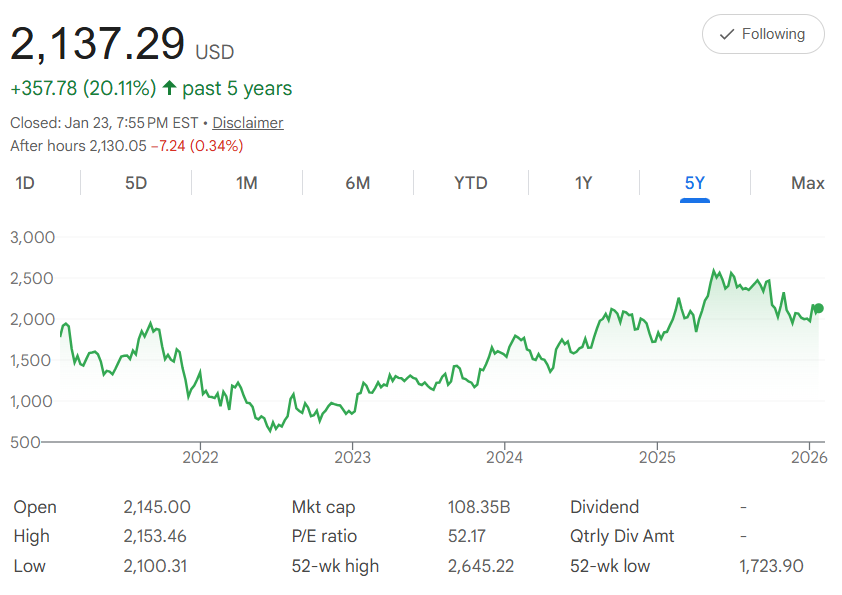

Five years ago, MercadoLibre $MELI shares were trading around $1,779 each. Today, January 23, 2026, it's closed at $2,137.29—a solid 20.11% gain over the period that reflects its dominance as Latin America's leading e-commerce and fintech platform, growing through online shopping, payments (Mercado Pago), logistics, and credit services across the region. The chart shows a strong recovery from 2022 lows, with consistent upward momentum through 2025 despite some volatility, and a 52-week high of $2,645.22 showing the ceiling it has reached recently.

In straightforward terms, the compound annual growth rate (CAGR) over the past five years is 3.74%. That's the average yearly increase—calculated by raising the total growth factor to the 1/5 power and subtracting 1. It means growing your money by about 3.7% each year, on average.

Dollar-cost averaging (DCA) keeps this simple and steady: Invest $500 every month for five years, totaling $30,000. This buys more shares on lower days and fewer on higher ones, helping smooth out the natural ups and downs of a growth stock. Projecting forward at the same historical CAGR, with a monthly growth rate of about 0.31% from $2,137.29, your shares accumulate value over time.

After 60 months, your portfolio could reach approximately $34,998. That's a gain of about $4,998—a 17% return on your investment.

Build your portfolio, one day at a time.

Get our daily 5-year horizon picks sent to your inbox. Subscribe here.

The early contributions benefit the most from compounding, while later ones still participate in the overall trend. This is based on historical performance, which does not guarantee future results. MercadoLibre operates in emerging markets with risks including currency fluctuations, economic instability in Latin America, competition, and regulatory changes, though its large addressable market, improving profitability, and diversified revenue streams (e-commerce, fintech, logistics) provide a strong foundation. The current P/E ratio of 52.17 reflects high growth expectations, and there is no dividend as the company continues to reinvest heavily.

With that 52-week high of $2,645.22 in sight and a $108.35B market cap, MELI remains one of the most influential companies in Latin America. If DCA fits your patient, long-term approach, it could turn your $500 monthly habit into a meaningful position by 2031. Keep the cart rolling?