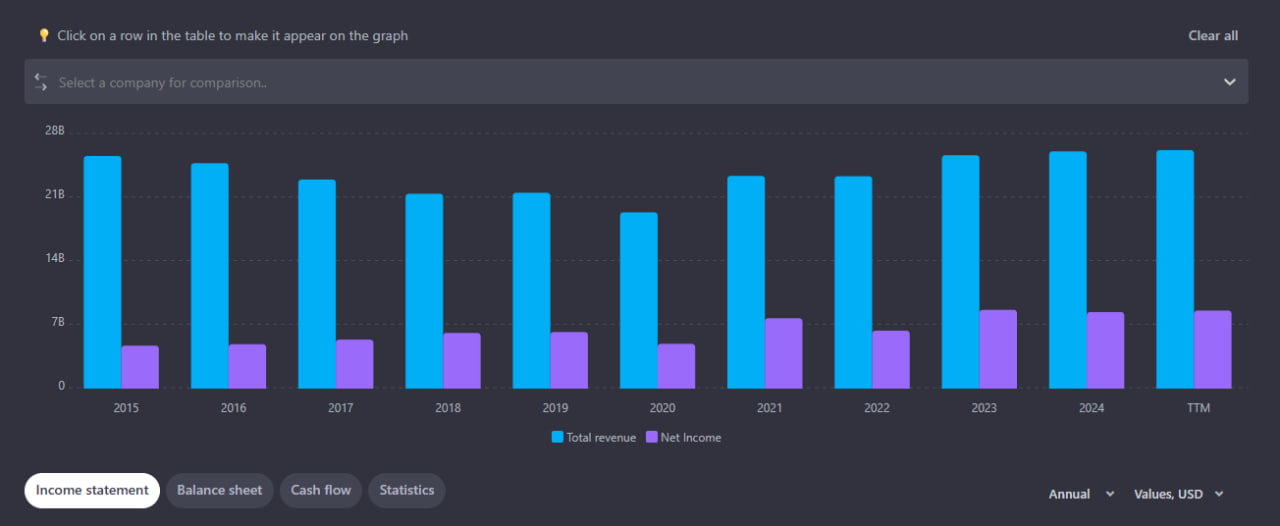

McDonald’s (MCD) remains one of the world’s most recognizable companies, but recent numbers point to pressure that could weigh on the stock and its long-term outlook. The shares have risen over the past few years, but they trailed the market: roughly +26% over three years versus +67% for the S&P 500. Revenue growth is slowing—rising only from $25.76B to $26.06B in the last year.

McDonald's: Revenue Dynamics and Net Profit

Revenue and Earnings Trends

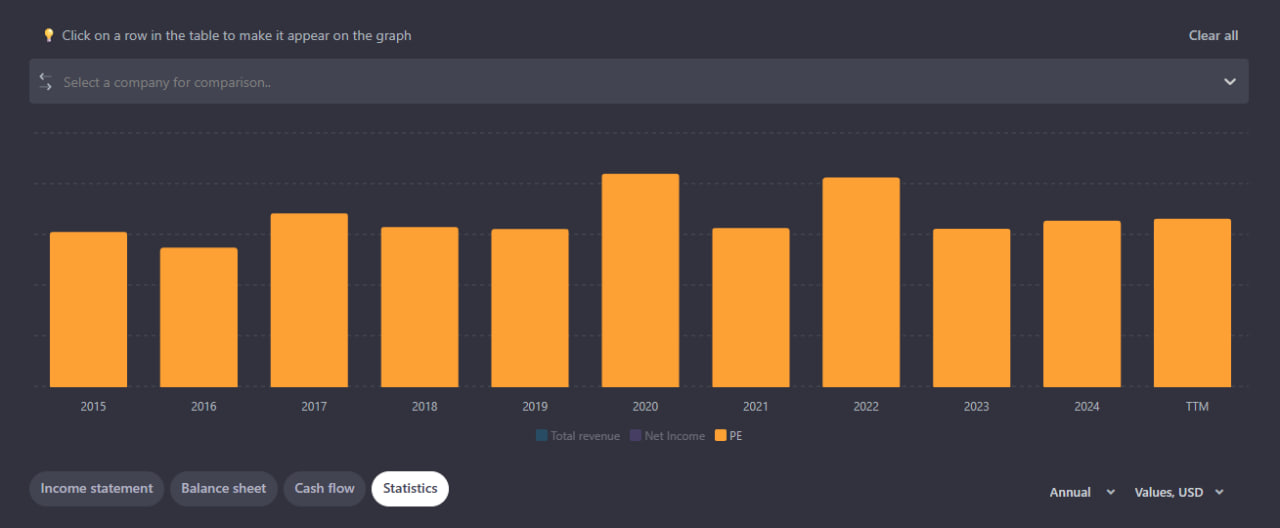

Valuation looks full. The stock trades at about 25–26x forward earnings, a rich multiple given slower growth. Street estimates call for 6–8% annual EPS growth, while revenue for 2025–2028 is expected to increase only 4–6%. Pricing power is limited: consumers are trading down and competition is intense.

Consumer and Geographic Headwinds

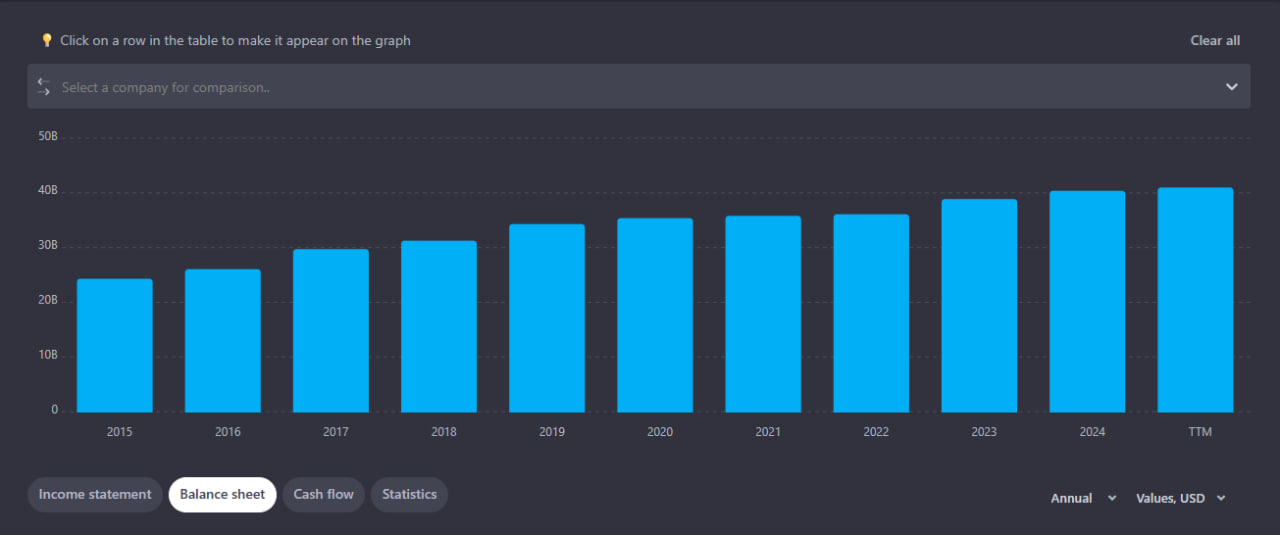

Management notes that middle- and lower-income consumers are spending more carefully, and China remains a soft market. High consumer debt and housing stress limit spend. To keep traffic, McDonald’s is leaning on low-price offers (for example, a $2.99 snack wrap), which supports volumes but pressures margins. Estimated traffic fell ~2.8% year over year, and total debt reached about $40.8B, near a 20-year high.

McDonald's debt and its dynamics over the past 10 years

Tech and Operations Risks

Digital friction is adding cost and slowing service—mobile-app glitches and point-of-sale issues have been reported. External reviews, including technical incident trackers, have documented recurring outages and errors across parts of the digital stack.

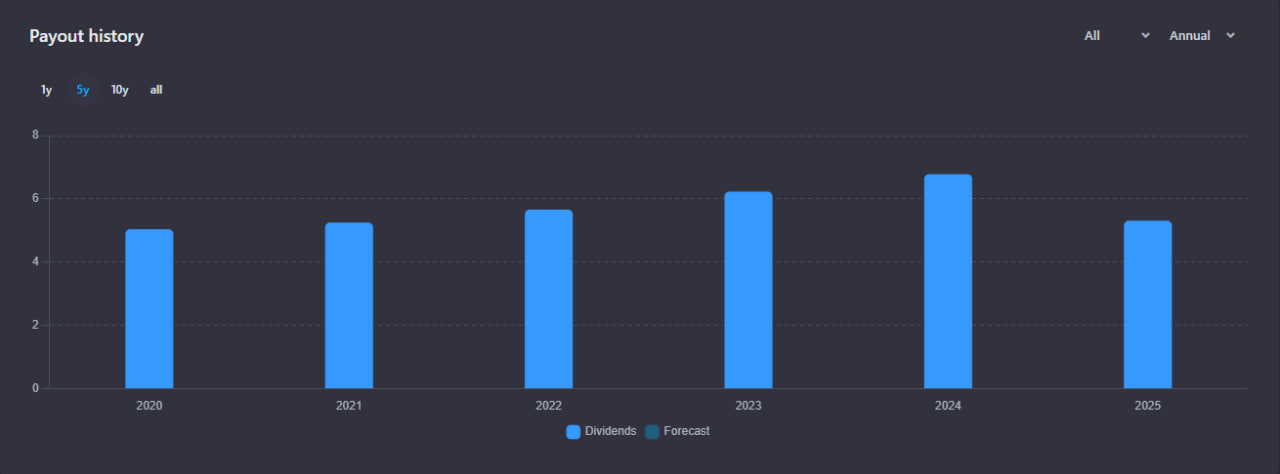

Outlook and Dividends

McDonald’s continues to pay a regular dividend and the yield remains steady, but today’s price already bakes in optimistic profit assumptions. With modest revenue growth and margin pressure, upside depends on flawless execution and a healthier consumer backdrop.

Takeaways for Investors

McDonald’s is a durable business with a powerful brand, but the combination of slower sales, greater reliance on value-seeking consumers, tech hiccups, elevated debt, and slower EPS growth suggests the shares may be overvalued at current levels. Long-term holders may stay the course, but new positions warrant caution until growth re-accelerates or the valuation resets.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment advice.

The author is not a licensed financial advisor, and the views expressed here reflect personal opinions, not professional recommendations.

Always conduct your own research or consult a qualified financial professional before making investment decisions.