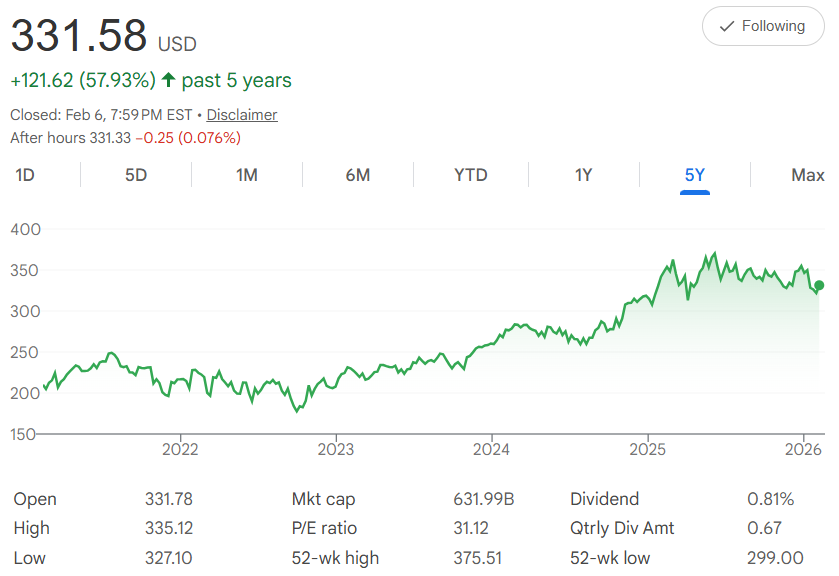

Five years ago, Visa Inc. $V shares were trading around $200 each. Today, it's closed at $331.58—a reliable 66% rise that comes from its position as the world's leading payment network, quietly handling trillions of dollars in card transactions every year across virtually every country. The chart shows a calm, consistent upward trend from 2022 lows, with measured but persistent gains through 2025 and early 2026, and a 52-week high of $375.51 proving the stock still has room to move higher.

In straightforward terms, the compound annual growth rate (CAGR) over the past five years is 10.7%. That's the average yearly increase—calculated by raising the total growth factor to the 1/5 power and subtracting 1. It means growing your money by roughly 11% each year, on average.

Dollar-cost averaging (DCA) fits Visa's steady nature perfectly: Invest $500 every month for five years, totaling $30,000. This buys more shares when prices dip temporarily and fewer when they're higher, which helps smooth out normal market fluctuations. Projecting forward at the same historical CAGR, with a monthly growth rate of about 0.85% from $331.58, your position grows quietly but reliably.

After 60 months, your portfolio could reach approximately $39,200. That's a gain of about $9,200—a 31% return on your invested capital. The earliest contributions benefit most from compounding, while later ones still participate in the overall upward trend.

Build your portfolio, one day at a time.

Get our daily 5-year horizon picks sent to your inbox. Subscribe here.

This is based on historical performance, which does not guarantee future results. Visa is generally considered one of the more stable large-cap growth names, but it is still affected by economic cycles, changes in consumer spending, competition from new payment technologies, and regulatory developments around fees and data privacy. The current P/E ratio of 31.12 reflects solid but not excessive growth expectations, and the 0.81% dividend yield provides dependable quarterly income ($0.67 per share).

With a $632B market cap and the 52-week high of $375.51 still within reach, Visa remains one of the most durable businesses in the world. If you're comfortable with a high-quality, lower-volatility growth name and want to participate without trying to time the market, DCA offers a calm, disciplined way to build exposure over the long term. Your consistent $500 monthly investments could create a meaningful, reliable position by 2031.

Keep the card swiping?