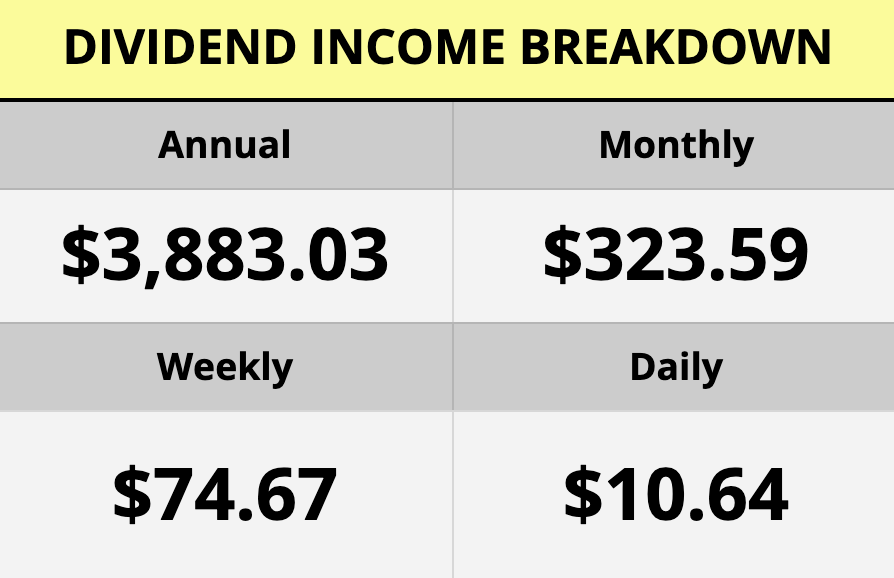

I recently went on record saying that I will hit $4,000 of projected annual dividend income by the end of this year. To get there, I’ll have to invest a bit more aggressively than I have all year long.

Luckily, these recent declines lined up perfectly with that goal. In the pursuit of more passive income, I’ve been investing heavier than usual and put a few extra thousand dollars to work taking advantage of the dips, and there are three stocks in particular I’ve been loading up on (and plan to keep buying).

Zoetis (ZTS)

As many of you know by now, Zoetis just reported its Q3 earnings — and the stock dropped roughly 16% over the past few days as a result.

Personally, I don’t think the results were bad at all. You can read my full notes on the call here. But the market clearly disagreed, sending shares much lower.

Even though Zoetis was already one of my larger positions, I couldn’t resist buying the dip. I’ve only added 4 shares so far, but since I’m down about 20% on the position, I plan to keep averaging down in the coming weeks.

Right now, my average cost per share is around $150. But if the price stays where it is, I should be able to bring that down into the mid-$140s, which would be fantastic.

VICI Properties (VICI)

VICI also reported earnings recently — again, you can read my full notes here — but I think the 6.5% decline over the last month is more tied to interest rate moves and negative headlines about tourism trends in Las Vegas.

As a Vegas local, I can tell you firsthand that even though the numbers show fewer travelers, this city is still packed. But I get why investors are nervous.

Either way, VICI’s share price recently dipped below $30 for the first time in a while, so I took the opportunity to finally add more. I’ve picked up 18 shares since the start of the month, and I’ll keep buying as long as the stock hovers around $30.

Watsco (WSO)

I’ve been a bit of a broken record about Watsco lately — and for good reason. If you missed my deep dive on why I added this one to my portfolio, you can check that out here.

This month, I picked up 3 more shares. That might not sound like much, but at around $360 per share, that’s a good chunk of change!

I started this position less than a month ago, and I’ve already invested about $7,000 into it, landing me 19 shares total.

Like the other two companies, Watsco recently reported earnings — you can read my notes here — and while sales were down 4% year over year, they also posted record-high operating cash flow.

Total Investments

Altogether, I’ve invested exactly $7,500 across these three companies over the past few weeks — easily one of the biggest short-term contributions I’ve made to my portfolio.

That $7,500 added $263 to my projected annual dividend income, which works out to an average yield of about 3.5%. Not too shabby.

Right now, my total projected annual income sits at $3,883, meaning I only need $117 more to hit my end-of-year goal. If I keep investing at roughly the same 3.5% yield, I’d only need to put in another $3,342 to get there — which is totally doable.

One way or another, though, I’m hitting this goal. Like Yoda said: “Do or do not. There is no try.”

With the finish line for 2025 less than two months away, I want to hear from you: Do you have an investing goal you’re working toward before the end of the year? Let me know in the comments below!