2025 has been a year of contrasts for commodity markets. Gold is setting new records amid expectations of rate cuts and rising geopolitical risks. Oil is under pressure due to weak demand and historically high supply. Industrial metals are moving in different directions, while rare earths are in focus because processing is highly concentrated and they play an important role in defense and the green transition.

Gold: Record Levels and What Supports Them

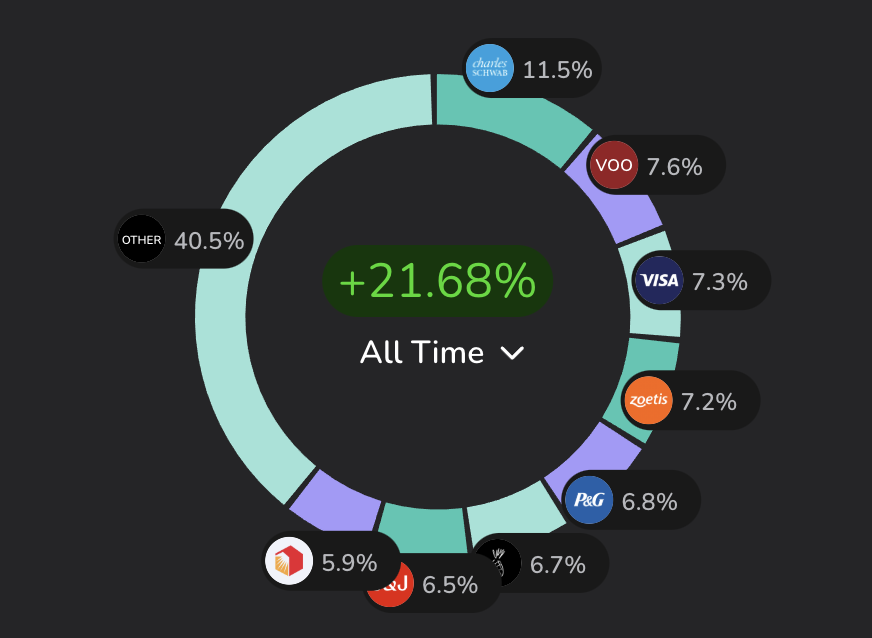

Prices have climbed to new all-time highs. The main reasons are expectations of easier Federal Reserve policy, greater uncertainty in global trade, and steady investment demand. Some banks and brokers see prices staying high if the rate-cut cycle continues and market volatility remains elevated. Reuters.com

Gold price (GOLD)

How to act. To judge the strength of the trend, watch U.S. real government bond yields and Fed guidance: falling real yields usually support gold, rising real yields work against it. Also track flows into gold ETFs and central-bank purchases—these are indicators of investment demand.

Oil: Excess Supply and Cyclicality

Global output in August reached a record 106.9 million barrels per day, helped by partial easing of OPEC+ limits and high volumes from non-OPEC producers. At the same time, demand forecasts have been revised down: consumption in developed economies remains weak.

Crude Oil WTI price (T)

With this balance, the market is vulnerable to inventory builds and lower price scenarios, although the sector’s cyclicality remains: low prices eventually stimulate demand and push out high-cost barrels. Iea.org

What to monitor. Weekly inventory reports, what OPEC+ countries are doing with production volumes, and the path of demand in Asia. Rising inventories together with weak demand increase downside risk; the opposite mix supports a rebound.

Industrial metals: what’s happening now

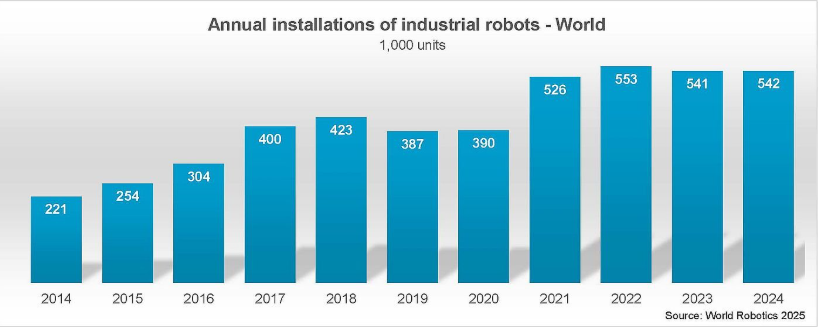

In 2025, silver and platinum did not move moderately—they jumped sharply. In October, silver set a new all-time high around $51–52 per ounce, with year-to-date gains above 70%.

Silver price (SI)

Platinum climbed to multi-year highs, up about 40–50% year to date.

Platinum price (PL)

Prices are driven by expectations of rate cuts, stronger investor demand, and industrial demand (for silver—electronics and solar panels; for platinum—auto catalytic converters). Reuters.com

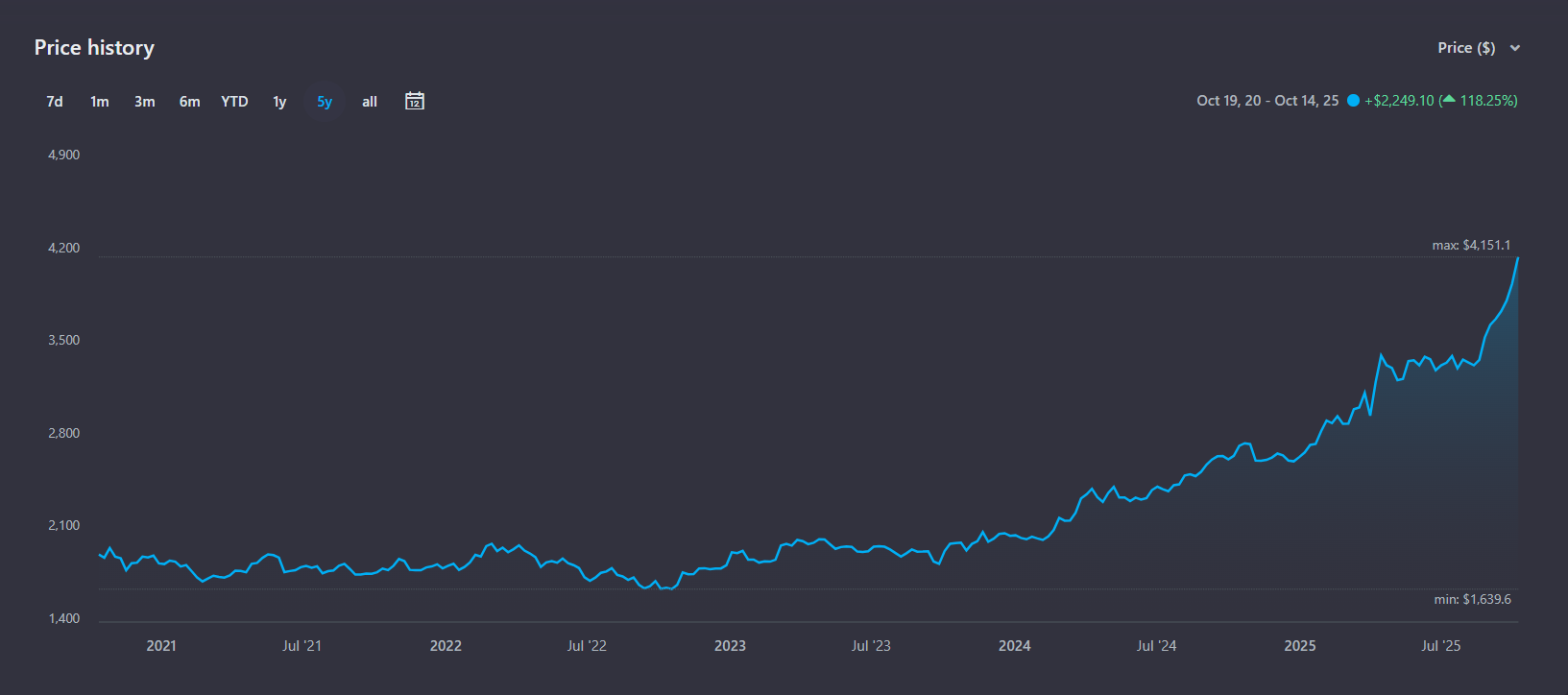

Home robots and materials. Growth in home robots (vacuums, lawn mowers, assistants) supports steady demand for copper (wiring, motors) and aluminum (housings, heat dissipation). The market profile is up: global industrial robot installations are expected at 575,000 units in 2025 and over 700,000 by 2028; related consumer segments are also expanding. In parallel, research into aluminum-ion batteries is gaining momentum as a potential complement to existing energy-storage technologies—still early, but worth including in medium-term assessments. Ifr.org

Rare Earths: Supply-Chain Bottleneck and Processing Concentration

The global rare-earth market is small in value (about $5.1 billion in 2024) but critical for high-power magnets, electronics, renewables, and defense systems. The main vulnerability is processing and separation: China accounts for over 90% of global processing capacity, creating risk for Western supply chains if export controls tighten. This explains the acceleration of projects to localize mining and processing in the U.S., Australia, and Canada, and the emergence of long-term offtake contracts. Marketsandmarkets.com

Why it matters in practice. Any news on processing capacity added outside China, on export-control regimes, and on financing along the chain “ore → oxides → magnets” directly affects valuations of companies in the segment and makers of end-use equipment.

Short Scenarios for 6–12 Months

If the Fed eases policy and real rates fall, gold is likely to hold elevated levels; if real rates rise, the risk of a pullback increases.

If oil production stays near record highs and demand doesn’t accelerate, the balance skews to surplus and prices remain vulnerable; the reverse mix supports recovery.

If restrictions on rare earths tighten, risk premia rise along the chain from raw materials to magnets; looser controls or new capacity outside China reduce that risk.

What This Means for Individual Investors

Gold and miners. The case holds if Fed policy is softer and uncertainty stays high. But miners’ shares move more than the metal itself: watch costs and spending discipline.

Oil and gas. With excess supply, valuation ratios can look higher because profits are compressed—this is a normal phase of the cycle. Focus on 3–5-year price scenarios and the stability of cash flows.

Industrial metals. In 2025, silver and platinum jumped sharply and remain volatile—factor in position size and risk limits. For copper and aluminum, build scenarios around demand from automation and home robotics, plus potential supply and production disruptions.

Rare earths. High price swings and policy exposure. Priority for companies with access to processing and long-term supply contracts.

Sources and further reading

Gold at record highs; rates context. Reuters on gold breaking above $4,000/oz and drivers such as Fed cuts and geopolitics (Oct 8 & Oct 13, 2025).

Oil supply/demand balance. IEA Oil Market Reports: August 2025 (demand growth trimmed; OECD flat) and September 2025 (global supply at a record 106.9 mb/d in August); see also IEF/SP Global summaries.

Industrial and home robots. IFR forecasts on factory robot installations (press release and executive summary PDF) and coverage of the 575k in 2025 and >700k by 2028 trajectory.

Rare earths — market size and processing concentration. MarketsandMarkets estimate of a ~$5.1B global market (2024) and Reuters on China’s >90% share of processing and related export controls.