Let’s be honest, one of the first things all of us dividend investors look at is the yield. We try to fight it, we try to deny it, but the higher the yield, the more tempting the stock becomes.

With that said, a dividend yield that looks too good to be true tends to come with more of a story. And right now, the situation with UPS—a company that needs no introduction—is definitely a story worth telling.

Over the past year, the share price has dropped about 30%, and if you zoom out over the past five years, the stock is still down roughly 35%.

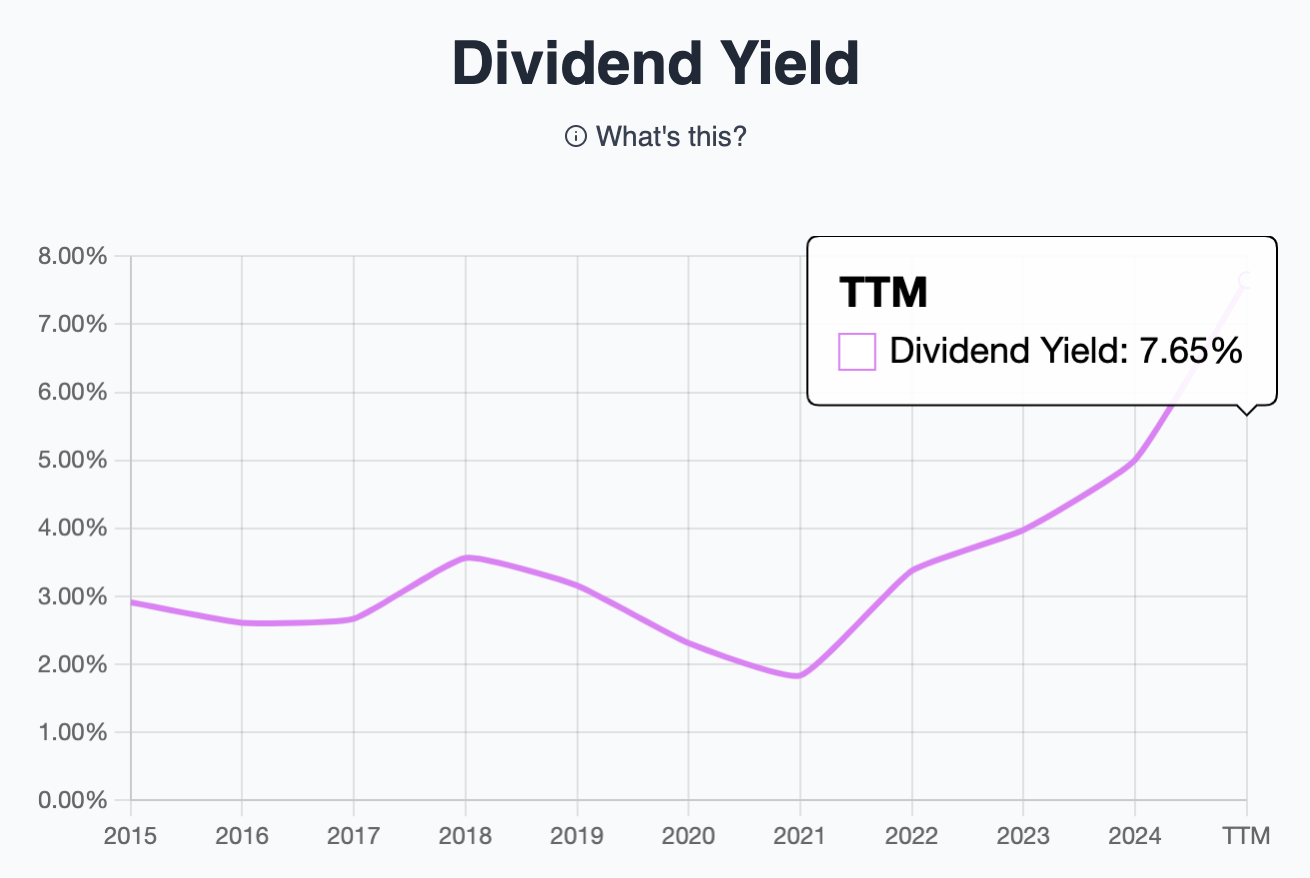

That’s pretty poor performance, no doubt, but that decline has pushed the dividend yield up to 7.65%—which is more than double the company’s five-year average of just 3.3%.

Typically, when a stock’s dividend yield moves up above the historical average, that makes it look like a bargain (since dividend yields tend to stay within a certain historical range).

In the case of UPS, that makes it look pretty attractively valued. But the real question is whether this is a golden opportunity for income-seeking investors, or a warning sign that something is wrong with the company.

Now UPS is one of those companies we all interact with—probably some more regularly than others. The company delivers millions of packages every day, which undoubtedly makes it an essential part of global commerce.

What makes a company like UPS tough to compete with is the combination of its global scale, distribution network, and unmistakable brand. You can’t just wake up one day and build out the fully-functioning network of planes, trucks, warehouses, delivery routes, and technology that UPS has spent over 100 years putting together (the company was founded in 1907).

The problem is that after hitting record highs in 2021 and 2022—when sales, earnings per share, and free cash flow were at all-time highs—UPS has taken an undeniable step backward.

As we can see from the charts above, earnings and free cash flow in particular have been moving in the wrong direction, which is a big red flag for dividend investors. Lower earnings and free cash flow mean less dividend coverage, which can call into question the safety of the dividend.

Fortunately, the company is still generating plenty of revenue, but it hasn’t been able to turn that into consistent bottom-line growth. One of the biggest reasons is higher labor costs.

In 2023, UPS signed a new labor contract with the Teamsters union, which secured major pay increases and benefits for roughly 340,000 employees. While that was a big win for workers, it’s also a heavier cost burden for the company moving forward.

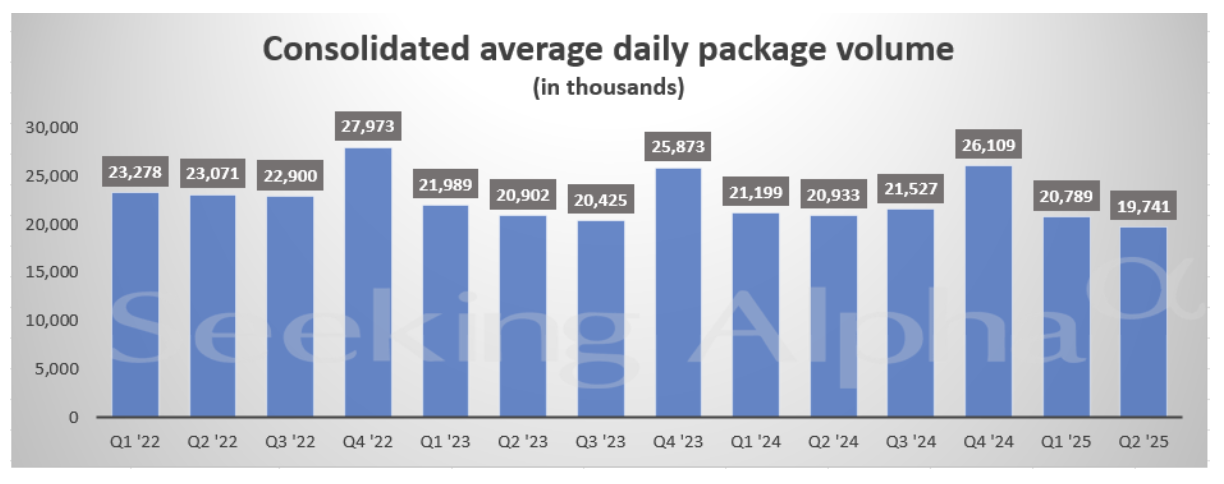

Another detriment to the financials is declining package volumes. Domestic demand has been trending down over the last few years, and UPS isn’t the only company feeling the impact.

Other shipping and logistics companies, like Old Dominion Freight Line (ODFL), have also reported weaker shipping volumes. Subsequently, their share price has also taken a pretty big hit.

This suggests that the slowdown isn’t entirely UPS’s fault. Some of the blame can be passed on to the broader economy.

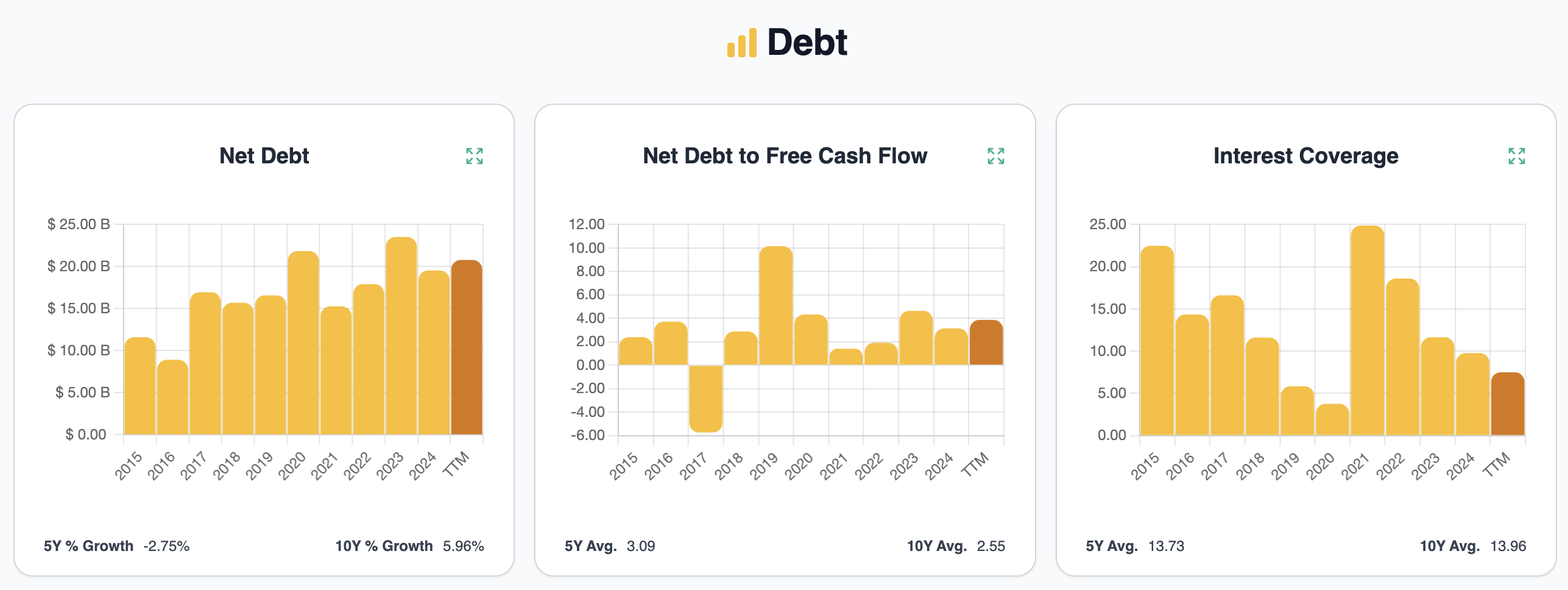

In addition to declining earnings and free cash flow, there are some other cracks starting to show.

Debt, for example, doesn’t look terrible at first glance. Net debt to free cash flow is sitting at about 3.9x on a trailing twelve-month basis, which is manageable. The issue here, though, is the interest coverage ratio.

Back in 2021, UPS could cover its interest more than 25 times over. Today, that figure has fallen to just 7.5—slightly below where I’d like to see it (my threshold is about 8.0).

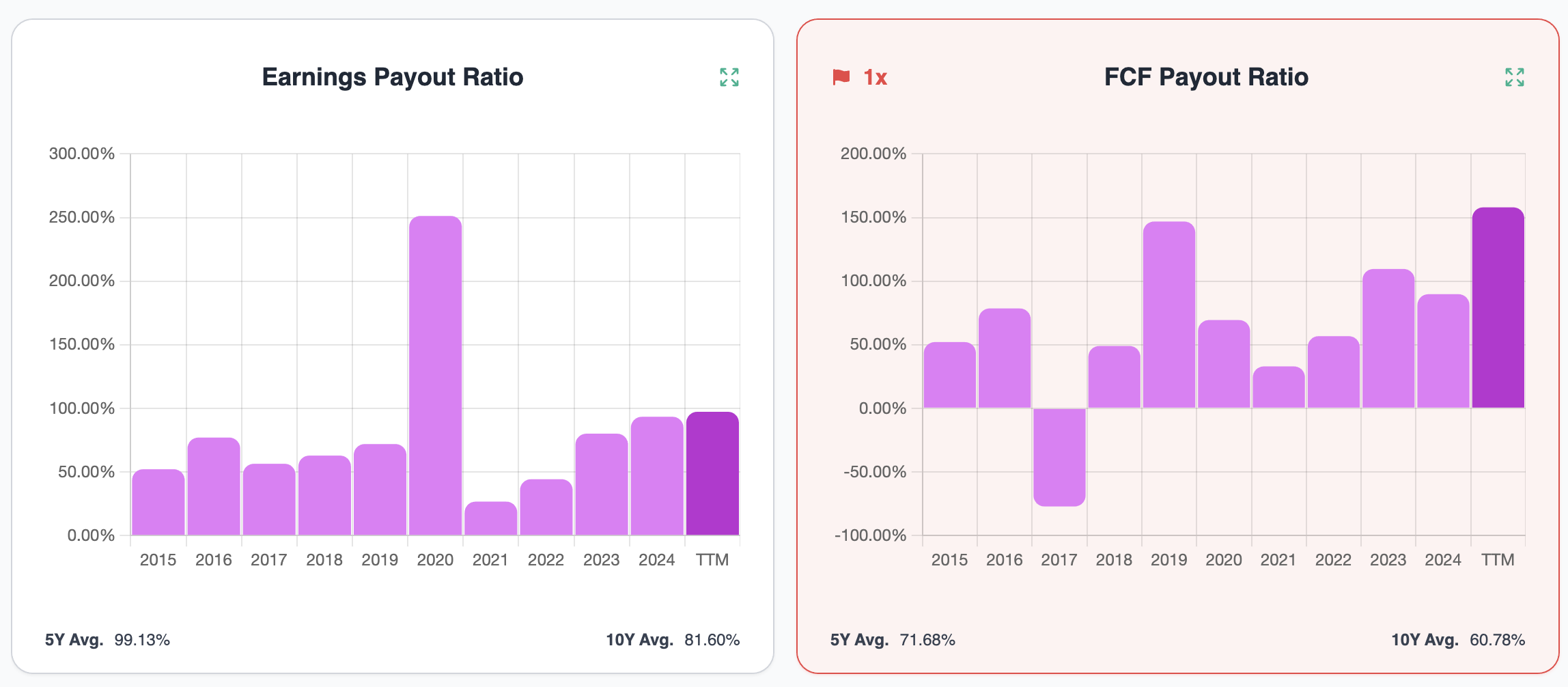

The dividend tells a similar story. The current 7.65% yield is undoubtedly hard to ignore, but the payout ratios are looking a bit too questionable for my liking.

In 2021, UPS was paying out just 26% of earnings and 33% of free cash flow as dividends. While the company was generating peak profits during this time, both of these numbers still left plenty of wiggle room for the dividend.

Fast forward to today, and the earnings payout ratio has shot up to 97%, while the free cash flow payout ratio has exploded to more than 158%. That’s certainly not sustainable.

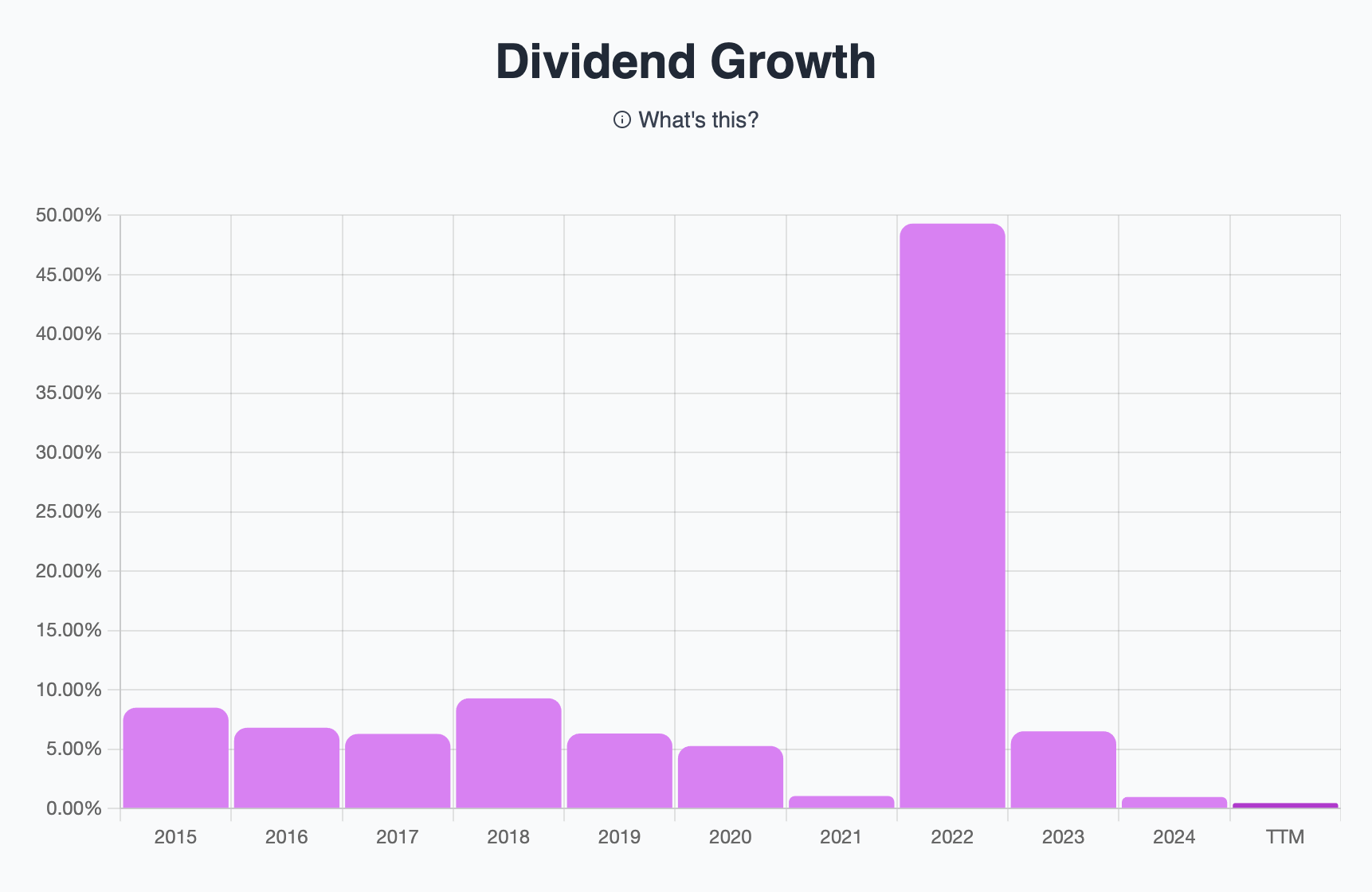

Part of the reason these payout ratios shot up so much has to do with the declining earnings and free cash flow, but it didn’t help that UPS raised its dividend by nearly 50% back in 2022.

Once again, these were peak profit years, so they were likely riding high off of that. But now the fundamentals haven’t kept up, and that’s exactly why I’m so concerned that the company may have no other option than to cut the dividend.

All in all, I don’t own any shares of UPS, and at this point, I’m not interested in buying it. The financials have been moving in the wrong direction, and the dividend coverage (or lack thereof) is a major red flag for me.

If I wanted exposure to shipping and logistics, I’d rather look at companies like Old Dominion Freight Line (ODFL) or even FedEx (FDX).

Both companies have much lower starting yields, but the fundamentals are stronger and the long-term dividend growth potential looks better. To me, those are better options than chasing yield with UPS right now.

Having said all of that, I’d love to hear from you. Do you own any shares of UPS, or are you thinking about buying at these levels? Let me know in the comments below!

And if you want to learn about a few stocks that, like UPS, I think could be next to cut their dividends, check out this video here.