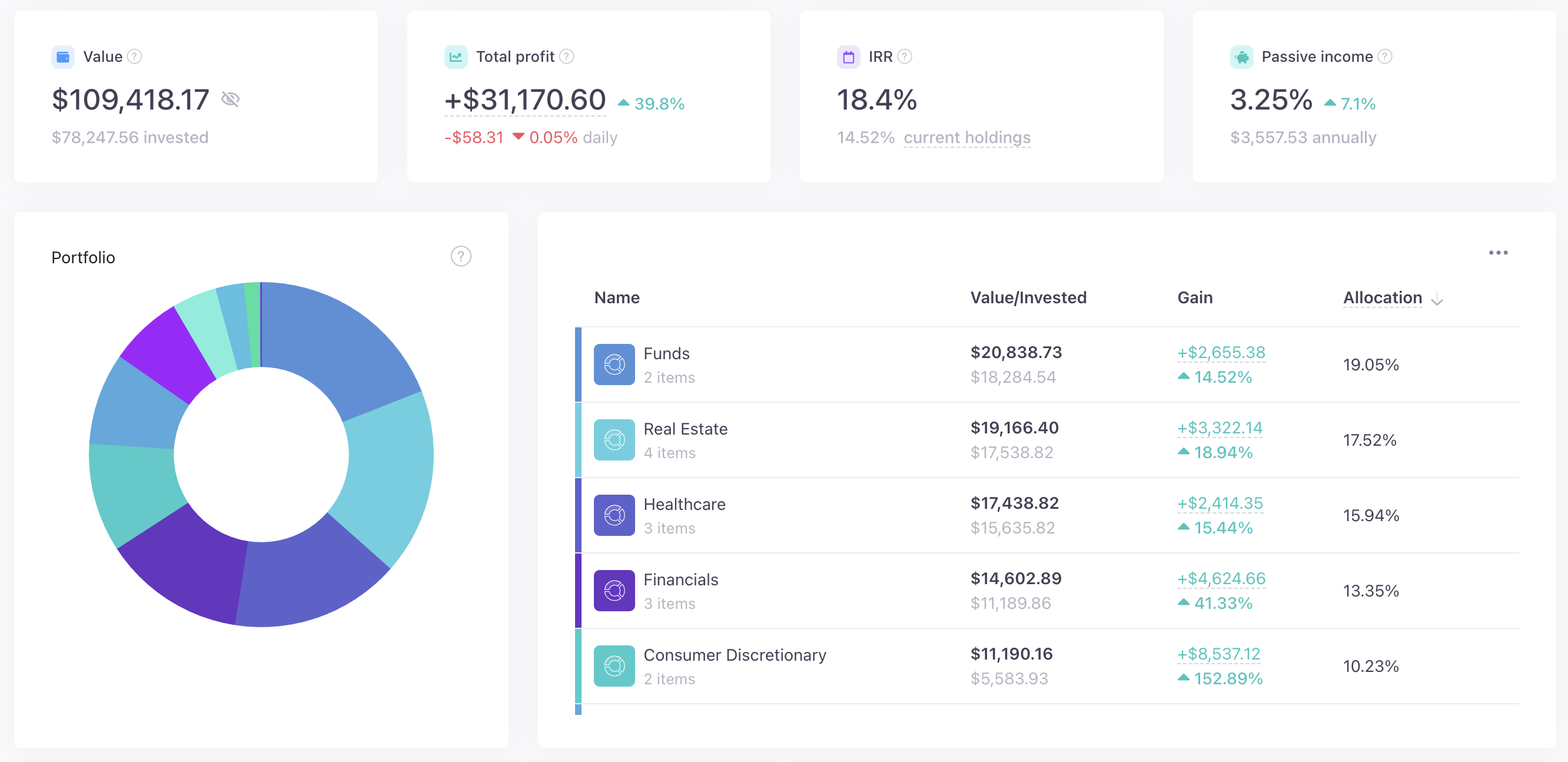

After five years of contributing to my portfolio every single week and reinvesting every single dividend, I finally crossed the $100,000 mark. It took me long enough, I know.

The climb from $50k to $95k felt like it happened in a flash. Two years ago, I was sitting at $53k, and I was at $75k a year later. Things were moving pretty fast.

But once I got near $95k, I found myself stuck in some sort of investing limbo. I kept hovering between $95k and $99k, which was frustrating. And after a while, that elusive final push seemed like it was never going to come.

But then, out of nowhere, it happened.

One random day last week, I got back from a run and saw a bunch of market notifications. SCHD was up a lot. Dividend stocks, in general, were flying.

I opened up Snowball Analytics to see that, lo and behold, the ceiling had finally shattered. My portfolio had officially crossed $100,000 for the very first time!

I can’t tell you how excited I was to see that number. It had been a long time coming.

Over the course of your investing journey, you hit a lot of cool milestones, but some of them feel undeniably bigger than others. Your first $10k, your first $100 month in dividends, hitting $50k—these are all pretty meaningful.

But $100,000…this one felt different for some reason. I think that’s because—as Charlie Munger said—it’s the hardest one to reach, but it’s also the most important.

Once you hit $100,000, the compounding effect in your portfolio really starts to become more noticeable. Once you get there, your returns start to move the needle for you in a much bigger way, as opposed to your contributions doing most of the heavy lifting.

I think that’s why this milestone hits a bit harder than some of the others I’ve experienced. At the end of the day, $100,000 is just a nice, round number. So it’s not really about that, it’s more about what it represents.

To me, it represents five years of showing up and staying the course. Five years of staying focused on working towards a goal. Five years of doing something that didn’t always feel like it was paying off…until it did.

We’ll see if the “hard part” is actually behind me. But if $100,000 really is the hardest, then $200,000 should come a lot easier, and $400,000 even more than that.

And that’s the cool thing about compounding. It just gets better with time.

So if you’re still on your way to your first big milestone—whether that’s $10k, $50k, or $100k—keep going. Don’t worry about being perfect, just be consistent.

Before you know it, one day—on some random Tuesday—you’ll open your portfolio to find that you’ve finally hit that milestone. And when that day comes, you will be so glad you didn’t give up.

With that said, I’d love to hear from you: what milestone are you working toward in your portfolio right now?