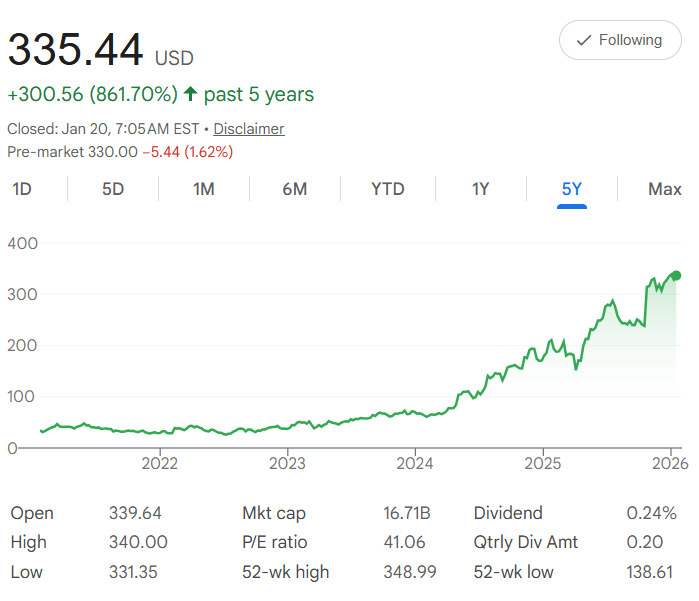

Five years ago, Carpenter Technology $CRS shares were trading around $35 each. Today, January 20, 2026, it's closed at $335.44—a strong 862% surge that comes from its expertise in specialty alloys and materials, powering gains in aerospace, defense, medical, and energy sectors with demand for high-performance metals, improved operations, and solid contracts driving the rise.

The chart shows a steady upward move from 2022 lows near $25-30, with clear acceleration through 2024 and 2025, and a 52-week high of $348.99 marking its recent peak strength.

In simple terms, the compound annual growth rate (CAGR) is 57.26%. That's the average yearly boost—calculated by raising the total growth factor to the 1/5 power and subtracting 1. It means growing your money by about 57% each year, on average. Dollar-cost averaging (DCA) keeps the path steady: Invest $500 every month for five years, totaling $30,000.

Build your portfolio, one day at a time.

Get our daily 5-year horizon picks sent to your inbox. Subscribe here.

This buys more shares on dips and fewer on peaks, helping through the ups and downs of coal markets. Projecting forward at the same historical pace, with a monthly growth rate of about 5.07% from $240.82, your shares build value over time.

After 60 months, your total could reach $190,998. That's a gain of $160,998—a 537% return on your investment. The early buys get the biggest compounding lift, while later ones still add to the haul.

This is based on the past, which isn't a guarantee ahead—coal stocks can shift with steel demand, energy policies, or global prices, but no P/E listed keeps the focus on growth. With that 52-week high of $253.82 in view and a $3.10B market cap, AMR has solid reserves. If DCA's your steady drill, it could turn your $500 habit into a rich payoff by 2031. Dig in?