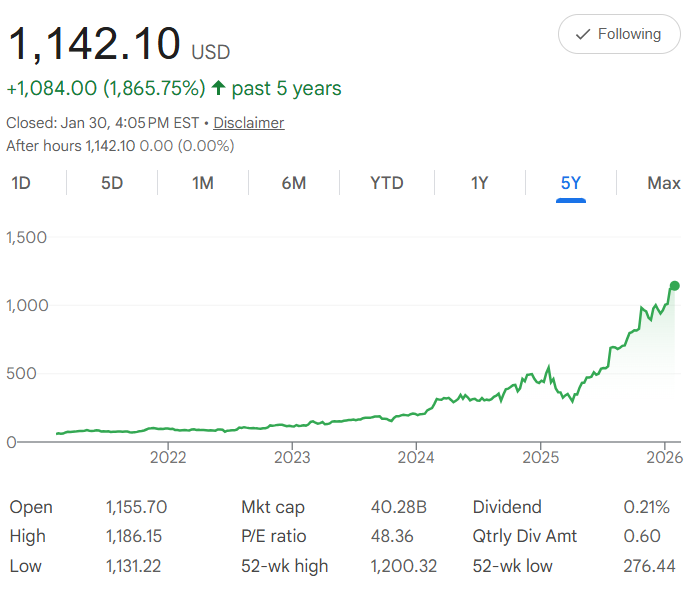

Five years ago, Comfort Systems USA $FIX shares were trading around $51 each. Today, it's closed at $1,142.10—a powerful 2,100%+ rise that reflects massive demand for HVAC, plumbing, electrical, and mechanical services in commercial buildings, data centers, manufacturing plants, and infrastructure projects. The chart shows a very strong, almost uninterrupted upward trend from 2022 lows, with consistent gains through 2025 and early 2026, and a 52-week high of $1,200.32 proving the company is still near its strongest levels ever.

In plain terms, the compound annual growth rate (CAGR) is 86.5%. That's the average yearly gain—calculated by raising the total growth factor to the 1/5 power and subtracting 1. It means your money would have grown by roughly 86–87% per year on average over the past five years.

Dollar-cost averaging (DCA) turns this into a practical plan: Invest $500 every month for five years, totaling $30,000. This buys more shares when prices are lower and fewer when they're higher, which helps smooth out any temporary pullbacks.

Projecting forward at the same historical CAGR, with a monthly growth rate of about 5.35% from $1,142.10, your position grows rapidly. After 60 months, your portfolio could reach approximately $238,000. That's a gain of about $208,000—a 693% return on your invested capital. The earliest contributions benefit the most from compounding, while later investments still capture very strong overall growth.

This projection follows historical performance, which does not guarantee future results. FIX has benefited from exceptional tailwinds (data center construction boom, infrastructure spending, commercial building activity), but construction and mechanical services stocks can be sensitive to interest rates, economic slowdowns, labor shortages, supply chain issues, or changes in building activity. The current P/E ratio of 48.36 reflects high growth expectations, and the 0.21% dividend yield is modest as the company reinvests heavily.

Build your portfolio, one day at a time.

Get our daily 5-year horizon picks sent to your inbox. Subscribe here.

With a $40.28B market cap and the 52-week high of $1,200.32 still very close, FIX remains one of the strongest-performing names in the industrial/services space. If you're comfortable with the risk and believe in continued demand for their services, DCA lets you participate consistently without trying to time the market. Your steady $500 monthly investments could build a very substantial position by 2031. Ready to keep building?