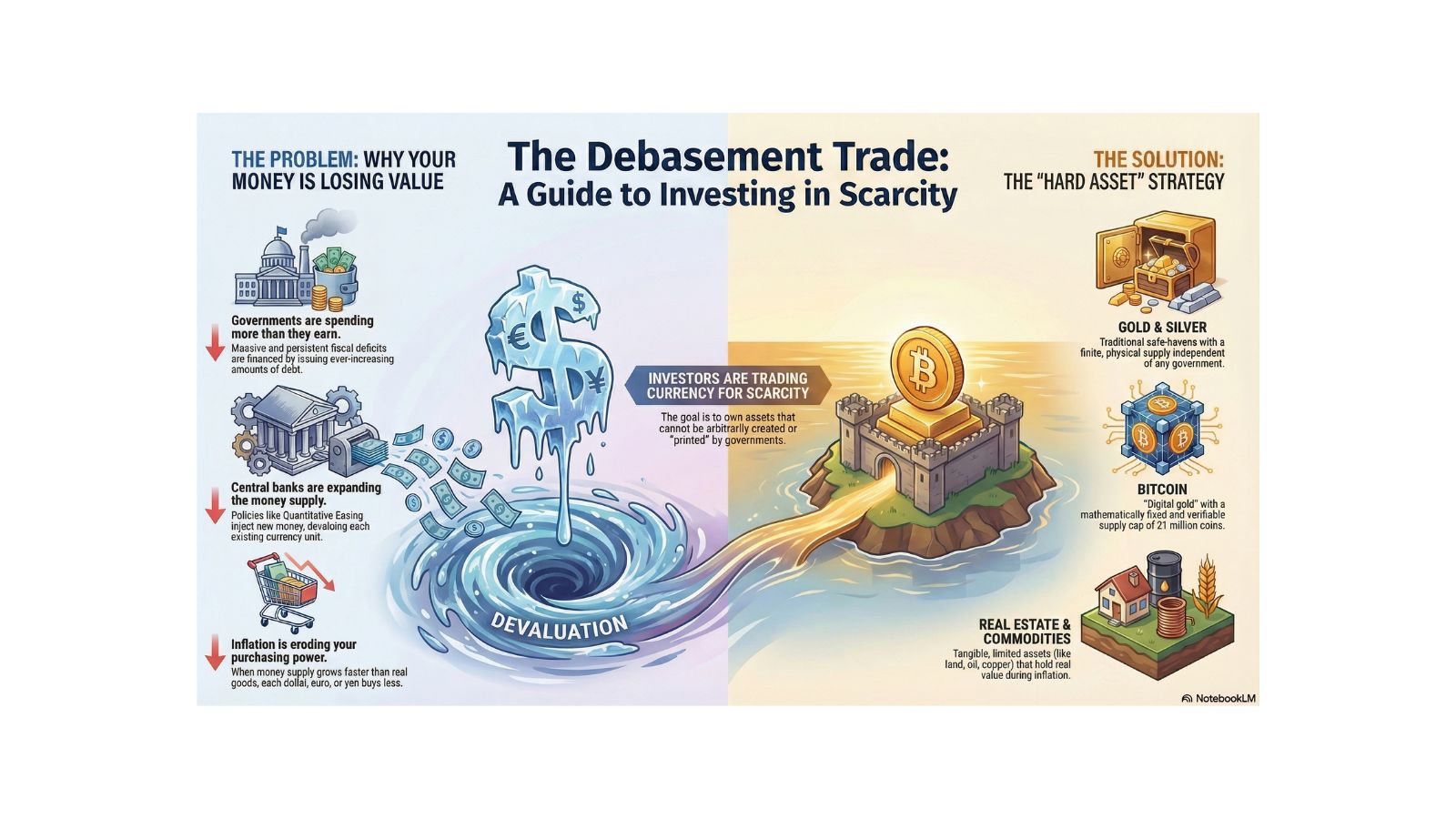

The "debasement trade" is an investment strategy driven by the belief that major fiat currencies (like the US Dollar, Euro, etc.) will steadily lose their real value and purchasing power over the long term. All one has to do is look at the cost of housing and other items to see that this is happening around them.

Investors engaging in this trade move capital out of cash and sovereign debt (like government bonds) and into "hard assets" or assets with verifiable scarcity to protect their wealth from this perceived erosion.

The Core Idea: Currency Debasement Historically, currency debasement was a physical act, for example, a king reducing the gold or silver content of a coin while keeping the face value the same.

1. Large & Persistent Fiscal Deficits: Governments consistently spending more than they take in and financing the gap by issuing massive amounts of debt. The US debt adds 1 trillion dollars every 71 days on average. (Source)

2. The devaluing of the US Dollar as outlined in the “A User’s Guide to Restructuring the Global Trading System” This is the paper or plan that is put into place by key President Trump cabinet members and is being played out right now during his administration. (Source)

3. China and other BRIX – Countries moving away from the US Dollar in the form of Treasuries and buying physical gold. (Source)

4. In the modern financial world, "debasement" refers to the loss of purchasing power due to: Excessive Money Supply Expansion: Central banks creating new money to inject liquidity into the system (often through policies like Rate cuts and Quantitative Easing). This can be seen in M2 Money Supply. (Source) This does not always mean that Fed Reserve is increasing its balance sheet. This has recently been discussed about the Federal Reserve balance sheet. We will address that in detail in another post, but not as relevant to the core factors of the debasement trade. Quantitative Easing only adds fuel to the fire.

5. Inflation: The result of the money supply growing faster than the production of real goods and services, meaning each unit of currency buys less.

The fundamental assumption of the debasement trade is that policymakers will likely continue with expansive monetary and fiscal policies to manage high national debt, leading to structural, long-term inflation.

The Investment Strategy

The debasement trade is a defensive strategy designed to preserve real value. It involves shifting money into assets that cannot be arbitrarily created or "printed" by governments or central banks.

Asset Class

Rationale for the Trade Gold & Silver: Traditional safe-haven assets with a finite supply. Their value is independent of any government or financial system.

Bitcoin, often referred to as "digital gold," it has a mathematically fixed supply cap (21 million coins), making it scarce and independent of central bank policy.

Real Estate: A tangible, limited asset that tends to hold value and appreciate during periods of inflation (though dependent on location and other factors).

Commodities Raw materials (like oil, copper, agricultural products) which often rise in price as a symptom of inflation.

Equities (Stocks)Some view certain stocks, especially those of companies with pricing power or tangible assets, as a hedge, as they represent a claim on real-world business and production, not just currency.

Why It Has Gained Traction

The debasement trade narrative gained significant momentum following the 2008 Financial Crisis and was greatly accelerated by the fiscal and monetary responses to the 2020 pandemic.

Investors point to: Record-High National Debts: The unsustainable trajectory of government borrowing. Unprecedented Central Bank Balance Sheets: The massive increase in the money supply due to central bank asset purchases.

Loss of Confidence: Growing skepticism that governments and central banks will prioritize currency stability over financing debt and government spending.

In my words, due to the high spending, rate cutting, dollar devaluing, and Central Banks buying gold over US Treasuries. We are going to see hard assets outpace other asset classes.

How do you invest into something like this? There are 3 ways that should be considered.

1. Own an ETF that unencumbered $BAR, $PHYS, $PSLV

It’s important to understand that not all ETFs are structured the same. These three provide access to the underlying assets, with the key distinction that they are unencumbered. Both $PHYS and $PSLV also offer the option to take physical delivery of gold or silver, but it’s essential to read and understand the requirements before doing so.

2. Income ETFS. $KGLD, $IAUI and $KSLV

These ETFs allow you to generate income from Gold and Silver.

3. Trade options on $GLD and $SLV

Someone could also trade options on funds that give you exposure to the Gold and Silver price action.

We have conversations like this in the investment group.