Imagine that the usual plastic cards could turn into digital tokens tomorrow, and central banks around the world would issue their currencies on the blockchain. The Visa and Mastercard payment networks have long been the "infrastructural heart" of the global economy.

But the world of payments is changing - stablecoins, private digital tokens, and central bank digital currencies (CBDCs) are entering the scene. I've studied the Visa and Mastercard strategies and I'm sharing my findings: who of the giants keeps abreast of innovation, and who relies on stability.

Mastercard (MA): a bet on stablecoins and the speed of implementation.

Mastercard is not waiting for the technology to become mainstream — the company is actively rolling out stablecoins. This goes beyond simple “technological experiments” and represents deliberate moves that position Mastercard as a connector linking fiat (traditional money) with commercial digital tokens. A clear example is its partnership with Fiserv and support for FIUSD, which make it possible to use tokens within familiar payment systems — cards, merchants, and point-of-sale terminals.

For an investor, this is a signal of the potential for earnings per share growth due to value-added services, albeit with slightly more volatility.

Visa (V) : Global infrastructure and work with regulators

Visa is betting on scale and sustainability. The new data center in Johannesburg is an example of how the company is investing in local markets with the rapid growth of digital payments. The opening of the first data center took place as part of a large-scale investment plan for the development and digitalization of Africa. The project strengthens the local payment infrastructure, meets regulatory requirements and prepares the base for working with CBDC. For an investor, this is a signal of reliable, predictable EPS growth and stable dividends.

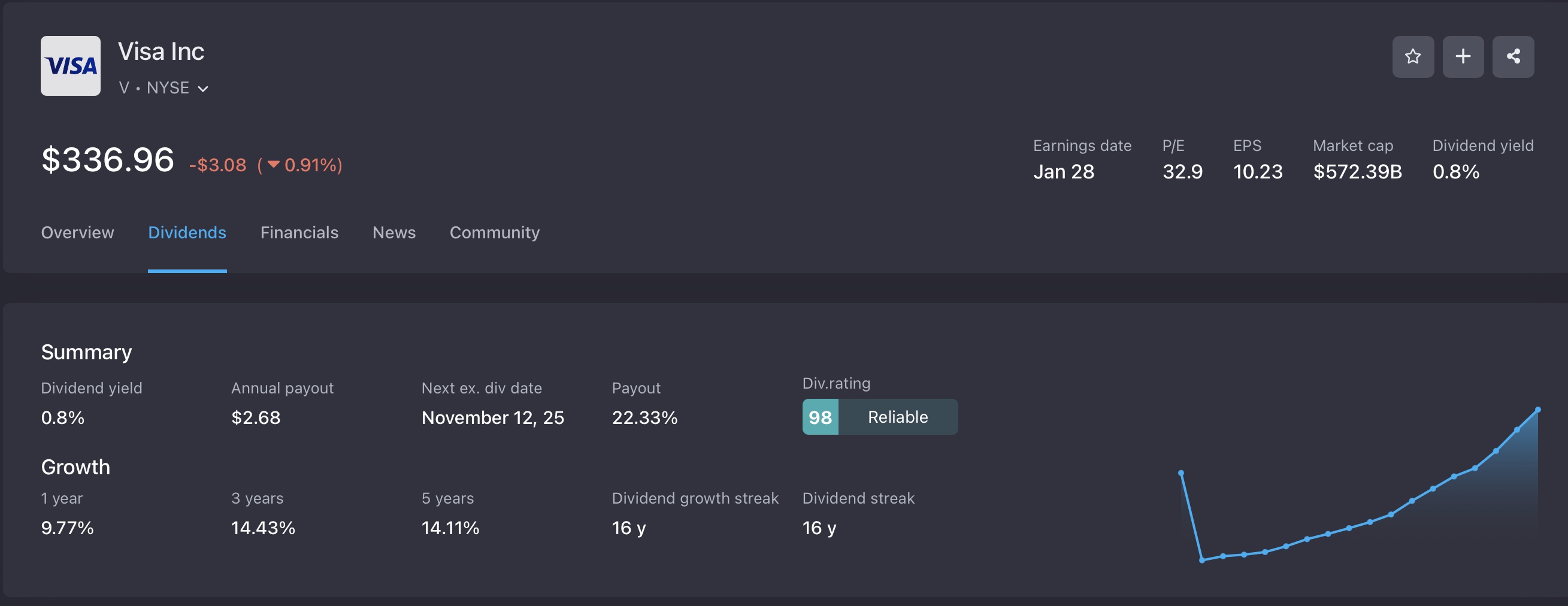

Results and Dividends:

Visa (Q3 FY2025): EPS $10.23, revenue $10.2 billion; EPS and revenue growth above expectations.

The annual dividend payment on Visa shares in 2025 is approximately $2.68 per share.

The payout ratio is 22.33% in 2025.

The dividend yield is 0.80%.

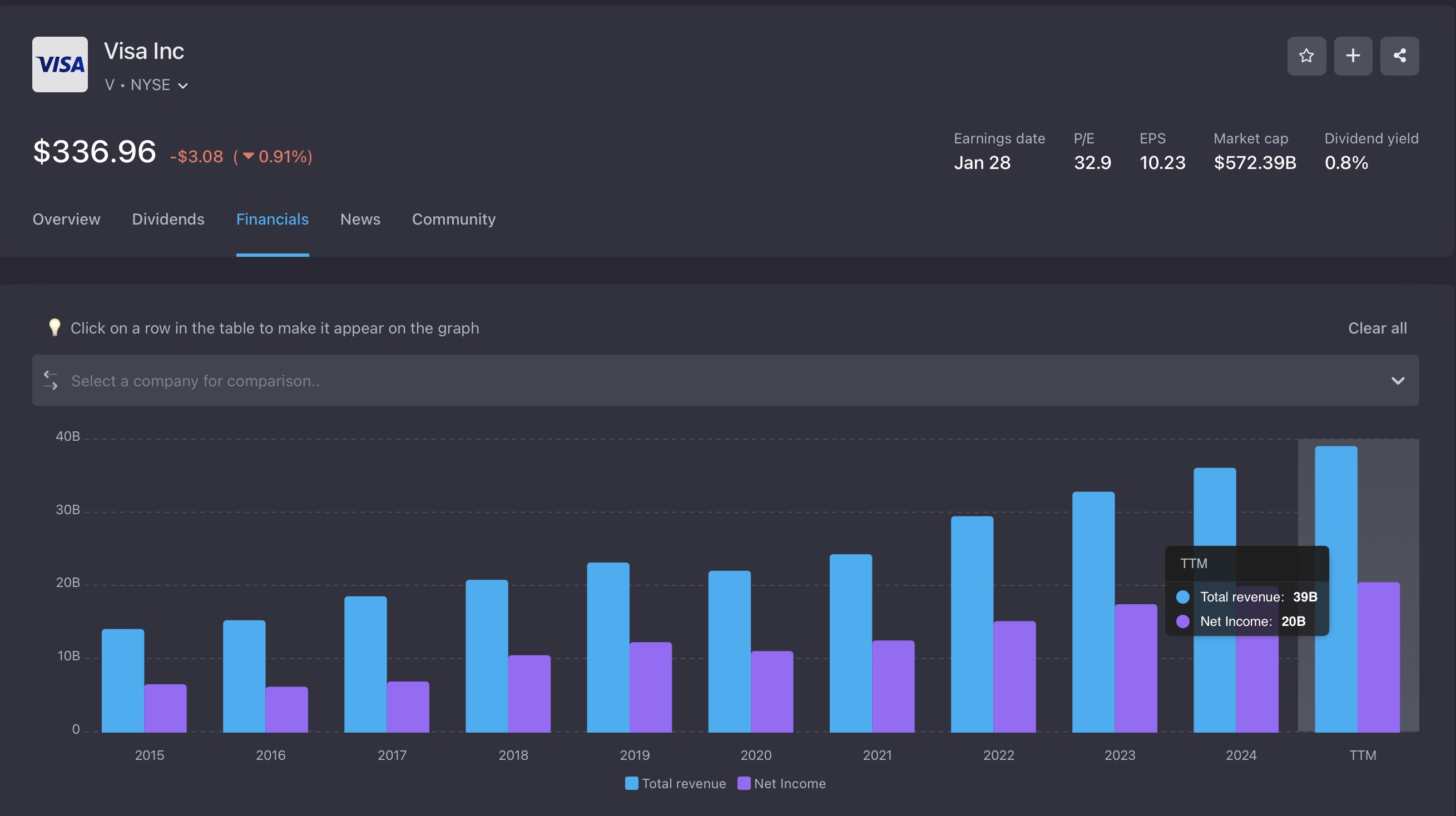

Earnings Report: Q4 FY2025 Visa reported revenue of $39 billion (+11% YoY)

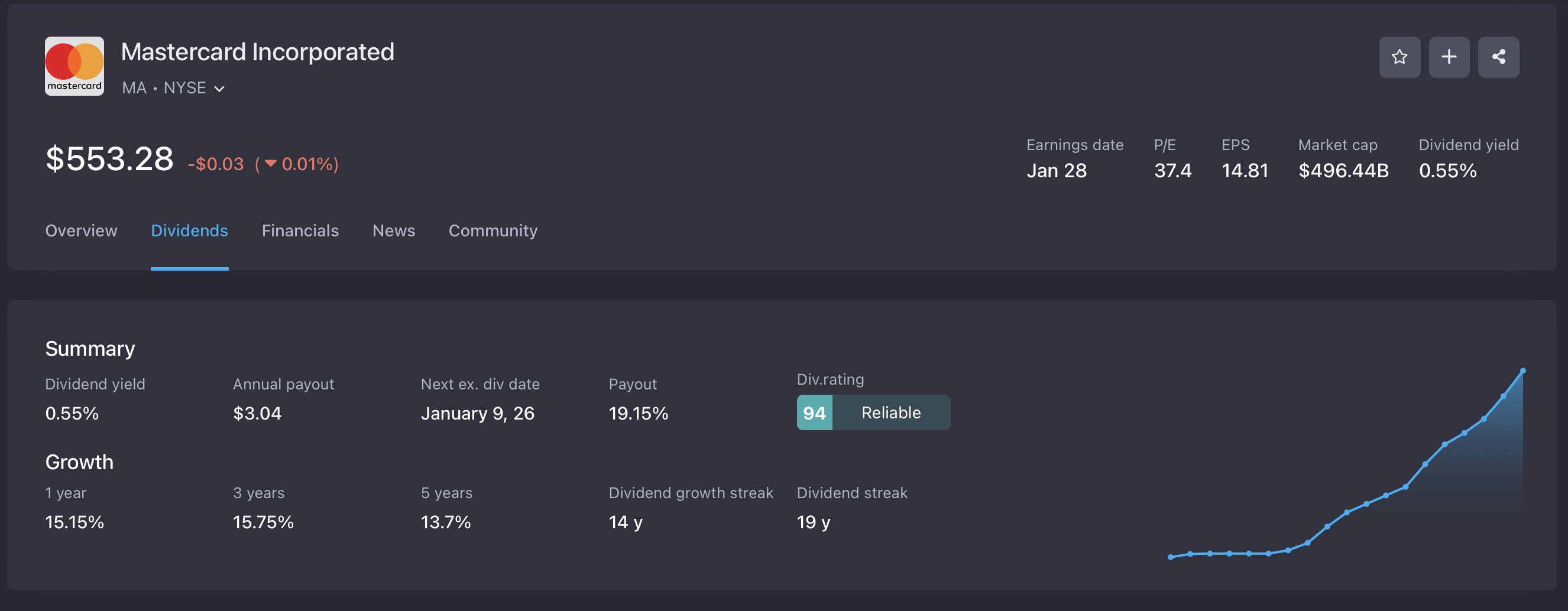

Mastercard (Q3 FY2025): Adjusted EPS of $14.81, strong revenue growth, high contribution from Value-Added Services.

The annual dividend payment on Mastercard shares in 2025 is $3.04 per share.

The payout ratio is 19.15%.

The dividend yield is 0.55%.

Earnings Report: Q4 FY2025 Mastercard reports revenue of $30 billion

Both companies pay low but regularly growing quarterly dividends; recent increases and share buybacks enhance earnings per share.

Fintech as competitors and partners

1. PayPal (PYPL)

PayPal has released its own PYUSD stablecoin, which gives it the opportunity to participate in the tokenized payment infrastructure.

PayPal plans to actively implement PYUSD for business transactions and payments.

PayPal does not just act as a competing payment network-it creates an infrastructure that reduces the dependence of merchants on classical networks (cards, bank payments). This may threaten the revenue share of Visa and Mastercard, but also create partnership potential for them: if PYUSD or another PayPal token is "running" through Visa/Mastercard channels, this increases the transaction load on their networks.

2. Stripe

Stripe actively integrates stablecoins and tokenized payment instruments.

In October 2024, Stripe allowed merchants to accept payments with the USDC stablecoin.

In September 2025, Stripe announced the "Open Issue” platform - businesses can now launch their own stablecoin using Stripe.

Stripe acts as a tool for changing the payment infrastructure - it can redistribute part of the transactions from the "card network" to the "token/stablecoin payment platform". This creates both a threat and a partnership opportunity for Visa/Mastercard: if they can become networks and platforms for these new tokens.

PayPal and Stripe are actually setting the direction for the entire payments market today. PayPal is developing its own digital currency, PYUSD, and expanding the payment ecosystem by linking classic banking with blockchain. This is pushing giants like Visa and Mastercard to adapt to tokens and digital currencies. Stripe, in turn, turns payments into a technology platform: companies can use its API to accept stablecoins, issue their own tokens, and build their own fintech solutions. As a result, both companies are changing the very foundation of the market — the transition from plastic cards to digital tokens and programmable payments has become not the future, but a reality.

What does this mean for Visa/Mastercard?

On the one hand, the growth of fintechs with tokens reduces entry barriers and may cut off some transactions from the card network, especially in digital commerce or cross‑border.

On the other hand, if fintechs use the usual channels of cards or networks (e.g. issued cards, token cards, on/off ramps), then Visa/Mastercard can benefit as a next‑generation transaction infrastructure.

For an investors it is important to keep track of the extent to which fintechs are replacing classic networks and partnering with them.

Fintech companies like PayPal and Stripe are becoming not just competitors, but new participants in the world of tokenized payments.

PayPal, with its PYUSD stablecoin, is creating its own payment ecosystem. This can reduce the dependence of merchants on classic networks, but in cooperation with Visa and Mastercard, it will increase transactions in their infrastructure.

Stripe allows businesses to accept USDC and even issue their tokens, turning into a platform for future digital settlements.

For Visa and Mastercard, this is both a risk and a chance: if they can adapt and become networks for tokens, not just for cards, their role in the new financial system will remain key.

Risks — what is important for an investor to monitor?

Regulatory risk. Antitrust investigations and pressure on interchange fees remain a real threat to margins (there have been major cases before and continued regulatory interest). This may limit the monetization of transactions.

Technological risk. The rapid adaptation of stablecoins and the emergence of platforms with "on-chain" settlements can cut off part of the premium margin of payment networks.

The risk of partnerships. If large retailers or technology platforms (such as Amazon/Walmart) introduce their own settlement tokens or solutions, this will partially bypass traditional networks. Analysts are monitoring this scenario.

What conclusions can be drawn?

Positioning in the portfolio. Visa is closer to "stable growth": scale, global infrastructure, and more predictable transaction revenue. Mastercard — "aggressive growth through innovation": integrates stablecoins and Value-Added Services faster, which provides greater EPS CAGR potential with slightly higher volatility.

Who benefits from stablecoins and tokens? In the short term, Mastercard, through fast partnerships (for example, Fiserv); in the medium/long term, the winner will be the one who more effectively monetizes on/off-ramp and tokenization of cards /merchants (internal network + partnerships).

The dividend and valuation aspect. Both companies pay low current yields, but they regularly raise dividends — the shareholder's main income now comes through EPS growth and buybacks. The valuation (P/E) of each company reflects growth expectations; an income—oriented investor can combine shares of both companies: Visa — for the "foundation", Mastercard - as the "engine of growth".

The world of payments is changing faster than ever: Tokenization, CBDC and stablecoins are no longer just trends, but real drivers of transformation. Visa and Mastercard remain the powerful "core" of the financial infrastructure, but now they have to compete — and at the same time cooperate — with the next generation of fintech giants.

The world is moving away from cards to tokens — the only question is who will lead this transition: the next-generation fintechs (PayPal/ Stripe) or the old masters of global payments( Visa/Mastercard).

What do you think about this - share your opinion in the comments — it will be interesting to compare investment views.