There are two types of investors when it comes to the stock market: shareholders and shareflippers.

The goal of the latter is to buy a stock for a certain price and then eventually sell it at a higher price in the future. As a result, there can never really be a sense of permanence in share-flipping since the only way to realize a return from your investment is to let it go.

There’s not necessarily anything wrong with that, per se. But I’ve always been much more partial to being a shareholder, where you can still benefit from your investment while holding onto it (through collecting the cash flow it spits off) instead of having to sell it.

There’s just something about that way of generating a return that resonates more with me. The way I see it, you’re less dependent on the market’s mood swings for your return. Instead, you’re relying on the operational performance of the business itself, which is much less manic.

The trade-off, though, is that as a shareholder who focuses on growing your passive income stream, you’re far less likely to be on the receiving end of those adrenaline-pumping, overnight returns that seem to be blessing everyone else’s portfolios on social media.

On that note, one of the questions I get asked all the time is whether I feel like I’m missing out on “growth,” or if I ever feel like I’m falling behind because I’m not doing what everyone else seems to be doing.

The truth is that I don’t at all, and that’s for two reasons.

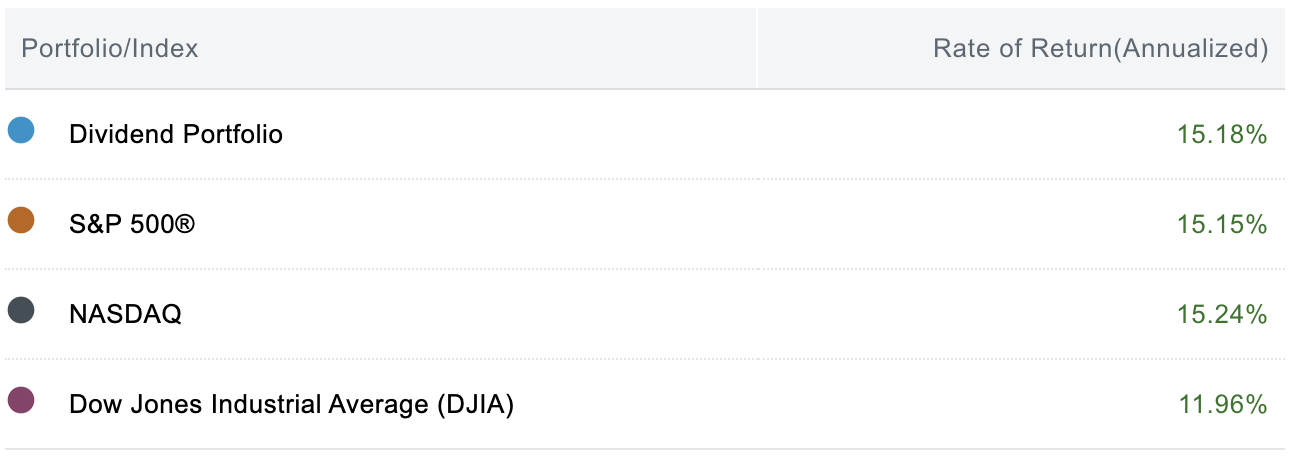

First, my “boring” dividend portfolio has actually kept pace with the rest of the market ever since I started investing about five years ago. Not that “beating the market” is even my main objective — but since that’s the generally accepted bar to reach, I still like to make the comparison.

And second, as mentioned earlier, my primary goal is to build a growing stream of passive income — and I continue to hit new highs on that front.

That’s one of the great things about being a dividend investor. No matter what share prices are doing — which, in the short term, can have nothing to do with what’s actually going on inside the business — your dividend income can still continue to grow.

As it does, you’ll be met with these small, but meaningful victories from time to time. Maybe it’s your first $100 month, your first four-figure year — or in my case this week, my biggest day of dividend income ever.

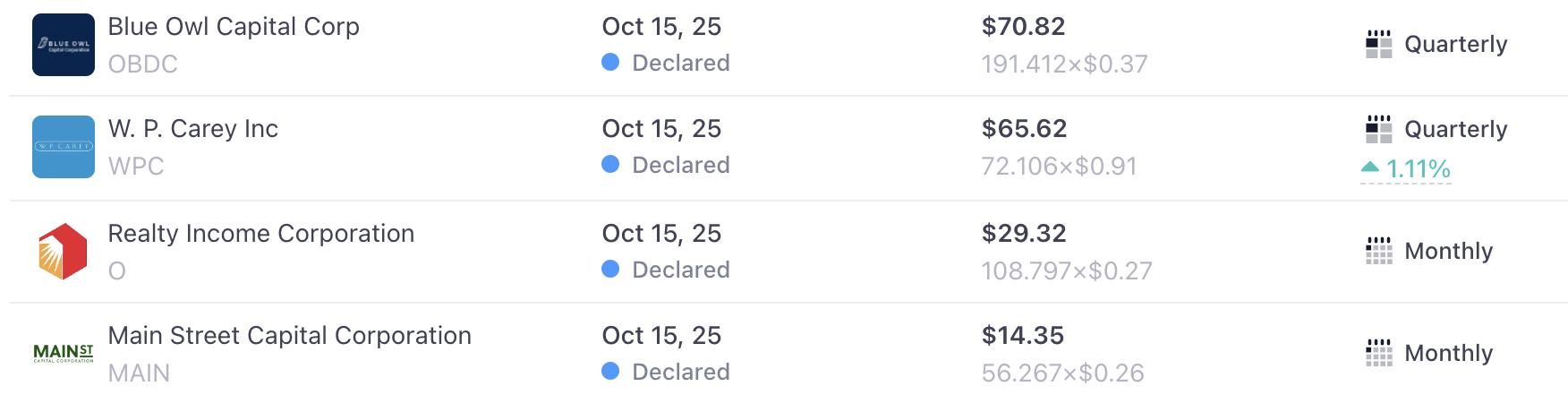

Yesterday, I received four dividend payments for a grand total of $180.11, surpassing my previous record of $145.04 back in July.

Yes, dividend investing is a slow burn. But every new record is worth celebrating, no matter how small it might seem. It’s the accumulation of those small victories over time that will eventually bring you to financial freedom.

With that said, now I want to hear from you: What’s the most dividend income you’ve ever received in a single day? Let me know in the comments below!

And if you want to learn about another recent dividend income record of mine (my highest month ever), then check out this video here.