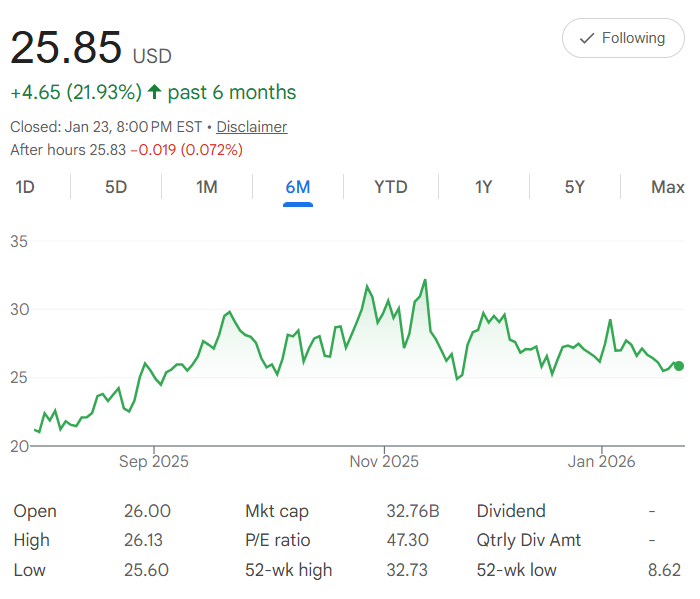

Five years ago, SoFi Technologies $SOFI shares were trading around $2.35 each (adjusted for its public debut and early trading levels). Today, it's closed at $25.85—a strong 1,000%+ rise that reflects its growth from a student loan refinancer into a full digital bank offering checking, savings, investing, loans, and credit cards.

The chart shows a bumpy early path through 2022-2023 with post-SPAC volatility and rate hikes, followed by steady recovery and acceleration in 2024-2025 as membership grew and profitability improved. The 52-week high of $32.73 (reached earlier in the period) shows the stock has room to stretch when sentiment and results align. In simple terms, the compound annual growth rate (CAGR) over the past five years is approximately 61.5%.

That's the average yearly lift—calculated by raising the total growth factor to the 1/5 power and subtracting 1. It means your money would have grown by roughly 60% per year on average. Dollar-cost averaging (DCA) makes this practical: Invest $500 every month for five years, totaling $30,000. This approach buys more shares when prices are lower (like during the 2022-2023 dips) and fewer when they're higher, which smooths out the ride in a volatile growth stock.

Build your portfolio, one day at a time.

Get our daily 5-year horizon picks sent to your inbox. Subscribe here.

Projecting forward at the same historical CAGR, with a monthly growth rate of about 4.07% from $25.85, your position builds steadily. After 60 months, your total could reach around $123,500. That's a gain of approximately $93,500—a 312% return on your invested capital. The early investments get the full benefit of compounding, while later ones still ride the overall upward trend.

This projection follows historical performance, but the future is never certain—fintech stocks like SOFI can be volatile due to interest rates, regulatory changes, competition, or shifts in consumer borrowing and spending. The current P/E ratio of 47.30 reflects high growth expectations, and there is no dividend yet as the company reinvests in expansion.

With a $32.76B market cap and that 52-week high of $32.73 as a recent benchmark, SOFI still has upside potential if execution continues.If you're comfortable with the risk and believe in SoFi's long-term vision, DCA lets you participate steadily without trying to time the market. Your $500 monthly habit could grow into a meaningful position by 2031. Ready to join the journey?