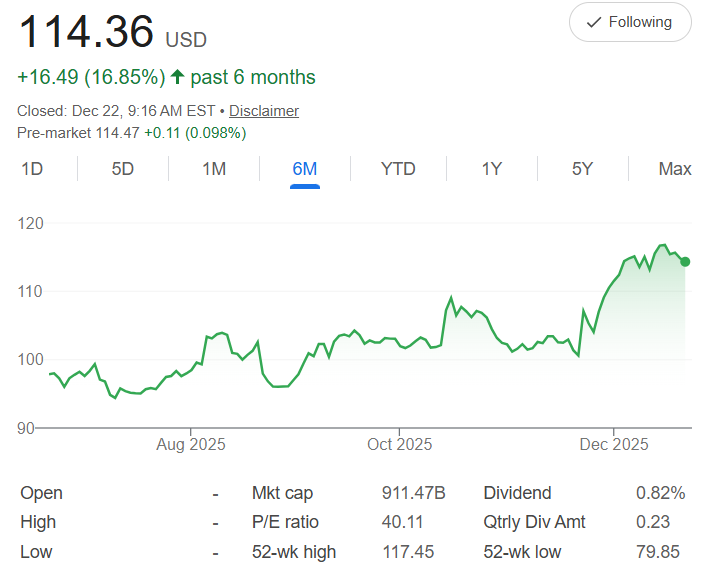

Walmart's journey $WMT is a classic tale of retail dominance, evolving from brick-and-mortar giant to a powerhouse in e-commerce and omnichannel shopping. From five years ago at $47.83 a share to today's $114.36, the 139% gain reflects its ability to capture everyday spending—groceries, household items, and online orders—while fending off competitors through low prices, vast supply chains, and investments in tech like pickup, delivery, and Walmart+. The chart's steady upward slope, with a strong push in 2025, underscores this reliability, with after-hours at $114.38 and a 52-week high of $117.45 showing the momentum is fresh.

The compound annual growth rate (CAGR) of 19.03% captures this consistent performance—calculated by raising the total growth to the 1/5 power and subtracting 1, delivering about 19% average annual returns. With dollar-cost averaging (DCA), your $500 monthly investments over five years total $30,000, allowing you to buy more shares during softer periods for a lower average cost. Projecting forward, with a monthly growth rate of 1.47%, your portfolio could reach $46,992—a $16,992 gain or 57% return. Early contributions benefit most from compounding, but the real power comes from discipline across market cycles.

Build your portfolio, one day at a time.

Get our daily 5-year horizon picks sent to your inbox. Subscribe here.

Looking deeper, Walmart's strengths include its scale ($911.47B market cap), defensive nature (people always need essentials), and growth engines: Walmart+ membership, advertising revenue from its marketplace, and international expansion. Analysts highlight 2025-2026 potential with mid-single-digit sales growth, improved margins from automation, and e-commerce scaling to 20%+ of U.S. sales. The P/E ratio of 40.11 is reasonable for a company blending growth and stability, while the 0.82% dividend yield (recently raised) provides steady income—quarterly payments of $0.23 per share.

Important considerations: Retail faces risks like inflation squeezing margins, intense online competition from Amazon, or supply chain disruptions. Economic slowdowns can pressure discretionary spending, though groceries (over 50% of U.S. sales) offer resilience. Labor costs and regulatory scrutiny are ongoing watches, but Walmart's size often turns these into advantages through negotiation power.

If you trust Walmart to keep delivering—enhancing tech, optimizing stores, and winning customer loyalty—DCA lets you ignore short-term noise and capitalize on dips by buying more at lower prices. Over five years, continued improvements in efficiency and digital reach make higher stock performance more likely. This disciplined $500 approach could build a dependable cornerstone for your portfolio by 2030.

Everyday wins add up—ready to invest in them?